Let’s be real: when someone mentions “budgeting,” your brain probably goes straight to complicated spreadsheets, endless formulas, and hours of number-crunching. 😴 But what if I told you that Dave Ramsey Budget Percentages could help you take control of your money without becoming a math wizard or spending your entire Sunday organizing color-coded Excel tabs?

I get it. You want financial freedom, but you also want to actually live your life. The good news? Dave Ramsey’s percentage-based budgeting system is basically the “set it and forget it” approach to managing your money. No complex calculations required—just simple percentages that tell you exactly where your money should go each month.

In this guide, I’m breaking down the Dave Ramsey Budget Percentages in the most straightforward, no-nonsense way possible. Whether you’re drowning in student loans, trying to save for that dream vacation, or just tired of wondering where your paycheck disappears to every month, this system has your back.

Key Takeaways

- Dave Ramsey Budget Percentages provide a simple framework: allocate 25-35% to housing, 10-15% each to transportation, food, savings, and giving, plus smaller percentages for other essentials

- Zero-based budgeting is the foundation—every dollar gets assigned a job, so your income minus expenses equals zero

- No spreadsheets required—you can use simple apps, the envelope method, or even just pen and paper to track your percentages

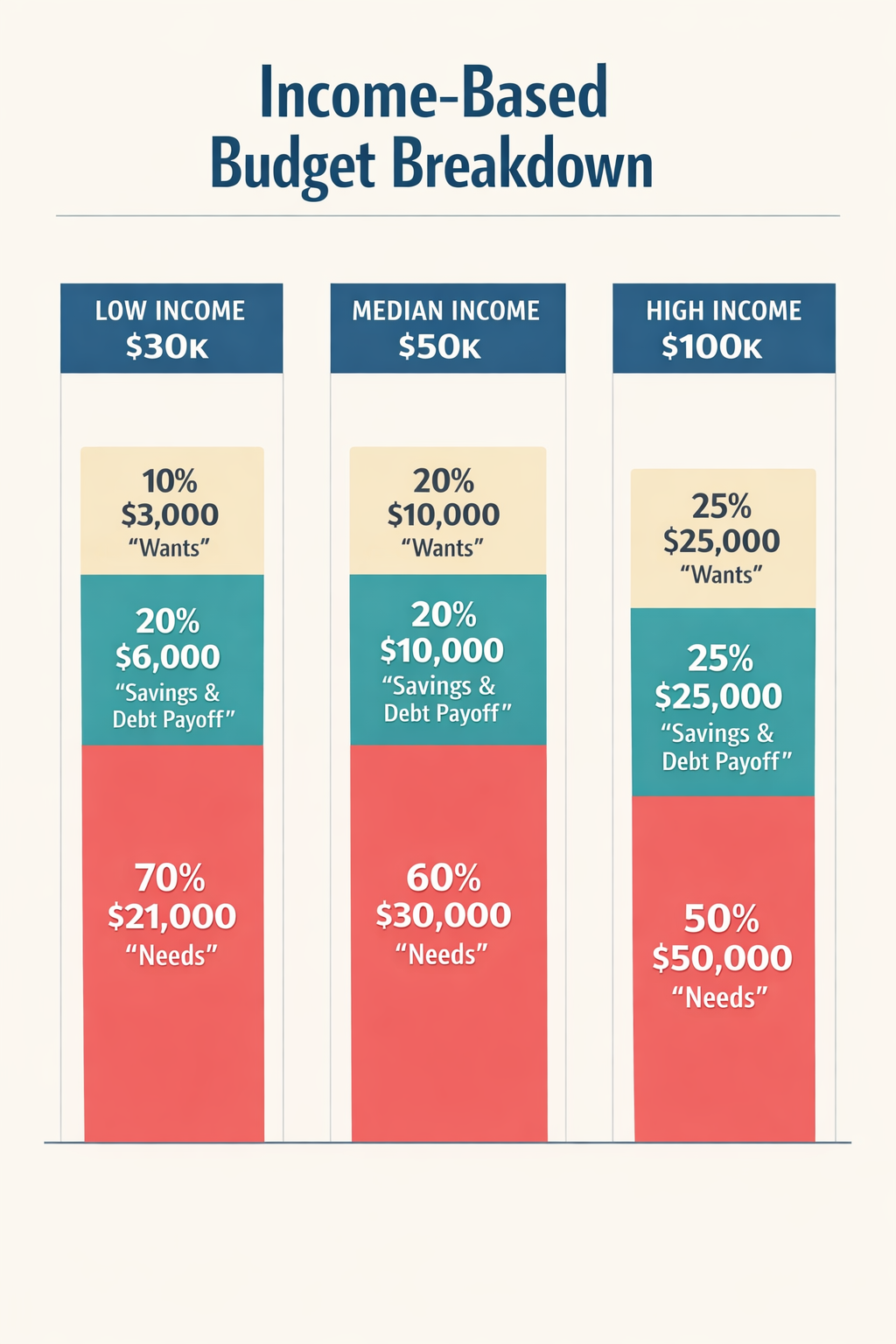

- Percentages adjust based on income—lower incomes need higher percentages for necessities, while higher incomes have more flexibility

- The system works best when customized—use the percentages as guidelines, not rigid rules, and adjust based on your actual life and location

What Are Dave Ramsey Budget Percentages, Anyway?

Here’s the deal: Dave Ramsey Budget Percentages are essentially a roadmap for your money. Instead of guessing how much you should spend on rent or groceries, Dave Ramsey has done the heavy lifting for you by creating recommended percentage ranges for each spending category.

Think of it like a recipe. You wouldn’t throw random ingredients together and hope for the best, right? The same goes for your budget. These percentages give you the perfect “ingredients” to create a balanced financial life.

