You’re standing at the checkout counter, about to swipe your credit card, when you realize you could be earning triple points on this purchase—but you grabbed the wrong card from your wallet. We’ve all been there! The truth is, credit cards can either be your best financial friend or your worst enemy, depending on how you use them. With the right credit card hacks, you can turn everyday spending into free flights, cash back bonuses, and valuable perks—all while staying completely debt-free.

I’ll be honest with you: I used to think credit cards were just plastic money traps designed to keep people in debt forever. But after learning these insider strategies, I’ve completely transformed my relationship with credit cards. Now they work for me, not against me. In 2026, with fraud threats increasing and new regulations changing the credit landscape, knowing how to navigate the credit card world smartly has never been more important.

In this comprehensive guide, I’m sharing the 10 most powerful credit card hacks that have helped me maximize rewards while avoiding the debt trap entirely. Whether you’re a credit card newbie or a seasoned points collector, these strategies will help you get more value from every swipe.

Key Takeaways

💳 Strategic card selection can multiply your rewards by 3-5x on everyday purchases when you match spending categories to the right cards

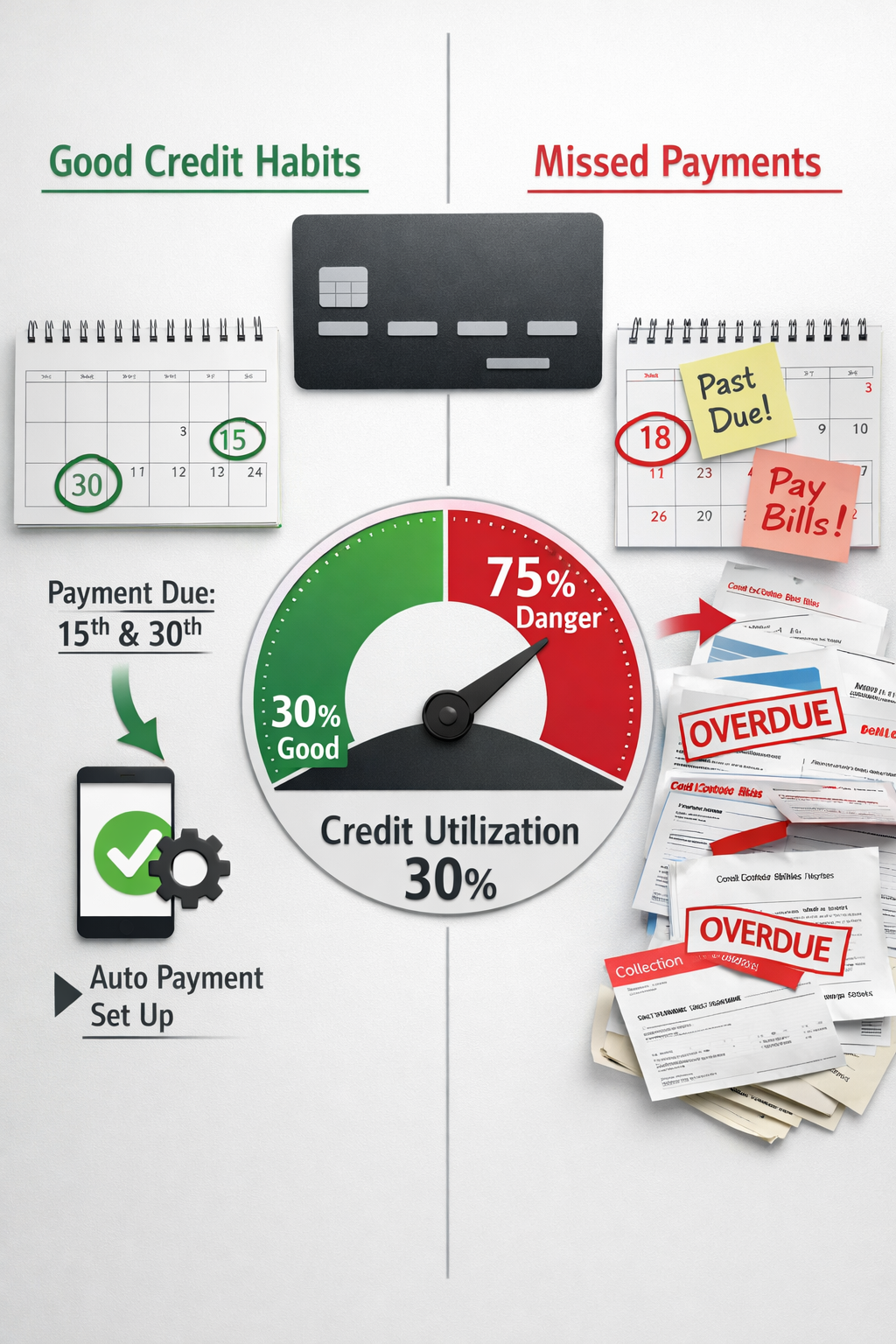

🛡️ Keeping credit utilization below 30% is crucial for maintaining excellent credit scores while avoiding interest charges completely

✈️ Signup bonuses alone can be worth $500-$1,000+ in travel or cash back if you meet spending requirements strategically

⚠️ Security awareness is essential in 2026 as web skimming attacks and fraud tactics become increasingly sophisticated

📊 Paying balances in full every month is the non-negotiable foundation that makes all other credit card hacks actually profitable

Understanding Credit Card Hacks: What They Really Mean

Let me clear something up right away: when I talk about credit card hacks, I’m not referring to anything illegal or unethical. These are completely legitimate strategies that savvy consumers use to maximize the benefits credit card companies already offer—you’re just learning to use them more intelligently.

Think of it this way: credit card companies design their rewards programs hoping you’ll carry a balance and pay interest. But when you use these hacks properly, you flip the script entirely. You collect all the rewards, perks, and bonuses while paying zero interest. It’s like getting paid to use their money for 30 days!

The key difference between people who thrive with credit cards and those who struggle comes down to one thing: intentional strategy. Random credit card use leads to random results (usually debt). Strategic use leads to predictable rewards and financial benefits.

Why Credit Card Hacks Matter More in 2026

