I’ll never forget the sinking feeling I’d get around the 25th of every month. My bank account would be gasping for air, bills were piling up, and I still had nearly a week until my next paycheck. Sound familiar? I tried every budgeting method out there—the envelope system, zero-based budgeting, even the popular 50/30/20 rule—but nothing seemed to stick. Then I discovered the Half Payment Budget Method, and everything changed. For the first time in my adult life, I wasn’t scrambling to cover expenses or living in constant financial anxiety.

The beauty of this approach? It works with your paycheck schedule instead of against it. If you get paid biweekly or twice monthly like most Americans, this method might just be the game-changer you’ve been searching for.

Key Takeaways

- 💰 The Half Payment Budget Method splits your monthly bills across two paychecks, creating better cash flow alignment

- 📅 This paycheck budgeting strategy works exceptionally well for biweekly and semi-monthly pay schedules

- ✅ By dividing expenses evenly, you avoid the end-of-month cash crunch that derails most budgets

- 🎯 Implementation takes 2-3 hours of initial setup but provides long-term financial predictability

- 🧠 The psychological benefits include reduced money stress and increased sense of financial control

What Is the Half Payment Budget Method?

The Half Payment Budget Method is a budget cash flow strategy that divides your monthly expenses into two equal payments, each aligned with your paycheck schedule. Instead of paying your entire rent, utilities, and other bills from one paycheck while leaving the other for groceries and discretionary spending, you split everything down the middle.

Here’s the core concept: If your rent is $1,200 per month, you’d set aside $600 from your first paycheck and $600 from your second. The same principle applies to all your regular monthly expenses. This creates a predictable pattern that prevents the feast-or-famine cycle many people experience with traditional monthly budgeting.

This biweekly budget technique transforms how you think about managing monthly bills. Rather than viewing your finances in 30-day chunks, you’re working with two-week periods that match when money actually enters your account. It’s a subtle shift that makes a massive difference in execution.

Why Traditional Budgeting Failed Me (And Maybe You Too)

Before discovering this method, I was caught in what I call the “budget enthusiasm trap.” I’d create elaborate spreadsheets, download the latest budgeting app, and commit to tracking every penny. The first week would go great. By week two, I’d miss a few entries. By week three, I’d abandoned the whole thing.

The problem wasn’t discipline—it was timing. Most budgeting advice assumes you’ll pay all your bills at once, typically at the beginning of the month. But when you get paid every two weeks, this creates an unnatural rhythm. One paycheck gets completely decimated by bills, while the other feels deceptively abundant. This imbalance led me to overspend from the “flush” paycheck, only to panic when bills came due.

According to recent financial research, approximately 64% of Americans live paycheck to paycheck [1]. The traditional monthly budget framework simply doesn’t align with how most people receive income. This mismatch is a primary reason why common budgeting mistakes continue to derail even the most well-intentioned financial plans.