The Basic Breakdown

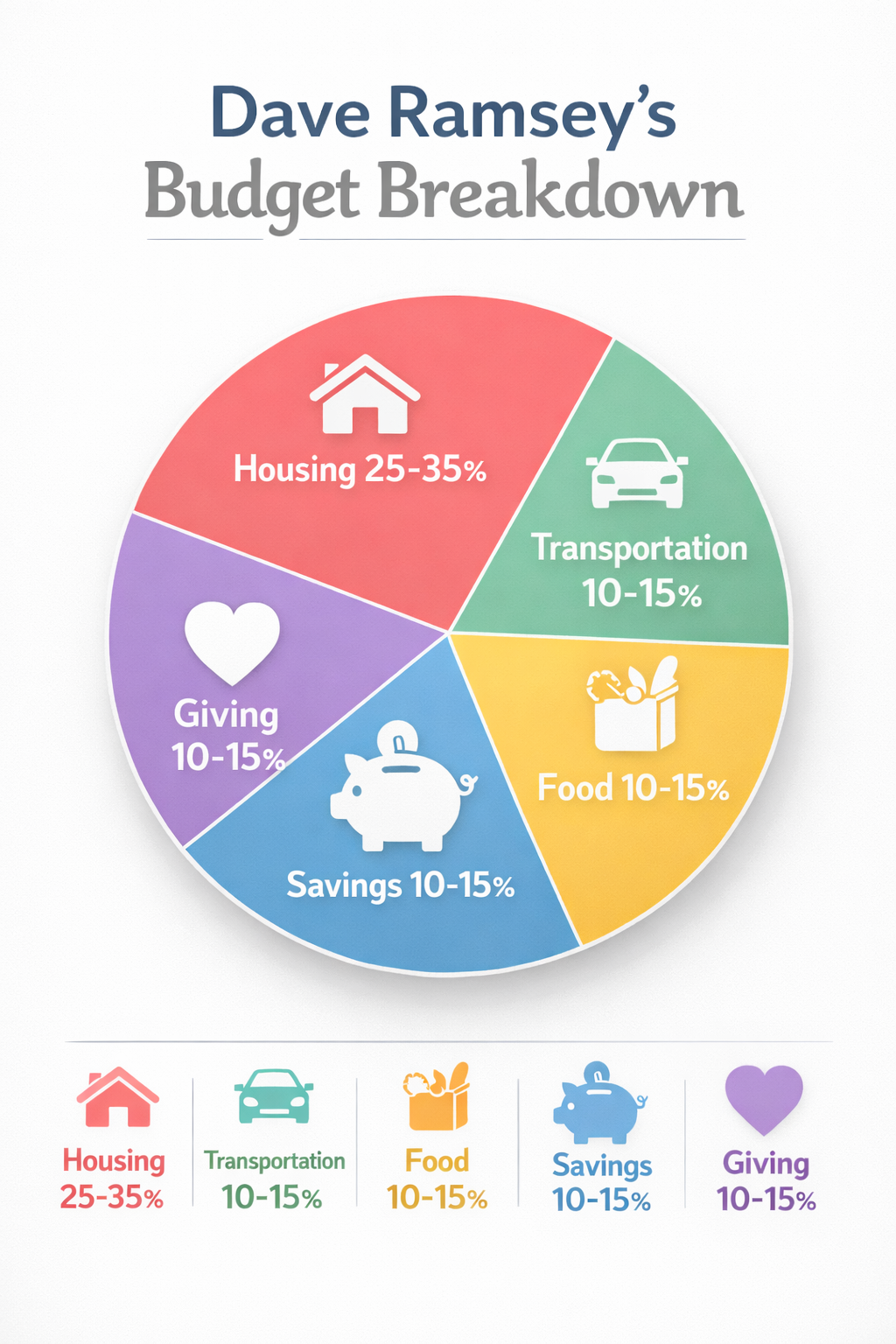

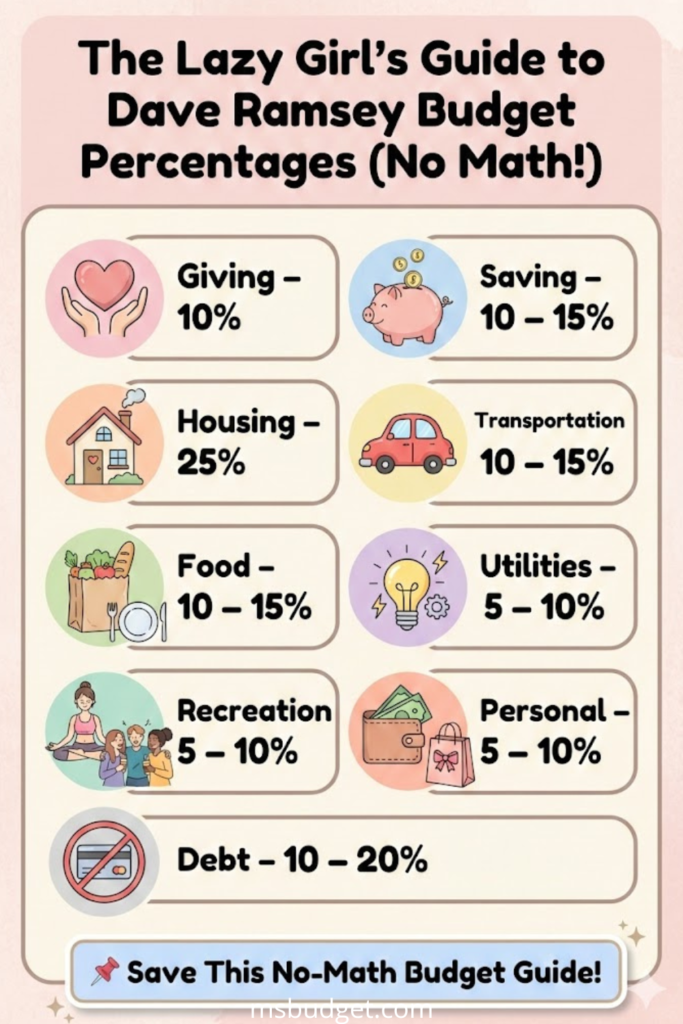

According to Dave Ramsey’s system, here’s how your take-home pay (that’s after taxes) should be divided[1]:

| Category | Percentage Range |

|---|---|

| 🏠 Housing | 25-35% |

| 🚗 Transportation | 10-15% |

| 🍕 Food | 10-15% |

| 💡 Utilities | 5-10% |

| 🏥 Insurance | 10-25% |

| 💰 Savings | 10-15% |

| ❤️ Giving/Charity | 10-15% |

| 💊 Health | 5-10% |

| 🎉 Recreation | 5-10% |

| 👗 Personal Spending | 5-10% |

Notice something? These percentages are based on your net income—that’s what you actually bring home after taxes, not your gross salary. This is super important because it keeps things realistic.