The credit card landscape has shifted dramatically. With fraud expected to increase throughout 2026, including sophisticated threats like AI-powered deepfakes and web skimming attacks that steal payment data from checkout pages[1], being smart about credit card security is just as important as maximizing rewards.

Additionally, proposed regulations like the 10% interest rate cap[4] and ongoing debates about swipe fees[3] mean the credit card industry is evolving rapidly. The strategies that work today might look different tomorrow, making it crucial to stay informed and adaptable.

Credit Card Hack #1: Master the Art of Strategic Card Pairing

Here’s one of my favorite credit card hacks: instead of using one card for everything, I strategically pair multiple cards to maximize rewards across different spending categories. This single strategy has tripled my annual rewards compared to when I just used one card randomly.

How Strategic Pairing Works

Different credit cards offer bonus rewards in specific categories. For example:

- Card A might offer 5% cash back on groceries

- Card B might offer 3% back on gas and dining

- Card C might offer 2% back on everything else

By keeping all three cards and using each one strategically, you’re earning 2-5x more rewards than someone who just uses their favorite card for everything.

My Personal Pairing Strategy

Here’s the exact system I use:

| Spending Category | Card Type | Typical Reward Rate |

|---|---|---|

| Groceries | Grocery rewards card | 3-6% cash back |

| Gas & Dining | Travel/dining card | 3-4% back or 3x points |

| Online Shopping | Rotating category card | 5% during quarters |

| Everything Else | Flat-rate cash back card | 2% on all purchases |

The beauty of this approach is that it’s not complicated once you set it up. I keep my primary cards in specific slots in my wallet, and after a few weeks, using the right card becomes automatic.

Pro tip: If tracking multiple cards feels overwhelming at first, start with just two: one for your highest spending category and one flat-rate card for everything else. You can always add more later as you get comfortable with the system.

This strategy pairs perfectly with smart budgeting habits to ensure you’re not overspending just to earn rewards.

Credit Card Hack #2: Optimize Your Credit Utilization Ratio

If there’s one credit card hack that impacts both your credit score and your debt avoidance strategy, it’s mastering your credit utilization ratio. This single metric accounts for about 30% of your credit score, yet most people don’t even know what it means!

What Is Credit Utilization?

Simply put, credit utilization is the percentage of your available credit that you’re currently using. For example:

- Total credit limit: $10,000

- Current balance: $3,000

- Utilization ratio: 30%

The magic number to remember is 30% or less. Keeping your utilization below this threshold signals to credit bureaus that you’re responsible with credit and not overextended.