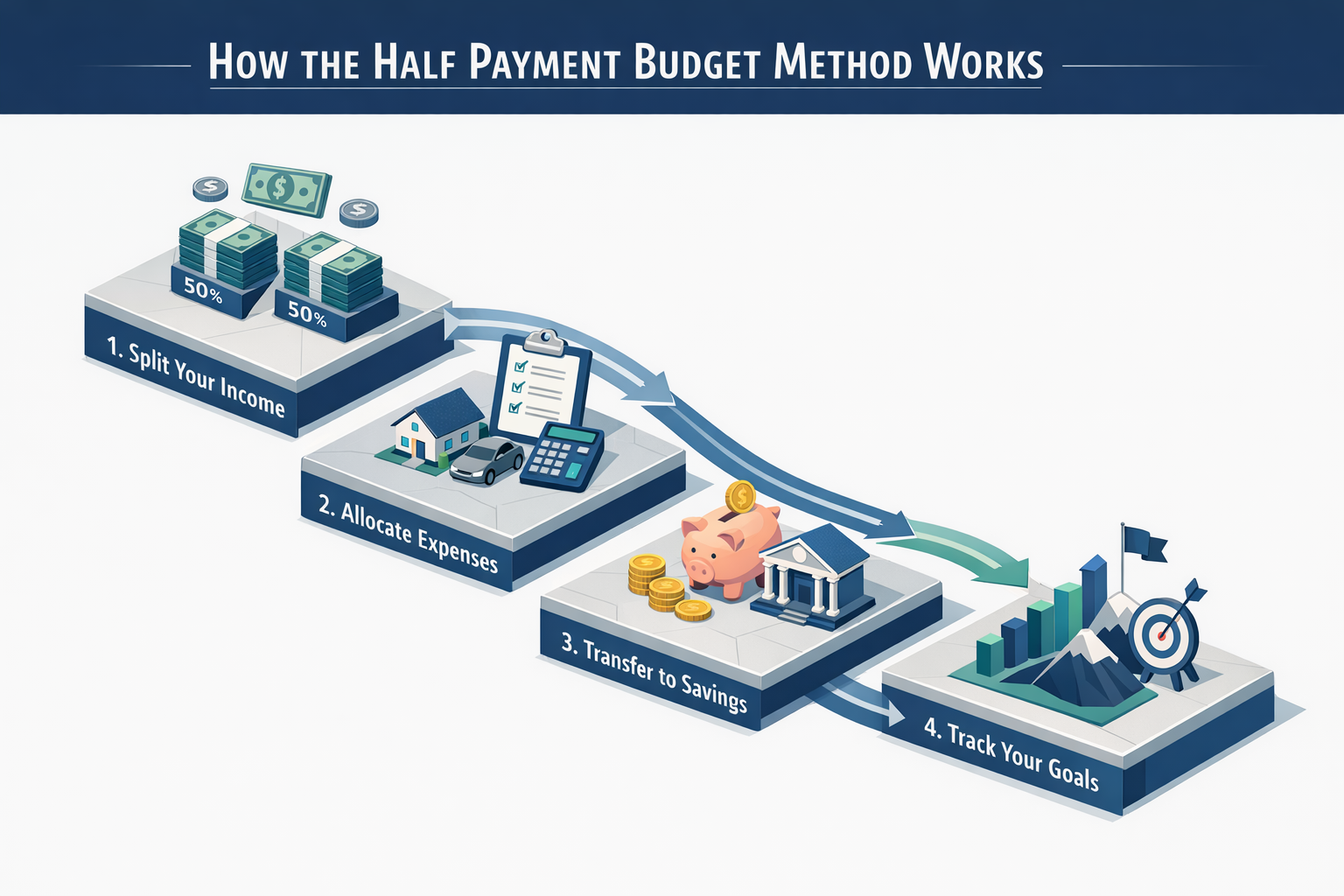

How the Half Payment Budget Method Works: Step-by-Step

Let me walk you through exactly how I implemented this system. The process is straightforward, but the initial setup requires some focused attention.

Step 1: List All Your Monthly Expenses

Start by documenting every recurring monthly expense. Include:

- Fixed expenses: Rent/mortgage, car payment, insurance premiums, loan payments

- Variable utilities: Electricity, water, gas, internet, phone

- Subscriptions: Streaming services, gym memberships, software subscriptions

- Estimated variable costs: Groceries, gas, personal care items

Don’t forget irregular expenses that occur throughout the year. I divide my annual car insurance premium by 12 and treat it as a monthly expense, then split that amount across both paychecks.

Step 2: Calculate Your Half-Payment Amounts

Take each monthly expense and divide it by two. Here’s what mine looked like when I started:

| Expense | Monthly Amount | Per Paycheck |

|---|---|---|

| Rent | $1,400 | $700 |

| Car Payment | $350 | $175 |

| Car Insurance | $120 | $60 |

| Utilities (avg) | $180 | $90 |

| Phone | $75 | $37.50 |

| Internet | $60 | $30 |

| Groceries | $400 | $200 |

| Gas | $160 | $80 |

| Total | $2,745 | $1,372.50 |

This visualization was eye-opening. Seeing that I needed to allocate $1,372.50 from each paycheck helped me understand my true financial picture.

Step 3: Align Payments With Your Paychecks

This is where the magic happens. You have two options for split bill payments:

Option A: Actually pay bills twice monthly – Contact service providers and arrange to pay half your bill on the 1st and half on the 15th (or whenever you get paid). Many companies are surprisingly accommodating about this.

Option B: Set aside money in a separate account – This is what I do. I created a “bills account” and automatically transfer my half-payment amount from each paycheck. When bills come due, the full amount is already waiting.

