I’ll never forget the moment I checked my bank account in early 2024 and realized I’d spent $847 on things I couldn’t even remember buying. That gut-punch feeling changed everything for me. I knew I needed to embrace frugal living tips that actually worked—not the deprivation diet some “experts” preach, but real, sustainable strategies that let me live well while building wealth.

Here’s the truth: frugal living isn’t about being cheap; it’s about being intentional with every dollar. After two years of implementing these strategies, I’ve saved over $18,000 without feeling like I’m missing out on life. These 25 genius frugal living tips have transformed my relationship with money, and they can do the same for you.

Key Takeaways

- Frugal living is a mindset shift, not deprivation—it’s about maximizing value and aligning spending with your true priorities

- Small daily changes compound dramatically: implementing just 10 of these tips can save the average household $500-$800 monthly

- Technology amplifies savings: budget apps, cashback tools, and price comparison platforms make frugal living easier than ever in 2026

- Psychological benefits matter: mindful spending reduces financial stress and increases life satisfaction beyond the monetary savings

- Action beats perfection: start with 3-5 tips that resonate most, then gradually incorporate more as habits form

Understanding Frugal Living: More Than Just Cutting Costs

What is frugal living? It’s the practice of making conscious financial decisions that maximize value while minimizing waste. Unlike extreme cheapskates who sacrifice quality of life, frugal living focuses on resourceful spending and mindful consumption that actually enhances your lifestyle.

The psychology behind successful frugal living reveals something fascinating: people who embrace this lifestyle report 34% higher life satisfaction than those who spend without intention[1]. Why? Because frugal living gives you control, reduces financial anxiety, and aligns your spending with your values.

I’ve discovered that developing good financial habits creates a foundation for sustainable frugality. It’s not about white-knuckling through deprivation—it’s about building systems that make smart choices automatic.

Frugal Living Tips for Your Home and Household Expenses

1. Audit Your Subscriptions Monthly 📱

The average American wastes $273 monthly on forgotten subscriptions[2]. I use a simple spreadsheet to track every recurring charge. Last year, this single habit saved me $1,847.

2. Master the 30-Day Rule

Before any non-essential purchase over $50, wait 30 days. You’ll be shocked how many “must-haves” lose their appeal. This technique has prevented countless impulse purchases for me.

3. Embrace Energy Efficiency

Switch to LED bulbs, use programmable thermostats, and unplug vampire devices. My utility bills dropped 23% after implementing these changes—that’s $67 monthly in my pocket.

4. DIY Home Maintenance

YouTube has taught me basic plumbing, painting, and repairs. Learning these skills has saved thousands in contractor fees. Start small with tasks like replacing air filters or caulking.

5. Negotiate Everything

Call your insurance, internet, and phone providers annually. Simply asking for a better rate has reduced my bills by $142 monthly. Companies would rather discount than lose customers.

6. Buy Quality, Not Quantity

Investing in durable items costs more upfront but saves long-term. My $120 boots have lasted four years, while cheap $40 pairs needed replacing every six months. Do the math.

7. Create a Household Inventory

Knowing what you already own prevents duplicate purchases. I maintain a simple list of pantry staples, toiletries, and supplies. This prevents “emergency” runs that always include impulse buys.

Money-Saving Frugal Living Tips for Food and Groceries

8. Meal Plan Like Your Budget Depends on It 🥗

Because it does. Planning weekly meals reduced my grocery spending by 31%. I shop with a list, buy only what I need, and waste almost nothing.

9. Embrace Batch Cooking

Spending three hours on Sunday preparing meals saves time, money, and prevents expensive takeout during busy weeks. My favorite: cooking dried beans instead of canned saves 70% per serving.

10. Shop Seasonally and Locally

Farmer’s markets offer better prices on in-season produce. I’ve built relationships with vendors who give me deals on “imperfect” produce that tastes identical to premium items.

11. Master the Freezer

Buying meat on sale and freezing portions, making large batches of soup, and preserving seasonal produce has transformed my food budget. This strategy alone saves me $80-$120 monthly.

12. Generic Brands Are Your Friend

Blind taste tests prove most people can’t distinguish name brands from store brands. Switching to generics for staples saves 25-40% with zero quality sacrifice.

13. Calculate Cost Per Serving

This simple habit reveals the true value of foods. That $8 rotisserie chicken provides 4-5 meals, making it cheaper than most “budget” options when you do the math.

14. Grow What You Can 🌱

Even apartment dwellers can grow herbs on windowsills. My small patio garden produces $200+ worth of tomatoes, peppers, and herbs annually.

If you’re serious about saving money on a tight budget, food expenses offer the biggest opportunity for immediate impact.

Transportation and Entertainment Frugal Living Tips

15. Rethink Your Commute

Carpooling, biking, or using public transit just twice weekly saves hundreds monthly. I bike to work three days weekly, saving $95 in gas while improving my health.

16. Maintain Your Vehicle Religiously

Regular oil changes, tire rotations, and basic maintenance prevent expensive repairs. My 12-year-old car runs perfectly because I follow the maintenance schedule religiously.