Why Percentages Make Life Easier

The beauty of using percentages instead of fixed dollar amounts is that they scale with your income. Whether you’re making $30,000 or $100,000 a year, the system adapts. You don’t need to completely reinvent your budget every time you get a raise or switch jobs.

Plus, percentages give you flexibility. Notice those ranges? That’s intentional. If you live in an expensive city, you might need to use 35% for housing. If you’ve got a paid-off car and bike to work, maybe transportation only takes up 5% of your budget. The percentages are guidelines, not handcuffs.

Understanding the Zero-Based Budget Method (The Secret Sauce)

Before we dive deeper into the specific percentages, you need to understand the foundation of Dave Ramsey’s approach: zero-based budgeting[1].

Don’t let the name intimidate you! It’s actually super simple. Here’s the concept in plain English:

Income – Expenses = Zero

That’s it. You’re giving every single dollar a job before the month begins. This doesn’t mean you spend everything—savings and debt payments count as “expenses” in this system.

How Zero-Based Budgeting Works in Real Life

Let’s say you bring home $4,000 per month. With zero-based budgeting, you’d assign all $4,000 to different categories:

- $1,200 to rent (30%)

- $400 to groceries (10%)

- $500 to car payment and gas (12.5%)

- $400 to savings (10%)

- $300 to insurance (7.5%)

- And so on…

When you’re done assigning every dollar, you should have exactly $0 left over. Not because you spent it all, but because you’ve intentionally allocated it all—including to savings, investments, and debt payoff.

This method forces you to be intentional with your money instead of just seeing what’s left at the end of the month (spoiler alert: it’s usually nothing).

If you’re looking for even simpler approaches to get started, check out our guide on budgeting hacks for beginners that can help you ease into the process.

Breaking Down Dave Ramsey Budget Percentages Category by Category

Alright, let’s get into the nitty-gritty of each category. I’m going to break down what each percentage means, what it includes, and how to make it work for your actual life.

Housing: 25-35% 🏠

This is typically your biggest expense, and Dave Ramsey recommends keeping it between 25-35% of your take-home pay[1].

What’s included:

- Rent or mortgage payment

- Property taxes (if not included in mortgage)

- HOA fees

- Basic home maintenance

Real talk: In 2026, keeping housing at 25% is basically impossible in major cities. At the median income, 35% translates to about $1,342 per month[1]—which won’t even get you a studio apartment in places like New York, San Francisco, or Washington D.C.

My lazy girl tip: If you’re spending more than 35% on housing, don’t panic. Instead, look at other categories where you can cut back. Maybe you go down to 5% on recreation or find ways to reduce transportation costs. The percentages work together as a system.

Transportation: 10-15% 🚗

This covers everything related to getting from Point A to Point B[1].

What’s included:

- Car payments

- Gas

- Auto insurance

- Maintenance and repairs

- Public transportation costs

- Parking fees

Real talk: If you’re spending more than 15% here, you might be driving too much car for your income. Dave Ramsey is famous for saying you shouldn’t have a car payment at all, but I know that’s not realistic for everyone.

My lazy girl tip: Consider bundling your car and home insurance to save $1,000-$3,000 annually[3]. That’s free money just for making a phone call! Also, if you’re struggling with transportation costs, our 50 ways to save money every month has some great ideas for cutting these expenses.

Food: 10-15% 🍕

This is where many budgets go to die, honestly.

What’s included:

- Groceries

- Dining out

- Coffee runs

- Work lunches

- Food delivery

Real talk: 10-15% can feel tight, especially if you’re used to eating out frequently. For someone making $4,000/month, that’s only $400-600 for all food.

My lazy girl tip: The 54321 grocery shopping method can help you save $250+ per month without feeling deprived. Also, meal planning doesn’t have to be complicated—even planning just 3-4 dinners per week can make a huge difference.

Utilities: 5-10% 💡

What’s included:

- Electricity

- Water

- Gas

- Trash service

- Internet and phone

My lazy girl tip: Set everything to autopay and forget about it. Most utility companies offer budget billing that averages your costs throughout the year, so you’re not shocked by a $300 electric bill in August.

Insurance: 10-25% 🏥

This is a wide range because it depends heavily on your situation[1].

What’s included:

- Health insurance (if not deducted from paycheck)

- Life insurance

- Disability insurance

- Any other insurance premiums

Real talk: If you’re young and healthy, you might be closer to 10%. If you’re supporting a family or have health issues, you might need the full 25%.