I prefer Option B because it’s simpler to manage and I earn a bit of interest on the money sitting in my high-yield savings account. Plus, not all companies will let you make split payments.

Step 4: Automate Everything Possible

The key to making this financial planning method stick is automation. I set up automatic transfers to happen the day after each payday:

- Transfer to bills account: $1,372.50

- Transfer to emergency fund: $100

- Transfer to savings goals: $150

What’s left in my checking account is truly discretionary. This removes decision fatigue and the temptation to “borrow” from bill money.

The Psychological Game-Changer Nobody Talks About

Here’s something the financial experts rarely mention: budgeting is as much about psychology as mathematics. The Half Payment Budget Method succeeds because it works with human nature rather than against it.

When I used traditional monthly budgeting, I experienced what behavioral economists call “mental accounting” problems. After paying all my bills from my first paycheck, my brain registered that second paycheck as “extra money.” Rationally, I knew it wasn’t—but emotionally, it felt like a windfall. This led to poor spending decisions.

With the half-payment approach, every paycheck looks similar. I allocate the same amount to bills, savings, and spending from each one. This consistency creates what I call “financial predictability,” and the mental health benefits have been remarkable.

I sleep better. I don’t avoid checking my bank account. I actually enjoy reviewing my budget because it’s working. These psychological wins compound over time, creating sustainable good financial habits that stick.

Real-Life Example: My First Three Months

Let me show you how this played out in practice. I implemented the Half Payment Budget Method in January 2025, and here’s what happened:

Month 1 (January): The setup phase was admittedly tedious. I spent about three hours listing expenses, calculating half-payments, and setting up automatic transfers. I also had to “prime” my bills account with an extra half-payment amount to get ahead of the cycle. This required dipping into my emergency fund temporarily, but I replenished it within six weeks.

Month 2 (February): This is when the system started clicking. Bills came due, and the money was just… there. No scrambling, no stress. I even had a surprise car repair ($380), but because my regular bills were handled, I could use my emergency fund without the panic I’d usually feel.

Month 3 (March): By this point, the method felt completely natural. I’d adjusted my variable expenses based on actual spending patterns and even found an extra $120 per month I’d been wasting on duplicate subscriptions and impulse purchases.

The most surprising benefit? I actually started saving money. With my bills on autopilot and my spending more controlled, I saved an extra $450 in those first three months—money that previously would have evaporated into “I don’t know where it went” purchases.

Pros and Cons of the Half Payment Budget Method

Like any financial strategy, this approach has both advantages and limitations. Here’s my honest assessment after using it for over a year:

✅ Advantages

Better cash flow management: Your money flows in sync with your income, eliminating the cash crunch at month’s end.

Reduced financial stress: Knowing exactly where every dollar is going creates tremendous peace of mind. This aligns with the principles I discovered when learning to stop living paycheck to paycheck.

Easier to stick with: The consistency and automation make this method far more sustainable than budgets requiring daily tracking.

Prevents overspending: When you allocate bill money immediately, you can’t accidentally spend it on other things.

Works with biweekly pay schedules: If you’re paid every two weeks, this method is practically designed for you.

Builds savings automatically: Once bills are handled, you can more easily direct money toward emergency funds and financial goals.

⚠️ Considerations

Requires initial setup time: Expect to invest 2-3 hours getting everything configured initially.

Not all bills split easily: Some service providers won’t accept split payments, requiring the separate account workaround.

Needs relatively consistent income: This works best with predictable paychecks. Freelancers and gig workers need modifications (more on this below).

Requires discipline during setup phase: You’ll need to “get ahead” by one half-payment, which might require temporarily reducing discretionary spending.

May need adjustment for irregular expenses: Annual or quarterly bills require planning ahead and dividing by 24 or 26 pay periods instead of 12 months.

Adapting the Half Payment Method for Different Situations

One of the strengths of this budget cash flow strategy is its flexibility. Here’s how to modify it for various circumstances:

For Freelancers and Variable Income Workers

If your income fluctuates, the half-payment principle still works—you just need a buffer. Here’s my recommendation:

- Calculate your average monthly income over the past 6-12 months

- Determine your half-payment amounts based on 80% of that average (building in a safety margin)

- During high-income periods, build a buffer in your bills account equal to 2-3 months of expenses

- During low-income periods, draw from this buffer to maintain consistent bill payments

This adaptation provides the psychological benefits of predictable bill management even when income isn’t predictable. I’ve recommended this approach to several freelance friends, and they’ve found it transformative for reducing financial anxiety.