Advanced Utilization Hacks

Here are the strategies I use to keep my utilization low while still maximizing rewards:

1. Make multiple payments per month 📅

Instead of waiting for the statement date, I make weekly or bi-weekly payments. This keeps my reported balance low even when I’m putting significant spending on my cards.

2. Request credit limit increases

Every 6-12 months, I request credit limit increases on my cards. This automatically lowers my utilization ratio without changing my spending. Just make sure to never increase your spending when your limit goes up!

3. Time large purchases strategically

If I need to make a large purchase, I do it right after my statement closes. This gives me the maximum time to pay it off before it’s reported to the credit bureaus.

4. Spread spending across multiple cards

Rather than maxing out one card, I distribute spending across several cards to keep each individual utilization low.

“Keeping my credit utilization below 10% helped me raise my credit score by 47 points in just three months—which qualified me for better interest rates on my mortgage.”

These techniques work hand-in-hand with the strategies outlined in our guide on how to raise your credit score fast. Remember, the goal isn’t just to have available credit—it’s to demonstrate that you don’t need to use all of it.

Credit Card Hack #3: Exploit Signup Bonuses Strategically

Let’s talk about one of the most lucrative credit card hacks available: signup bonuses. These offers can be worth anywhere from $200 to $1,000+ in rewards, travel points, or cash back—essentially free money for spending you were going to do anyway.

The Signup Bonus Formula

Most premium credit cards offer substantial signup bonuses with a requirement like this:

“Spend $3,000 in the first 3 months and earn 60,000 bonus points”

Those 60,000 points might be worth $600-$1,000 depending on how you redeem them. That’s a 20-33% return on your spending! You won’t find that kind of return anywhere else.

How to Maximize Signup Bonuses Without Overspending

Here’s my foolproof system for earning signup bonuses without falling into the debt trap:

Step 1: Plan ahead 🗓️

I only apply for new cards when I have upcoming planned expenses (like holiday shopping, annual insurance premiums, or home repairs). Never manufacture spending just for a bonus.

Step 2: Calculate the math

Before applying, I verify that:

- I can comfortably meet the spending requirement with normal expenses

- I can pay off the entire balance before interest kicks in

- The annual fee (if any) is worth the rewards I’ll receive

Step 3: Set up automatic payments

The moment I activate a new card, I set up autopay for the full statement balance. This ensures I never miss a payment or pay interest, which would completely negate the signup bonus value.

Step 4: Track the deadline

I create a calendar reminder for the spending requirement deadline and track my progress weekly.

Signup Bonus Timing Strategy

Here’s an insider tip: I strategically time new card applications around major planned expenses:

- January: Tax payments or annual insurance premiums

- April: Spring home improvements

- November: Holiday shopping season

- Throughout the year: Planned travel or major purchases

By aligning signup bonuses with expenses I was already planning, I’ve earned over $2,500 in bonus rewards in the past year alone—without spending a single extra dollar or carrying any balance.

Important warning: Only pursue signup bonuses if you’re already following the golden rule of paying your balance in full every month. If you’re currently carrying credit card debt, focus on paying that off first before chasing rewards.

Credit Card Hack #4: Automate Payments to Avoid Interest Completely

This might sound simple, but automating your credit card payments is arguably the most important credit card hack for avoiding debt. It’s the foundation that makes every other strategy on this list actually profitable.

Why Automation Is Non-Negotiable

Here’s the brutal truth: a single missed payment can cost you more than an entire year of rewards. Late fees typically run $25-$40, plus you’ll trigger penalty APRs as high as 29.99%, and your credit score will take a significant hit.

I learned this lesson the hard way years ago when I forgot to pay a $47 balance on a card I rarely used. That oversight cost me:

- $35 late fee

- $12 in interest charges

- A 30-point drop in my credit score

- Months of effort to recover

All because I forgot one payment! Never again.

The Right Way to Automate

Not all automation is created equal. Here’s what I recommend:

Option 1: Full statement balance autopay ✅ (BEST OPTION)

This automatically pays your entire statement balance by the due date. You never pay interest, and you maintain perfect payment history.

Option 2: Current balance autopay ✅ (GOOD ALTERNATIVE)

This pays whatever you currently owe, even if it’s more than the statement balance. Great if you make purchases after your statement closes.