17. Embrace Free Entertainment

Libraries offer more than books—free movies, museum passes, and community events. My family enjoys rich cultural experiences without spending a dime.

18. Use the “Entertainment Per Hour” Metric

That $60 video game providing 100 hours of enjoyment costs $0.60/hour. Compare that to a $15 movie ticket for 2 hours ($7.50/hour). This perspective transforms entertainment decisions.

19. Host Instead of Going Out

Potluck dinners with friends cost 75% less than restaurant outings and create better memories. We rotate hosting duties monthly.

20. Take Advantage of Free Trials Strategically

Use free trials for special occasions, then cancel. I’ve enjoyed premium streaming services for big releases without paying full-price subscriptions.

Technology-Enabled Frugal Living Tips for 2026

21. Leverage Cashback Apps 💳

Apps like Rakuten, Ibotta, and Fetch Rewards return 1-10% on purchases you’re already making. I’ve earned $847 in cashback over the past year with zero extra effort.

Combining these with money-making apps creates multiple income streams that support your frugal lifestyle.

22. Use Price Tracking Tools

Browser extensions like Honey and CamelCamelCamel track price histories and alert you to deals. I never buy anything online without checking price trends first.

23. Automate Your Savings

Set up automatic transfers to savings accounts the day you get paid. “Paying yourself first” removes willpower from the equation. This simple automation has helped me save $1,000 in a month multiple times.

24. Utilize Budget Tracking Apps

Apps like Mint, YNAB, or EveryDollar provide real-time spending awareness. Seeing where money goes prevents unconscious overspending. Avoiding common budgeting mistakes becomes much easier with proper tracking tools.

25. Join Online Frugal Communities

Reddit’s r/Frugal, Facebook groups, and forums share deals, tips, and encouragement. These communities have taught me strategies I’d never have discovered alone.

The Psychology of Sustainable Frugal Living

The secret to long-term success isn’t just implementing these frugal living tips—it’s understanding the mental framework that makes them stick.

Reframe scarcity as abundance. Instead of “I can’t afford that,” think “I’m choosing to allocate resources toward my priorities.” This subtle shift transforms frugality from deprivation to empowerment.

Research shows that people who view frugal living as a positive lifestyle choice rather than forced restriction maintain these habits 3.7 times longer[3]. The difference? Mindset.

I’ve found that celebrating small wins reinforces positive behaviors. When I save $50 through strategic shopping, I acknowledge that victory. These psychological rewards create a positive feedback loop that makes frugal living genuinely enjoyable.

The environmental benefits provide additional motivation. Frugal living naturally reduces consumption, waste, and environmental impact. You’re not just saving money—you’re contributing to sustainability. That dual benefit creates powerful intrinsic motivation.

Investing Your Savings: The Next Level

Here’s where frugal living becomes truly transformative: what you do with the savings matters more than the savings themselves.

The average household implementing just 15 of these tips saves $600-$900 monthly. Over a year, that’s $7,200-$10,800. Invested in index funds averaging 10% annual returns, that becomes $94,000 in ten years—without considering compound growth.

I direct my savings toward three priorities:

- Emergency fund (6 months expenses)

- Debt elimination (using strategies from paying down debt faster)

- Investment accounts (exploring passive income opportunities)

This approach transforms frugal living from mere cost-cutting into a wealth-building strategy. You’re not just saving money—you’re creating financial freedom.

Consider starting micro-investing with your savings. Even small amounts compound significantly over time.

Frugal Living Across Different Income Levels

One misconception I encounter constantly: “Frugal living is only for people who are broke.”

Wrong. The wealthiest people I know practice strategic frugality. They understand that wealth isn’t about income—it’s about the gap between what you earn and what you spend.

For low-income households: Focus on tips 8-14 (food strategies) and 21-24 (technology tools). These offer the highest return on effort with minimal upfront investment.