For Monthly Paycheck Recipients

If you’re paid once monthly, you can still use this method’s core principle: separate bill money immediately upon receiving your paycheck. Transfer your total monthly bill amount to a separate account the day you’re paid, leaving only discretionary money in your checking account. This creates the same psychological separation that makes the method effective.

For Couples With Different Pay Schedules

My partner and I get paid on different schedules—I’m biweekly, she’s semi-monthly. We created a joint bills account that we both contribute to based on our income proportions. Each of us transfers our calculated amount with every paycheck, regardless of when the other person gets paid. The bills account becomes the “neutral zone” that smooths out our different payment rhythms.

Digital Tools and Apps That Make This Method Easier

While you can absolutely implement the Half Payment Budget Method with just a spreadsheet and a separate savings account, technology can make it even smoother. Here are the tools I use:

YNAB (You Need A Budget): This app’s philosophy aligns perfectly with the half-payment method. It emphasizes giving every dollar a job and works beautifully with the paycheck-to-paycheck funding approach.

Qapital or Digit: These automated savings apps can be configured to transfer your half-payment amounts automatically based on your paycheck schedule.

Google Sheets with templates: I created a simple template that calculates my half-payment amounts and tracks which bills come from which paycheck. The visual clarity helps tremendously.

Your bank’s automatic transfer feature: Most banks offer free automatic transfers. Set it and forget it—this is the foundation of the entire system.

Bill reminder apps: Apps like Prism or Mint can send notifications when bills are due, helping you verify that your automated payments are processing correctly.

The key is choosing tools that reduce friction rather than adding complexity. Start simple—a basic spreadsheet and automatic bank transfers will get you 90% of the benefit.

Common Pitfalls and How to Avoid Them

After helping several friends implement this method, I’ve noticed recurring mistakes. Here’s how to avoid them:

Pitfall #1: Not accounting for irregular expenses

Solution: Create a “sinking fund” category for annual or quarterly bills. Divide the annual amount by 24 (or 26 if you’re paid biweekly) and include it in your half-payment calculation.

Pitfall #2: Forgetting about the “extra” paychecks

If you’re paid biweekly, you’ll receive three paychecks in two months of the year. Don’t blow this “extra” money! I direct mine entirely to debt payoff and savings goals, which has helped me stay debt-free.

Pitfall #3: Making the system too complicated

Start with just your major bills. You don’t need to split every single expense down to the penny. Simplicity beats perfection.

Pitfall #4: Not building a small buffer

Keep an extra $100-200 in your bills account as a cushion for variable utility bills or slight miscalculations. This prevents overdrafts and stress.

Pitfall #5: Abandoning the method after one mistake

You’ll probably mess up at some point—forget a bill, miscalculate an amount, or overspend from the wrong account. That’s normal. Adjust and continue. The method still works even if the execution isn’t perfect.

Integrating This Method With Broader Financial Goals

The Half Payment Budget Method isn’t just about paying bills—it’s a foundation for comprehensive financial wellness. Once I had my basic expenses under control, I was able to focus on bigger goals:

Building an emergency fund: With consistent cash flow, I could reliably direct $200 per paycheck toward savings. Within eight months, I had a fully funded three-month emergency fund. The strategies I used to save quickly worked because my baseline budget was stable.

Paying down debt: Knowing exactly how much discretionary money I had made it easier to direct extra payments toward my credit card balance. I used the debt avalanche method and paid off $8,400 in 14 months.

Starting to invest: Once my emergency fund was established and high-interest debt was gone, I began directing $150 per paycheck toward a Roth IRA. The consistent contribution was only possible because my budget was predictable.

Improving my credit score: Automated bill payments meant I never missed a due date, which significantly improved my payment history. Combined with other credit-building strategies, my score increased by 87 points in 18 months.

The half-payment approach creates a stable platform from which you can pursue these larger financial objectives. It’s not the destination—it’s the vehicle that gets you there.