Option 3: Minimum payment autopay ❌ (AVOID)

This only pays the minimum required amount, leaving you with interest charges on the remaining balance. This defeats the entire purpose of these hacks!

My Automation System

Here’s exactly how I’ve set up my credit card automation:

- Primary checking account holds my bill payment funds

- All credit cards have autopay set to “full statement balance” from this account

- Calendar reminders alert me 3 days before each payment date to verify sufficient funds

- Weekly reviews ensure all charges are legitimate and within budget

This system has given me 100% on-time payment history for the past five years while requiring minimal mental energy.

Automation + Manual Monitoring

Here’s the key: automation doesn’t mean “set it and forget it.” I still:

- Review every transaction for fraud or errors

- Verify my statement before the autopay processes

- Ensure my checking account has sufficient funds

- Monitor for any suspicious activity

This combination of automation and oversight gives me the security of never missing a payment while maintaining full awareness of my spending.

If you’re struggling with organizing your overall finances, check out these budgeting mistakes to avoid that could be sabotaging your financial progress.

Credit Card Hack #5: Leverage Category Bonuses and Rotating Rewards

One of my favorite credit card hacks involves maximizing rotating category bonuses. Some cards offer elevated rewards (typically 5% cash back) on specific categories that change every quarter. When used strategically, this can significantly boost your annual rewards.

Understanding Rotating Categories

Cards like Chase Freedom Flex and Discover it rotate their 5% cash back categories quarterly. Recent examples include:

- Q1: Grocery stores, drugstores, fitness clubs

- Q2: Gas stations, select streaming services

- Q3: Restaurants, PayPal purchases

- Q4: Amazon, Target, Walmart

The catch? You typically need to activate these categories each quarter, and there’s usually a spending cap (often $1,500 per quarter, earning a maximum of $75 in cash back per category).

My Rotating Category Strategy

Here’s how I maximize these bonuses:

1. Set quarterly calendar reminders 📱

I have recurring reminders on the first day of each quarter to activate my rotating categories. Missing activation means missing out on 5% rewards!

2. Front-load category spending

When a category aligns with my regular spending (like groceries), I try to reach the $1,500 cap early in the quarter. This ensures I don’t miss out due to forgetting later.

3. Buy gift cards strategically

During grocery store quarters, I purchase gift cards for stores I regularly shop at anyway. This converts future spending into current 5% rewards.

4. Stack with shopping portals

For online categories, I stack the 5% card rewards with cash back shopping portals for double rewards (sometimes 8-10% total!).

Category Bonus Tracking Table

I keep a simple spreadsheet to track my category bonuses:

| Quarter | Category | Card | Cap | Amount Spent | Remaining |

|---|---|---|---|---|---|

| Q1 2026 | Groceries | Discover | $1,500 | $847 | $653 |

| Q1 2026 | Drugstores | Discover | $1,500 | $0 | $1,500 |

| Q2 2026 | Gas | Chase Freedom | $1,500 | $0 | $1,500 |

This visual tracker helps me optimize my spending without going overboard.

Pro tip: Some cards offer permanent category bonuses (like 3% on dining) that don’t rotate. I use these for consistent spending categories and save rotating cards for the quarterly bonuses.

Credit Card Hack #6: Protect Yourself from Fraud and Skimming

In 2026, credit card security has become just as important as rewards optimization. With sophisticated web skimming campaigns actively stealing credit card data from e-commerce checkout pages—targeting major payment networks including American Express, Mastercard, Discover, and others—protecting your information is a critical credit card hack[1].

The Growing Threat Landscape

Recent security research has uncovered alarming trends:

- Long-running skimming operations have been stealing payment data since January 2022, creating fake payment forms that capture credit card details, expiration dates, and CVV numbers[1]

- Advanced evasion tactics allow attackers to detect when website administrators are logged in, hiding their malicious code from detection[1]

- AI-powered fraud including deepfakes and synthetic identity schemes are expected to increase throughout 2026[3]

The attackers aren’t just after your credit card number—they’re harvesting names, phone numbers, email addresses, and shipping information too[1].

My Fraud Prevention System

Here are the specific strategies I use to protect my credit card information:

1. Virtual card numbers 💳

Many card issuers now offer virtual card numbers for online shopping. I use these whenever possible, especially for new or unfamiliar merchants. If the number gets compromised, I can delete it without affecting my actual card.

