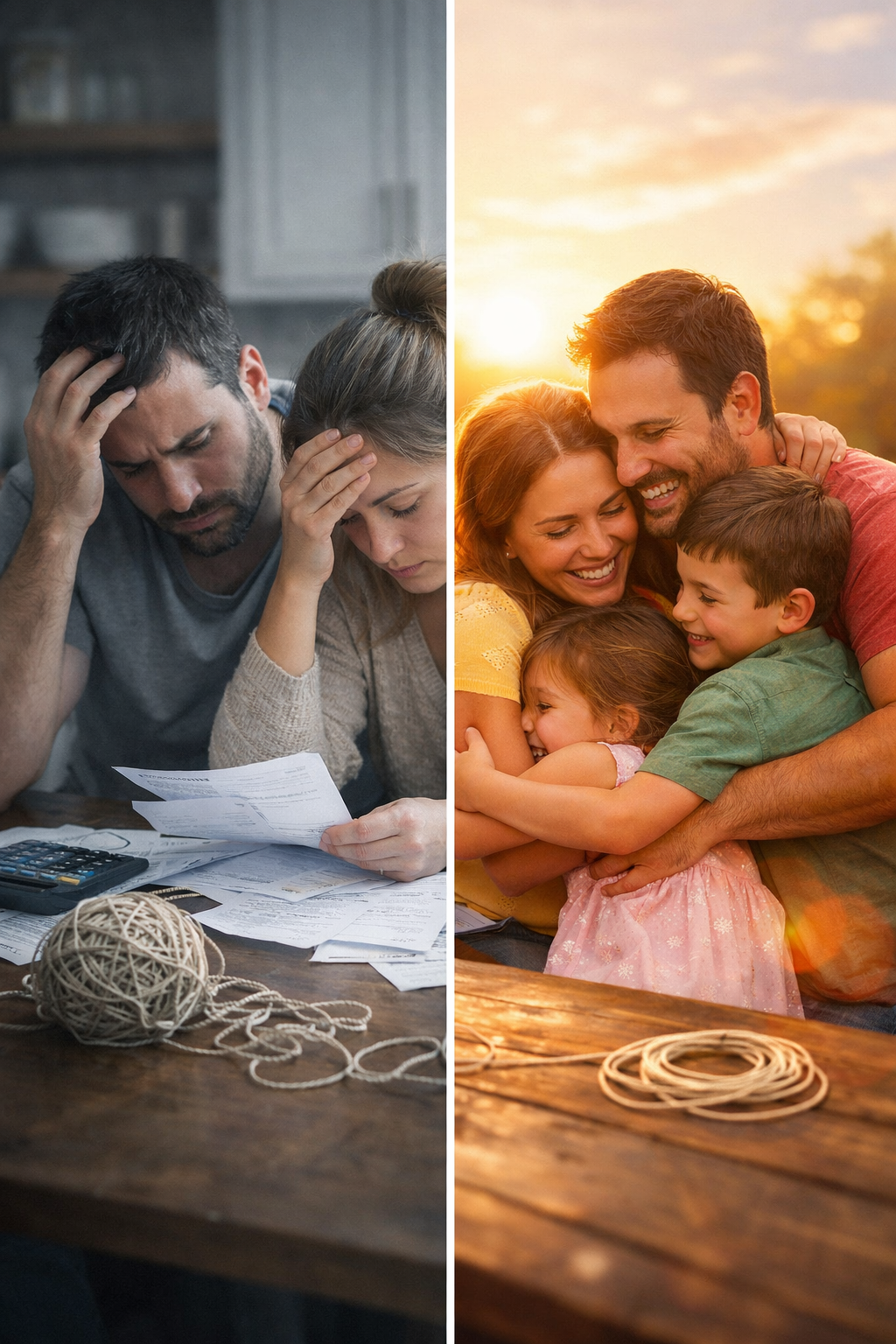

I’ll never forget the night I sat at our kitchen table, surrounded by bills, tears streaming down my face as I realized we owed more than $67,000. With three kids under seven, a single income, and what felt like a mountain of debt crushing us, becoming a debt free family seemed impossible. But here’s the truth: three years later, we paid off every single penny. If you’re drowning in debt while raising kids on one income, I’m here to tell you that freedom is possible—and I’m going to show you exactly how we did it.