Savings: 10-15% 💰

This is non-negotiable in Dave Ramsey’s world[1], and honestly, I agree.

What’s included:

- Emergency fund contributions

- Retirement savings (401k, IRA)

- Sinking funds for irregular expenses

- General savings

My lazy girl tip: Automate this! Set up automatic transfers to your savings account on payday. If you never see the money, you won’t miss it. Our 7 genius savings strategy hacks can help you reach your goals faster.

Giving/Charity: 10-15% ❤️

Dave Ramsey is big on generosity, recommending 10-15% for charitable giving[1].

Real talk: If you’re drowning in debt or barely making ends meet, this might feel impossible. And that’s okay. Start where you can—even 1% is better than nothing.

My lazy girl tip: Set up automatic donations to causes you care about. It’s easier to give consistently when it’s automated.

Health, Recreation, and Personal: 5-10% Each 💊🎉👗

These categories cover everything else[1]:

Health (5-10%):

- Gym memberships

- Medications

- Co-pays

- Vitamins and supplements

Recreation (5-10%):

- Entertainment

- Hobbies

- Subscriptions (Netflix, Spotify, etc.)

- Vacations

Personal (5-10%):

- Clothing

- Hair and beauty

- Gifts

- Miscellaneous purchases

My lazy girl tip: Track these categories loosely. You don’t need to account for every single dollar, but knowing your general spending patterns helps you stay within the percentages.

How to Adjust Dave Ramsey Budget Percentages for Your Income

Here’s something most budgeting guides won’t tell you: the percentages change dramatically based on your income level[2].

Low-Income Adjustments

If you’re making $30,000 or less per year, you’ll likely need to allocate more to necessities and less to discretionary spending:

- Housing might need to be 40-45% (unfortunately)

- Food might be 15-20%

- Transportation could be 15-20%

- Savings might only be 5% to start

This isn’t failure—it’s reality. The goal is to use the percentages as a guide while you work toward increasing your income. Check out our guide on how to stop living paycheck to paycheck in 90 days for actionable steps.

High-Income Adjustments

If you’re making $100,000+, you have more flexibility:

- Housing might only be 20-25%

- You can max out savings at 20-30%

- Recreation and personal spending can increase

- You have room for aggressive debt payoff

The 2026 Reality Check

Recent guidance suggests a modified framework for 2026: 70% for essential needs, 10% for wants, and 15% for savings[4]. This acknowledges that the traditional 50/30/20 rule (which allocated only 50% to needs) just doesn’t work in today’s economy.

If you’re finding Dave Ramsey’s percentages too restrictive, you might want to explore the 70/20/10 budget rule as an alternative approach.

The Lazy Girl’s Method: No Spreadsheets Required!

Okay, here’s the part you’ve been waiting for: how to actually use these percentages without becoming a spreadsheet ninja.

Method 1: The Smartphone App Approach 📱

Dave Ramsey’s EveryDollar app is designed specifically for zero-based budgeting[1]. But honestly, any budgeting app works:

- Download a free budgeting app (EveryDollar, Mint, YNAB, etc.)

- Enter your monthly take-home income

- Create categories based on the percentages

- Let the app do the math

- Check in once a week to make sure you’re on track

Time investment: 30 minutes to set up, 10 minutes per week to maintain.

Method 2: The Envelope System (Updated for 2026) 💸

The classic envelope method gets a modern twist:

- Calculate your percentages once

- Use digital “envelopes” in your banking app OR

- Use actual envelopes for cash categories

- When the envelope is empty, you’re done spending in that category

Time investment: 1 hour to set up, 5 minutes per week to check balances.

Method 3: The “Good Enough” Approach ✅

This is my personal favorite for the truly lazy:

- Calculate your percentages once (use a calculator, I won’t judge)

- Write them down on a sticky note

- Set up automatic payments for fixed expenses (rent, insurance, savings)

- Keep a rough mental tally for variable expenses (food, recreation)

- Check your bank account once a week

Time investment: 20 minutes to set up, 5 minutes per week to maintain.

The key is finding a system that you’ll actually use. A perfect budget that you abandon after two weeks is useless. A “good enough” budget that you stick with for years will change your life.