2. Transaction alerts

I have instant push notifications enabled for every transaction over $1. This means I know within seconds if someone uses my card fraudulently.

3. Regular account monitoring

I check my credit card accounts at least twice weekly, looking for any unfamiliar charges. The sooner you catch fraud, the easier it is to resolve.

4. Secure online shopping practices

- Only shop on HTTPS-secured websites (look for the padlock icon)

- Avoid entering card details on public WiFi

- Use PayPal or Apple Pay when available for an extra layer of protection

- Never save card information on merchant websites

5. Credit freezes for major data breaches

When I hear about major data breaches affecting companies I’ve used, I proactively freeze my credit reports to prevent new account fraud.

What to Do If Your Card Is Compromised

Despite best efforts, fraud can still happen. Here’s my action plan:

- Immediately contact the card issuer to report fraudulent charges

- Request a new card number to prevent additional fraud

- Document everything including dates, amounts, and who you spoke with

- Update any autopay accounts linked to the old card number

- Monitor credit reports for 6-12 months after the incident

The good news? Credit card fraud protection is excellent—you’re typically not liable for unauthorized charges if you report them promptly.

For more ways to protect your financial health, explore these surprising things that hurt your credit score that you might not be aware of.

Credit Card Hack #7: Time Your Purchases Around Statement Cycles

Understanding credit card statement cycles is a powerful credit card hack that most people completely overlook. Strategic timing can give you extra time to pay off purchases, improve your credit utilization reporting, and even help you meet signup bonus requirements more efficiently.

How Statement Cycles Work

Every credit card has two important dates:

- Statement closing date: When your billing cycle ends and your balance is calculated

- Payment due date: When payment must be received (typically 21-25 days after closing)

Here’s the key insight: purchases made right after your statement closes won’t be due for almost two months.

The Statement Cycle Strategy

Let me illustrate with an example:

Scenario A: Purchase on Day 1 of cycle

- Statement closes: Day 30

- Payment due: Day 55

- Float time: 55 days

Scenario B: Purchase on Day 29 of cycle

- Statement closes: Day 30

- Payment due: Day 55

- Float time: 26 days

By timing large purchases right after your statement closes, you maximize your interest-free float period. This gives you more time to keep money in your high-yield savings account earning interest before paying the bill.

Practical Applications

Here’s how I use statement cycle timing:

For large planned purchases 🛒

I schedule major expenses (like annual insurance premiums or appliance purchases) for right after my statement closes, giving me maximum time to pay without interest.

For credit utilization optimization

If I need to make a large purchase but want to keep my reported utilization low, I do it right after the statement closes. The balance won’t report to credit bureaus until the next statement.

For signup bonus timing

When working toward a signup bonus spending requirement, I strategically time purchases across statement periods to give myself maximum time to pay everything off.

Know Your Statement Dates

I keep a simple note in my phone with all my credit card statement closing dates:

- Card A: Closes on the 15th of each month

- Card B: Closes on the 3rd of each month

- Card C: Closes on the 28th of each month

This allows me to make informed decisions about which card to use for larger purchases based on timing.

Important note: This strategy only works if you’re paying your full balance every month. If you’re carrying balances and paying interest, timing doesn’t matter—you need to focus on paying down that debt before optimizing rewards.

Credit Card Hack #8: Maximize Travel and Purchase Protections

Here’s a credit card hack that most people don’t even know exists: premium credit cards come with valuable built-in insurance and protection benefits that can save you hundreds or even thousands of dollars. I’ve personally used these benefits to get refunds, replacements, and coverage that would have cost me significantly out of pocket.

Hidden Credit Card Benefits

Many credit cards include these protections at no extra cost:

Purchase Protection 🛡️

Covers theft or damage to items purchased with the card (typically for 90-120 days). I once had a laptop stolen within 60 days of purchase, and my credit card’s purchase protection reimbursed me the full $1,200.

Extended Warranty Protection

Automatically extends manufacturer warranties by an additional year. This saved me $400 when my camera broke 14 months after purchase—the manufacturer warranty had expired, but my credit card coverage kicked in.

Trip Cancellation/Interruption Insurance

Reimburses non-refundable travel expenses if you need to cancel for covered reasons. When a family emergency forced me to cancel a $2,800 vacation, this benefit covered the entire cost.