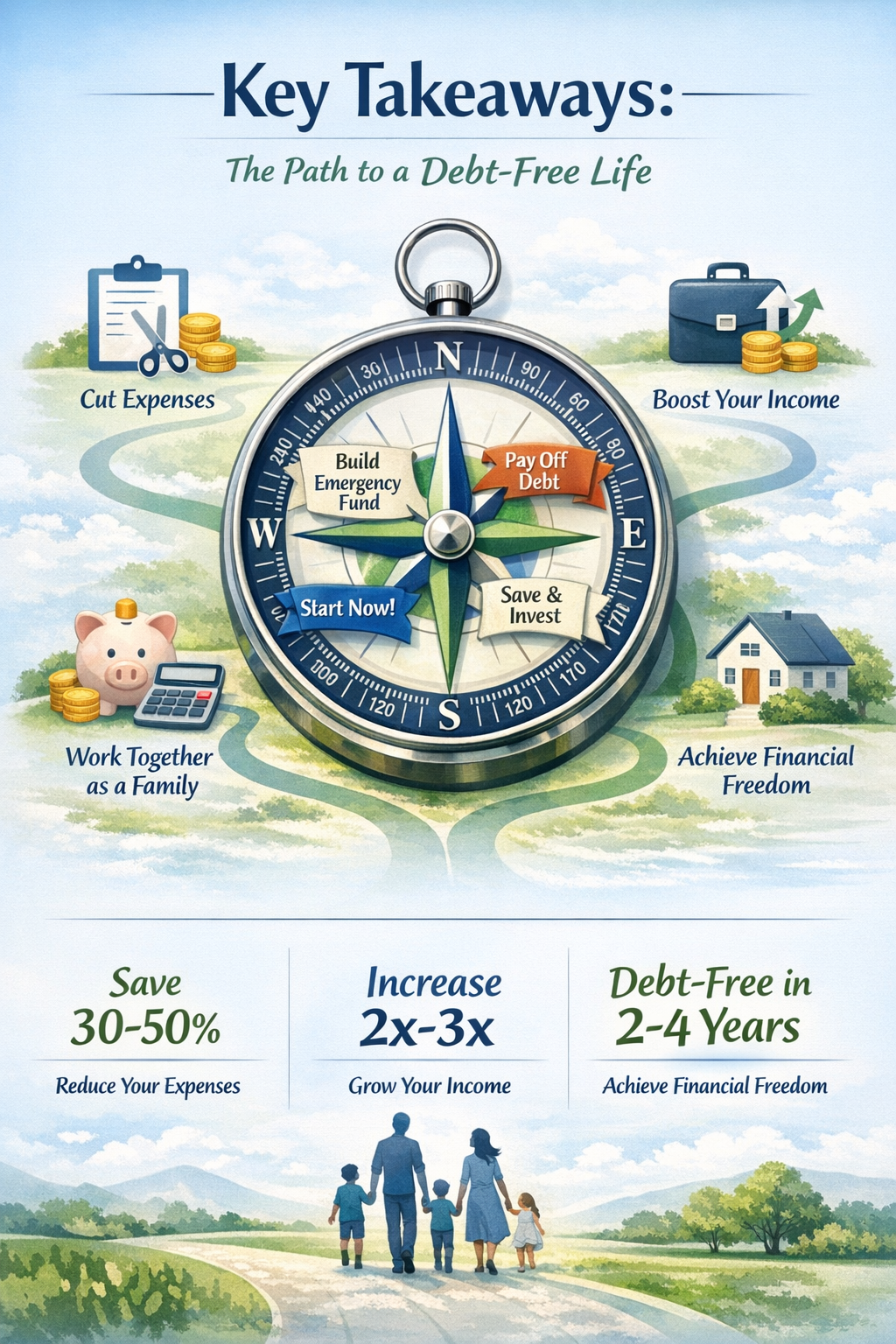

Key Takeaways

- Becoming a debt free family on one income is achievable with intentional budgeting, sacrifice, and a clear payoff strategy

- The debt snowball method combined with extreme frugality helped us eliminate $67,000 in 36 months

- Involving your kids in the journey teaches valuable money lessons and creates family unity around financial goals

- Cutting expenses ruthlessly while finding creative income sources accelerates debt payoff dramatically

- Building simple money habits ensures you stay debt-free long after the final payment

Our Debt-Free Family Story: Where It All Started 💔

Let me take you back to 2023. My husband had just started a new job after being laid off, and I had recently become a stay-at-home mom to our three beautiful children. We thought we were doing okay—until I actually sat down and added up all our debt.