The Long-Term Impact: One Year Later

It’s now been over a year since I implemented the Half Payment Budget Method, and the results have exceeded my expectations. Here’s what’s changed:

Financial metrics:

- Emergency fund: Fully funded (3 months of expenses)

- Credit card debt: Paid off completely

- Credit score: Increased from 658 to 745

- Monthly savings rate: Increased from essentially $0 to $400+

- Late payment fees: $0 (previously averaged $35/month)

Psychological changes:

- Financial stress: Dramatically reduced

- Money confidence: Significantly increased

- Relationship harmony: Improved (money arguments with my partner decreased by about 80%)

- Future optimism: I actually believe I can achieve my financial goals now

Behavioral shifts:

- I check my bank account regularly without anxiety

- I make better spending decisions because I know my true discretionary amount

- I’ve developed other positive financial habits that compound the benefits

- I actually enjoy budgeting now (never thought I’d say that!)

The method has become so ingrained that I don’t even think about it anymore. It’s just how I manage money now. That’s the ultimate sign of a sustainable system—when it becomes effortless.

Who Should (and Shouldn’t) Use This Method

The Half Payment Budget Method works exceptionally well for:

✅ People paid biweekly or semi-monthly

✅ Those who struggle with traditional monthly budgeting

✅ Anyone living paycheck to paycheck who wants to break the cycle

✅ Couples with different pay schedules

✅ People who prefer automated systems over manual tracking

✅ Those with relatively consistent income and expenses

It may need modification for:

⚠️ Freelancers with highly variable income (though adaptations work well)

⚠️ People paid weekly (though you could use a quarter-payment method)

⚠️ Those with extremely irregular expenses

⚠️ People who prefer cash-based envelope budgeting systems

Even if you fall into the second category, the core principle—aligning bill payments with income timing—can still be valuable. The specific implementation just needs adjustment.

Getting Started: Your Action Plan for This Week

Ready to try the Half Payment Budget Method? Here’s your step-by-step action plan:

Day 1-2: Information gathering

- List all monthly expenses (fixed and variable)

- Review 3 months of bank statements to ensure you haven’t missed anything

- Calculate average amounts for variable expenses

- Determine your pay schedule and exact paycheck dates

Day 3: Calculations

- Divide each monthly expense by two

- Total your half-payment amount

- Verify this amount is less than your average paycheck

- If not, identify expenses to reduce (this is valuable information regardless!)

Day 4: Account setup

- Open a separate high-yield savings account for bills (or designate an existing one)

- Set up automatic transfers from checking to bills account for each payday

- If possible, set up automatic bill payments from the bills account

Day 5: Buffer building

- Transfer one half-payment amount to your bills account to “prime” the system

- If you don’t have this amount available, create a 2-4 week plan to build it

Day 6-7: Testing and refinement

- Review your setup for any errors

- Make sure automatic transfers are scheduled correctly

- Create a simple tracking spreadsheet or choose a budgeting app

- Set calendar reminders to review the system in 2 weeks and 1 month

Remember, the initial setup is the hardest part. Once your automation is running, the system maintains itself with minimal effort.

Conclusion: Why This Method Finally Stuck

I’ve tried a lot of budgeting methods over the years. The envelope system felt too restrictive. Zero-based budgeting required too much ongoing maintenance. The 50/30/20 rule was too vague for my needs. But the Half Payment Budget Method succeeded where others failed because it addressed the root cause of my budgeting struggles: timing mismatch.

By aligning my bill payments with my actual income schedule, I eliminated the cash flow rollercoaster that had derailed every previous budgeting attempt. The psychological shift from “Where did all my money go?” to “I know exactly where my money is” has been transformative.

This method won’t magically increase your income or eliminate your expenses. What it will do is create clarity, reduce stress, and provide a stable foundation for achieving your financial goals. Whether you want to build an emergency fund, pay off debt, or simply stop living in financial anxiety, the Half Payment Budget Method can be the system that finally makes budgeting stick.

Start small. Be patient with yourself during the setup phase. Give the system at least three months to prove itself. I’m confident you’ll experience the same relief and financial progress that I did.

Your future self—the one sleeping peacefully without money worries—will thank you for starting today. Visit MSBudget for more practical strategies to transform your financial life.