For couples trying to navigate budgeting together, our couples budgeting bootcamp can help you manage money without the fights.

Common Mistakes to Avoid with Dave Ramsey Budget Percentages

After helping dozens of friends implement this system (and making plenty of mistakes myself), here are the biggest pitfalls to avoid:

Mistake #1: Forgetting About Irregular Expenses

Your budget percentages should account for things that don’t happen every month:

- Car registration

- Holiday gifts

- Annual insurance premiums

- Vet bills

The fix: Create a “sinking fund” within your savings category for these irregular expenses.

Mistake #2: Using Gross Income Instead of Net Income

The percentages are based on what you actually bring home, not your salary before taxes[5]. Using gross income will make your percentages way off.

The fix: Look at your actual paycheck, not your offer letter. If you’re self-employed, set aside 25-30% for taxes first[5], then apply the percentages to what’s left.

Mistake #3: Being Too Rigid

Life happens. Some months you’ll go over in one category and under in another. That’s normal!

The fix: Look at your budget as a living document. Adjust as needed, and focus on the overall trend rather than perfection every single month.

Mistake #4: Not Tracking Anything

You can’t manage what you don’t measure. Even with a “lazy” approach, you need some level of awareness.

The fix: Choose ONE tracking method and commit to it for 90 days. That’s long enough to form a habit but short enough to feel manageable.

For more budgeting pitfalls to watch out for, check out our guide on 10 budgeting mistakes to avoid.

Mistake #5: Giving Up Too Soon

Most people quit budgeting after one or two months because it feels restrictive or complicated.

The fix: Give yourself grace during the first 3 months. Your budget won’t be perfect right away, and that’s okay. Each month gets easier as you learn your actual spending patterns.

Making Dave Ramsey Budget Percentages Work for Debt Payoff

If you’re dealing with debt (and let’s be real, most of us are), you’re probably wondering how debt payoff fits into these percentages.

Dave Ramsey’s approach is to go gazelle intense on debt payoff, which might mean temporarily adjusting your percentages:

The Debt Payoff Adjustment

While paying off debt aggressively:

- Reduce recreation to 2-5%

- Cut personal spending to 2-5%

- Minimize giving to 5-10% (if needed)

- Keep a small emergency fund ($1,000)

- Throw everything else at debt

This isn’t forever—just until you’re debt-free. Then you can rebalance back to the standard percentages.

Real example: If you have $20,000 in credit card debt at 18% interest, paying an extra $500/month (by cutting other categories) could save you years of payments and thousands in interest.

For specific strategies on tackling credit card debt with a low income, our guide on how to pay off credit card debt fast on low income has actionable steps you can implement today.

The Baby Steps Integration

Dave Ramsey’s famous Baby Steps work hand-in-hand with the budget percentages:

- Baby Step 1: Save $1,000 emergency fund (use your 10-15% savings allocation)

- Baby Step 2: Pay off all debt except mortgage (temporarily adjust percentages)

- Baby Step 3: Build 3-6 months expenses in savings (back to 10-15% savings)

- Baby Steps 4-7: Invest, save for kids’ college, pay off mortgage, build wealth

The percentages provide the framework; the Baby Steps provide the roadmap.

If you’re looking to become completely debt-free, our 10 simple habits that help you stay debt-free for life can help you maintain your progress long-term.

Customizing Your Budget Percentages for 2026 Reality

Let’s be honest: Dave Ramsey’s percentages were created before inflation went crazy, before rent prices skyrocketed, and before everyone and their mother had 17 different subscription services.

Here’s how to make the Dave Ramsey Budget Percentages work in 2026:

Geographic Adjustments

High cost of living areas (NYC, SF, LA, Seattle):

- Housing: 35-45% (unfortunately necessary)

- Transportation: 5-10% (use public transit)

- Food: 12-18%

- Savings: 5-10% to start

- Everything else: adjust accordingly

Medium cost of living areas:

- Stick close to Dave’s original percentages

- Housing: 28-35%

- Savings: 10-15%

Low cost of living areas:

- Housing: 20-30%

- Savings: 15-20% (take advantage!)