Rental Car Insurance

Provides collision damage coverage for rental cars, allowing you to decline the expensive insurance at the rental counter. I save $15-25 per rental day using this benefit.

Cell Phone Protection

Some cards cover cell phone damage or theft if you pay your monthly bill with the card. This can replace expensive phone insurance plans.

How to Actually Use These Benefits

The challenge is that credit card companies don’t make these benefits obvious. Here’s my system:

1. Create a benefits reference sheet

I keep a document listing all my cards and their key protections, so I know which card to use for what purchase.

2. Save receipts and documentation

For major purchases, I photograph receipts and save them in a dedicated folder. When filing claims, you’ll need proof of purchase.

3. Know the claim process before you need it

I’ve bookmarked the benefits guide and claims contact information for each card, so I’m not scrambling during an emergency.

4. Use the right card for the right purchase

- Travel bookings: Card with best trip protection

- Electronics: Card with best purchase protection and extended warranty

- Rental cars: Card with primary rental car coverage

- Cell phone bill: Card with phone protection

Real-World Example

Last year, I booked a $1,500 flight using a card with trip cancellation insurance. When I got sick two days before departure and couldn’t travel, I filed a claim with medical documentation. Within three weeks, I received full reimbursement for the non-refundable ticket.

That single claim paid for five years of the card’s $95 annual fee!

Pro tip: Always read your card’s “Guide to Benefits” document (usually available online). You’ll be amazed at what protections you already have access to.

Credit Card Hack #9: Avoid These Common Mistakes That Cost You Money

Even with the best credit card hacks in your arsenal, certain mistakes can completely sabotage your rewards strategy and trap you in debt. I’ve made some of these errors myself, and I want to help you avoid the financial pain I experienced.

The Biggest Credit Card Mistakes

1. Paying only the minimum payment ❌

This is the fastest way to turn credit card rewards into credit card debt. The minimum payment is designed to keep you in debt for years while maximizing interest charges.

Example: A $5,000 balance at 18% APR with minimum payments would take over 20 years to pay off and cost you $6,000+ in interest. That completely erases any rewards you earned!

2. Chasing rewards without a budget

I once increased my spending by 30% in a single month because I was trying to earn more cash back. The problem? I spent an extra $500 to earn $15 in rewards. That’s not a hack—that’s terrible math!

The solution: Use credit cards within your existing budget, not as an excuse to spend more. Pair your credit card strategy with proven budgeting techniques to stay on track.

3. Ignoring annual fees without doing the math

Annual fees aren’t automatically bad—but you need to ensure the benefits exceed the cost.

My annual fee calculation:

- Card annual fee: $95

- Signup bonus value: $500 (first year)

- Annual rewards earned: $350

- Travel credits used: $200

- Net benefit: +$955 first year, +$455 ongoing

For me, this card is worth keeping. But I’ve also canceled cards where the math didn’t work out.

4. Closing old cards and hurting your credit score

Closing credit cards reduces your available credit and can increase your utilization ratio. It also shortens your average credit history length.

Instead of closing cards, I keep old cards active by putting one small recurring charge on them (like a streaming subscription) and setting up autopay.

5. Applying for too many cards too quickly

Each credit card application triggers a hard inquiry on your credit report. Too many inquiries in a short period can significantly lower your credit score.

My rule: I space new card applications at least 3-6 months apart, and I never apply for multiple cards in the same month.

The Debt Spiral Warning Signs

Watch for these red flags that indicate you’re using credit cards dangerously:

- 🚩 You don’t know your current balance across all cards

- 🚩 You’re making purchases hoping to “pay it off later”

- 🚩 You’re using one card to pay another card

- 🚩 You feel anxious when checking your credit card statements

- 🚩 You’re only making minimum payments

If you’re experiencing any of these warning signs, it’s time to pause the rewards game and focus on getting out of debt. The best credit card hack when you’re in debt is to stop using credit cards entirely until you’ve paid them off.

Remember: credit card rewards only work when you’re paying zero interest. The moment you carry a balance, you’ve lost the game.

Credit Card Hack #10: Build a Sustainable Long-Term Strategy

The final and most important credit card hack isn’t really a trick at all—it’s about building a sustainable, long-term strategy that works with your lifestyle and financial goals. The flashiest rewards program in the world won’t help you if it leads to debt and financial stress.