Our debt breakdown looked like this:

| Debt Type | Amount | Interest Rate |

|---|---|---|

| Credit Cards | $23,400 | 18-24% |

| Car Loan | $18,600 | 6.5% |

| Student Loans | $21,000 | 5.2% |

| Medical Bills | $4,000 | 0% |

| Total | $67,000 | Varies |

On a single income of $52,000 per year, this felt insurmountable. We were living paycheck to paycheck, constantly stressed about money, and setting a terrible example for our kids. Something had to change.

The turning point came when our oldest asked why we couldn’t go on vacation like her friends. I realized our debt was stealing not just our money, but our family experiences and peace of mind. That night, I made a commitment: we would become a debt-free family, no matter what it took.

Step 1: Facing the Truth and Creating Our Debt-Free Family Plan 📊

The hardest part of any debt payoff journey is getting brutally honest about your situation. I spent an entire weekend gathering every statement, bill, and financial document we had. It was painful, but necessary.

Getting Crystal Clear on Our Numbers

First, I created a complete debt inventory. I wrote down:

- Every creditor’s name

- Total balance owed

- Minimum monthly payment

- Interest rate

- Due date

This simple act of facing our reality gave us power over our debt instead of letting it have power over us. I recommend using a step-by-step debt payoff plan to organize this process.

Choosing Our Payoff Strategy

After researching different methods, we chose the debt snowball approach. This meant listing our debts from smallest to largest and attacking the smallest first while making minimum payments on everything else.

Why? Because we needed quick wins. As a debt free family wannabe with three kids to feed and only one income, we needed motivation to keep going. Paying off that first $800 medical bill in two months gave us the momentum we desperately needed.

Setting Our Target Date

We calculated that with aggressive payments, we could be debt-free in three years. I circled December 31, 2026, on our calendar and wrote “FREEDOM DAY” in big red letters. That date became our family’s rallying cry.

Step 2: Slashing Our Budget to the Bone 🔪

Becoming a debt free family on one income meant we had to get serious about our spending. I’m talking extreme frugality that would make our friends think we’d lost our minds.

Our Grocery Budget Transformation

Our biggest expense after housing was food. We were spending nearly $900 a month feeding five people, eating out regularly, and wasting tons of food.

Here’s what we changed:

✅ Meal planning every single week – No more wandering the grocery store aimlessly

✅ Shopping with a strict list – If it wasn’t on the list, it didn’t go in the cart

✅ Cooking from scratch – Goodbye convenience foods, hello dried beans and rice

✅ Eliminating restaurants – We went from eating out 8 times a month to zero

✅ Using every leftover – “Leftover night” became a weekly tradition

We cut our grocery bill to $450 a month using frugal grocery strategies that actually work. That’s $450 extra per month toward debt—$5,400 per year!

Cutting the “Necessities” That Weren’t

We questioned everything. Did we really need cable? Nope. Did we need the latest phones? Absolutely not. Did we need a gym membership when we could exercise at home? You get the idea.

Our monthly cuts included:

- Cable TV: Saved $120/month

- Gym memberships: Saved $80/month

- Subscription boxes: Saved $45/month

- Premium phone plans: Saved $60/month (switched to prepaid)

- Reduced car insurance: Saved $35/month (shopped around)

- Cancelled streaming services: Saved $40/month (kept one, rotated)

Total monthly savings: $380

Annual savings: $4,560

Combined with grocery savings, we found nearly $10,000 per year just by cutting expenses. For a family trying to stop living paycheck to paycheck, this was life-changing.

Housing and Transportation Sacrifices

We seriously considered downsizing our home, but the moving costs and market conditions didn’t make sense. Instead, we:

- Rented out our spare bedroom to a college student ($400/month)

- Sold one car and became a one-car family (saved $280/month on payment, insurance, and gas)

- Kept the thermostat at 68°F in winter, 76°F in summer

These weren’t easy choices, especially with three kids. But every sacrifice brought us closer to becoming a debt free family.

Step 3: Increasing Our Income While Staying Home 💰

Cutting expenses only gets you so far. To really accelerate our debt payoff, I needed to find ways to earn money while still being home with our kids.

My Side Hustle Journey

As a stay-at-home mom, I had limited time, but I was determined. Here’s what worked:

Freelance Writing ($300-600/month)

I started writing articles during naptime and after the kids went to bed. It was exhausting, but that extra income made a huge difference.

Selling Items We No Longer Needed ($2,400 in year one)

We decluttered our entire house and sold everything from old toys to furniture we didn’t use. I made $1,000 in one month just by decluttering.

Online Surveys and Apps ($50-100/month)

While not huge money, every little bit helped. I used money-making apps during downtime.