- You have more flexibility across the board

Life Stage Adjustments

Single, no kids:

- Lower food percentage (8-12%)

- Higher recreation (10-15%)

- Maximize savings (15-20%)

Married, no kids:

- Moderate all categories

- Focus on building wealth together

- Consider our couples budgeting guide for managing joint finances

Parents with young kids:

- Higher food percentage (15-20%)

- Add childcare category (10-25%)

- Lower recreation temporarily

- Adjust personal spending

Empty nesters:

- Lower food percentage

- Increase savings and giving

- More flexibility for recreation and travel

The Side Hustle Factor

If you have income from a side hustle or freelancing:

- Set aside 25-30% for taxes immediately[5]

- Apply the percentages to the remaining income

- Consider using side hustle money exclusively for debt payoff or savings

Looking for ways to increase your income? Check out our guide on 25 realistic ideas for making money from home to boost your budget flexibility.

Your Action Plan: Getting Started This Week

Alright, enough theory. Here’s your simple, lazy-girl-approved action plan to implement Dave Ramsey Budget Percentages this week:

Monday: Calculate Your Numbers (30 minutes)

- Find your last paycheck stub

- Write down your take-home pay (net income)

- Use your phone calculator to multiply by each percentage

- Write these target amounts next to each category

Example: If you bring home $3,500/month:

- Housing (30%): $1,050

- Transportation (12%): $420

- Food (12%): $420

- Savings (10%): $350

- And so on…

Tuesday: Track Current Spending (15 minutes)

- Log into your bank account

- Look at last month’s transactions

- Roughly categorize your spending

- Compare to your target percentages

- Identify the biggest gaps

Don’t judge yourself here—just observe. This is data collection, not a report card.

Wednesday: Make One Adjustment (10 minutes)

Pick the category where you’re most over budget and make ONE change:

- Cancel one subscription you don’t use

- Plan one more home-cooked meal per week

- Switch to a cheaper phone plan

- Bundle your insurance

Small changes compound over time.

Thursday: Set Up Automation (20 minutes)

- Set up automatic transfer to savings on payday

- Set up autopay for fixed bills

- Set up alerts for when you’re approaching limits in variable categories

Friday: Choose Your Tracking Method (15 minutes)

Download an app, grab some envelopes, or create a simple note in your phone. Pick ONE method and commit to trying it for 30 days.

Weekend: Review and Adjust

Take 10 minutes to look at your week. Did you stick to your percentages? Where did you struggle? What felt easy?

Adjust as needed. Remember: progress over perfection.

Conclusion: Your Money, Your Rules (But With Percentages)

Here’s the truth: Dave Ramsey Budget Percentages aren’t magic. They won’t automatically make you wealthy, and they definitely won’t make budgeting feel like a day at the spa.

But what they will do is give you a framework—a starting point that takes the guesswork out of managing your money. Instead of wondering if you’re spending too much on groceries or not saving enough, you have clear targets to aim for.

The “lazy girl” approach isn’t about being irresponsible with money. It’s about being efficient. It’s about finding systems that work with your life, not against it. It’s about progress, not perfection.

You don’t need complicated spreadsheets or a degree in accounting. You just need:

- ✅ Your take-home pay

- ✅ A calculator (your phone has one)

- ✅ A simple tracking method you’ll actually use

- ✅ The willingness to adjust as you go

Start with the percentages Dave Ramsey recommends[1], then customize them for your actual life in 2026. Live in an expensive city? Adjust. Paying off debt? Adjust. Have a side hustle? Adjust.

The percentages are guidelines, not commandments. Use them as a framework to build the financial life you want—one that includes both security and the occasional overpriced latte.

Your next step: Pick ONE thing from the action plan above and do it today. Not tomorrow, not next Monday—today. Calculate your target percentages, download an app, or set up one automatic transfer.

That’s it. That’s how you start.

Your future self (the one who’s debt-free, has a fully-funded emergency fund, and doesn’t panic when unexpected expenses pop up) will thank you.

Now go forth and budget—the lazy way. 💪💰

References

[1] Dave Ramsey Budget – https://www.debt.org/advice/dave-ramsey-budget/

[2] Planning – https://calculator.me/planning/

[3] Watch – https://www.youtube.com/watch?v=Hrc-4dZxI08

[4] Watch – https://www.youtube.com/watch?v=aLfLgADYBBY

[5] Dave Ramsey Budget Percentages – https://innovasport.co.uk/dave-ramsey-budget-percentages/