Creating Your Personal Credit Card Strategy

Here’s the framework I use to ensure my credit card approach remains healthy and profitable:

Step 1: Define your goals 🎯

What are you optimizing for?

- Cash back for everyday expenses?

- Travel rewards for vacations?

- Building credit score?

- Maximizing purchase protections?

Your goals determine which cards and strategies make sense for you.

Step 2: Match cards to spending patterns

I analyzed six months of spending and discovered:

- 35% goes to groceries and household items

- 20% goes to gas and transportation

- 15% goes to dining and entertainment

- 30% goes to miscellaneous expenses

This analysis helped me choose cards that aligned with my actual spending, not aspirational spending.

Step 3: Set up systems, not willpower

Relying on willpower to use credit cards responsibly is a recipe for failure. Instead, I built systems:

- Automated payments ensure I never pay interest

- Budget tracking prevents overspending for rewards

- Weekly reviews catch errors and fraud early

- Annual card evaluations ensure each card still makes sense

Step 4: Track your net benefit

Once per year, I calculate my actual credit card benefit:

2025 Credit Card Net Benefit:

- Total rewards earned: $1,847

- Annual fees paid: -$190

- Interest paid: $0

- Time spent managing: ~12 hours

- Net benefit: $1,657 (or $138/hour for time invested)

This annual review helps me decide which cards to keep, which to cancel, and whether my strategy is actually working.

The Long-Term Mindset

The most successful credit card users I know share these characteristics:

✅ They’re patient – They don’t chase every new card or promotion

✅ They’re disciplined – They stick to their budget regardless of rewards

✅ They’re educated – They understand how credit works and make informed decisions

✅ They’re systematic – They have processes that don’t rely on memory or willpower

This mindset has helped me maintain perfect payment history while earning thousands in rewards annually—without ever feeling stressed about credit cards.

When to Simplify

Here’s something important: it’s okay to simplify if credit cards become stressful. I have a friend who uses just one 2% cash back card for everything. She earns fewer rewards than I do, but she also spends zero mental energy on credit card optimization.

Her approach is absolutely valid! The goal isn’t to maximize rewards at all costs—it’s to find the strategy that works for your life while keeping you financially healthy.

If you’re feeling overwhelmed by credit cards, consider simplifying to one or two cards and focusing on other aspects of financial health, like building good financial habits or staying debt-free for life.

Conclusion: Your Credit Card Success Action Plan

We’ve covered a lot of ground in this guide to credit card hacks, from strategic card pairing and signup bonuses to fraud protection and sustainable long-term strategies. The key takeaway? Credit cards are powerful financial tools that can either build wealth or create debt—the difference is entirely in how you use them.

Let me be clear: these credit card hacks only work if you’re paying your balance in full every single month. If you’re currently carrying credit card debt, your first priority should be eliminating that debt before focusing on rewards optimization. The interest you’re paying far exceeds any rewards you could possibly earn.

Your Next Steps

Here’s exactly what I recommend you do after reading this article:

This week:

- ✅ Review your current credit cards and their reward structures

- ✅ Set up autopay for full statement balance on all cards

- ✅ Enable transaction alerts for fraud protection

- ✅ Check your credit utilization ratio

This month:

- ✅ Analyze your spending patterns to identify your top categories

- ✅ Research whether different cards could better match your spending

- ✅ Activate any rotating category bonuses you’ve been missing

- ✅ Create a simple tracking system for your cards and rewards

This quarter:

- ✅ Consider applying for one new card if there’s a strong signup bonus and it fits your strategy

- ✅ Review all your credit card benefits and create a reference sheet

- ✅ Calculate your actual net benefit from credit card rewards

- ✅ Adjust your strategy based on what’s working and what isn’t

The Bottom Line

Credit card rewards can be incredibly valuable—I’ve earned thousands of dollars in cash back and traveled for free using the strategies in this guide. But the moment credit cards become a source of debt or stress, they’re not worth it.

Use these credit card hacks wisely, stay disciplined with your spending, and always prioritize financial health over rewards points. When used correctly, credit cards can be one of the most powerful tools in your financial toolkit.

Remember: the credit card companies are hoping you’ll mess up and carry a balance. By following these strategies, you’re beating them at their own game—collecting all the rewards while paying zero interest. That’s the ultimate credit card hack! 💳✨

If you found this guide helpful, you might also enjoy learning about money mistakes to avoid and how to achieve financial freedom.