Babysitting for Friends ($200/month)

Since I was already home with my kids, watching one or two more a few times a week was manageable and brought in cash.

My Husband’s Efforts

My husband also stepped up:

- Took on overtime whenever available

- Started a small lawn care business on weekends (seasonal)

- Sold his collectibles that had been gathering dust

Between both of us, we added roughly $800-1,200 per month in extra income during our most aggressive debt payoff phase.

Step 4: Involving Our Kids in the Debt-Free Family Mission 👨👩👧👦

One of the best decisions we made was being age-appropriately honest with our children about our financial situation and goals.

Teaching Moments

We didn’t burden them with adult stress, but we did explain:

- Why we were choosing different activities (free parks instead of expensive entertainment)

- How saving money helps our family

- The importance of being grateful for what we have

- How to distinguish between wants and needs

Our Debt-Free Chart

We created a giant thermometer chart on our refrigerator showing our progress toward zero debt. Every time we paid off a debt, the kids helped color in the chart. They celebrated with us!

Kid-Friendly Sacrifices

Our children learned to:

- Choose library books over bookstore purchases

- Enjoy homemade pizza nights instead of delivery

- Appreciate hand-me-downs and thrift store finds

- Save their own money for special wants

These lessons were priceless. Our kids developed financial literacy that will serve them their entire lives. They saw firsthand that becoming a debt free family requires teamwork and sacrifice.

Step 5: Staying Motivated Through the Tough Times 💪

Let me be real: there were moments when I wanted to quit. When the car broke down and needed $800 in repairs. When all three kids needed new shoes at the same time. When I was so tired of saying “no” to everything fun.

Our Motivation Strategies

Monthly Celebrations

Every time we paid off a debt, we had a small celebration—usually a homemade special dinner or a free family activity we loved.

Visual Reminders

Besides our refrigerator chart, I kept a photo of our family on my phone with “DEBT FREE 2026” as the caption. Every time I was tempted to overspend, I looked at it.

Community Support

I joined online debt-free communities where other families shared their journeys. Knowing we weren’t alone made a huge difference. Reading about staying motivated while dealing with debt stress helped during the hardest months.

Tracking Every Win

I kept a journal where I wrote down every payment, every milestone, every small victory. Looking back at how far we’d come kept us moving forward.

The Emergency Fund Buffer

One critical strategy: we paused our aggressive debt payoff to save a $1,000 emergency fund first. This prevented us from going further into debt when unexpected expenses hit. Once we had that buffer, we attacked debt with everything we had.

The Numbers: Our Three-Year Debt-Free Family Journey 📈

Here’s exactly how we paid off $67,000 in 36 months on one income:

Year One:

- Debt paid: $18,200

- Average monthly payment: $1,517

- Methods: Extreme budget cuts + side hustles + selling stuff

- Debts eliminated: All medical bills, 2 credit cards

Year Two:

- Debt paid: $22,800

- Average monthly payment: $1,900

- Methods: Continued frugality + increased side income + tax refund

- Debts eliminated: Remaining credit cards, car loan

Year Three:

- Debt paid: $26,000

- Average monthly payment: $2,167

- Methods: Snowball effect + bonus from husband’s work + final push

- Debts eliminated: All student loans

Our Income Breakdown

Primary income: $52,000/year ($4,333/month)

Side income average: $800/month

Total monthly income: $5,133

Our debt payment averaged: $1,794/month

Percentage of income to debt: 35%

We lived on roughly $3,300/month for a family of five, which included:

- Mortgage/rent

- Utilities

- Groceries

- Basic necessities

- Minimal entertainment

It was tight. Really tight. But we made it work by implementing proven strategies to pay down debt faster.

Life After Becoming a Debt-Free Family 🎉

On December 28, 2026 (three days ahead of schedule!), we made our final student loan payment. I literally cried tears of joy. Our kids made us a “Congratulations!” banner, and we had a family dance party in our living room.

What Changed Immediately

The most noticeable change was breathing room. That $1,800+ we’d been throwing at debt every month suddenly became available for:

- Building a real emergency fund (we’re now at 6 months of expenses)

- Saving for our kids’ education

- Planning a modest family vacation (our first in three years!)

- Starting to invest for retirement

The Habits That Stuck

Even though we’re debt-free, we’ve maintained many of the frugal habits that got us here:

- Meal planning and cooking from scratch

- Thoughtful spending on wants

- Living below our means

- Avoiding lifestyle inflation

These simple habits help us stay debt-free for life.

Our New Financial Goals

Now we’re focused on:

- Achieving complete financial freedom

- Building wealth for our family’s future

- Teaching our kids about money management

- Giving generously to causes we care about

Practical Tips for Your Debt-Free Family Journey 🎯

Based on our experience, here’s my best advice for families trying to become debt-free on one income:

Start Where You Are

Don’t wait for the “perfect” time. We weren’t in an ideal situation when we started, but we started anyway. Even if you can only put $50 extra toward debt this month, that’s $50 closer to freedom.

Get Your Spouse on Board

This only works if you’re united. My husband and I had to have some difficult conversations, but we committed to the goal together. If you’re struggling with money discussions, try a couples budgeting approach that reduces conflict.

Be Flexible But Committed

Life happens. Kids get sick. Cars break down. Appliances die. When setbacks occur, adjust your timeline but don’t abandon your goal.

Find Free Fun

We discovered so many free activities: library story times, community events, nature walks, free museum days, backyard camping. Your kids won’t remember expensive entertainment—they’ll remember time together.

Avoid These Common Mistakes

Based on what I learned, avoid these pitfalls:

- Don’t skip the emergency fund (even a small one)

- Don’t hide spending from your spouse

- Don’t deprive yourself so much you burn out

- Don’t compare your journey to others

- Don’t forget to celebrate small wins

For more guidance, check out common money mistakes to avoid that could derail your progress.

Consider Your Timeline Realistically

We chose three years, but your timeline might be different. Factors to consider:

- Total debt amount

- Income level

- Family size and expenses

- Geographic location (cost of living)

- Health considerations

Some families do it faster; some take longer. What matters is consistent progress, not perfection.

Resources That Helped Our Debt-Free Family Succeed 📚

Throughout our journey, certain tools and resources were invaluable:

Books That Changed Our Mindset

“Debt-Free Forever” by Gail Vaz-Oxlade became our debt payoff bible [1]. Her practical, no-nonsense approach resonated with us and provided actionable steps we could implement immediately.

Tracking Tools

We used:

- A simple Excel spreadsheet to track all debts

- A debt-free journal to document our journey [3]

- Free budgeting apps to monitor spending

- Cash envelopes for variable expenses

Online Communities

Connecting with other families on the same journey provided encouragement, accountability, and practical tips. YouTube channels featuring debt-free stories [2] kept us motivated during tough months.

Financial Education

We educated ourselves through:

- Personal finance blogs and podcasts

- Library books on money management [4]

- Free online courses on budgeting

- Debt payoff calculators to track progress

Your Debt-Free Family Action Plan: Start Today ✅

Ready to begin your own journey? Here’s your step-by-step action plan:

This Week:

- Gather all debt statements and create your complete debt inventory

- Calculate your total debt amount (yes, it’s scary, but necessary)

- Have an honest conversation with your spouse about your financial goals

- Choose your debt payoff method (snowball or avalanche)

This Month:

- Create a bare-bones budget focusing on needs vs. wants

- Identify 3-5 expenses you can cut immediately

- Set up automatic minimum payments on all debts

- Start your $1,000 emergency fund

- List items you can sell for quick cash

This Quarter:

- Establish a side hustle or additional income stream

- Make your first extra debt payment

- Create a visual tracker for your family

- Review and adjust your budget based on what’s working

- Celebrate your first small win

This Year:

- Pay off your first debt completely

- Build your emergency fund to one month of expenses

- Involve your kids in age-appropriate ways

- Reassess your timeline and adjust as needed

- Stay connected to your support community

Remember, becoming a debt free family isn’t about being perfect—it’s about making consistent progress toward freedom.

Conclusion: Your Debt-Free Family Future Awaits 🌟

Three years ago, I couldn’t imagine how we’d ever escape our $67,000 debt prison. Today, we’re completely debt-free, building wealth, and teaching our children financial principles that will change their lives.

If we could do it on one income with three kids, you can too. Will it be easy? Absolutely not. Will it require sacrifice? Yes. Will there be moments you want to quit? Definitely. But will it be worth it? Without a doubt.

The peace of mind that comes from being a debt free family is indescribable. No more anxiety about bills. No more fighting about money. No more feeling trapped by payments. Just freedom to build the life you actually want.

Your journey starts with a single decision: today is the day you commit to change. You don’t need perfect circumstances, unlimited income, or special knowledge. You just need determination, a plan, and the willingness to do hard things for a better future.

We’re cheering for you. Your debt-free family story is waiting to be written. Now go write it! 💪