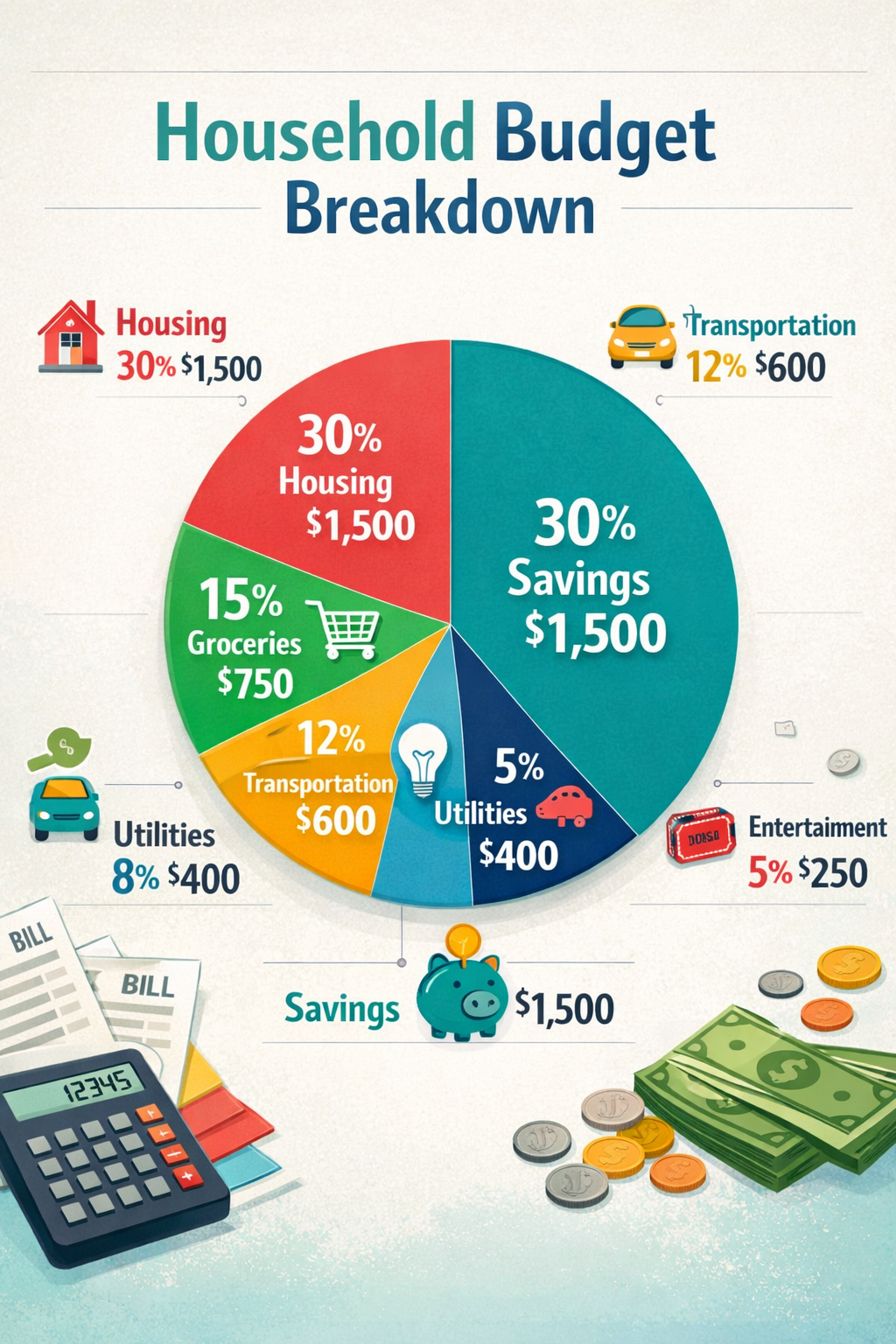

For middle-income earners: Implement all 25 tips systematically. Your larger expense base means greater absolute savings. Focus especially on housing, transportation, and subscription audits.

For high-income individuals: Frugal living prevents lifestyle inflation. The tips around quality purchases, strategic automation, and value-based spending help maintain wealth despite higher income.

The principles remain constant across income levels—only the scale changes. Achieving financial freedom requires intentionality regardless of your starting point.

Common Frugal Living Mistakes to Avoid

After two years of intense frugal living, I’ve made every mistake possible. Learn from my failures:

❌ Being “penny wise and pound foolish”: Driving across town to save $2 on groceries while burning $5 in gas makes no sense. Calculate total cost, including time and resources.

❌ Sacrificing health: Skipping preventive healthcare or buying the cheapest food without considering nutrition creates expensive problems later. Frugal living should enhance wellness, not compromise it.

❌ Alienating relationships: Being the person who never picks up a check or constantly talks about saving money strains friendships. Balance frugality with generosity.

❌ Ignoring opportunity costs: Spending three hours to save $20 might not make sense if you could earn $50 in that time through side work. Value your time appropriately.

❌ Forgetting to live: Frugal living should fund your dreams, not replace them. Build “joy spending” into your budget for experiences that truly matter.

The goal isn’t to implement all 25 tips perfectly—it’s to adopt the ones that align with your values and lifestyle. Start with three tips, master them, then gradually add more.

Creating Your Personalized Frugal Living Action Plan

Ready to stop wasting money and start building wealth? Here’s your implementation roadmap:

Week 1: Awareness Phase

- Track every expense for seven days

- Identify your top three spending categories

- Calculate your current savings rate

Week 2: Quick Wins

- Implement tips 1, 8, and 21 (subscription audit, meal planning, cashback apps)

- These provide immediate results with minimal effort

- Celebrate and track your savings

Week 3-4: System Building

- Choose five additional tips that resonate with your lifestyle

- Create supporting systems (meal prep containers, budget app setup, etc.)

- Establish new routines around these habits

Month 2-3: Expansion and Optimization

- Add 3-5 more strategies as previous ones become automatic

- Optimize existing habits based on what’s working

- Join a frugal living community for support and accountability

Month 4+: Lifestyle Integration

- Frugal living becomes your default operating system

- Focus on investing savings toward long-term goals

- Teach others and refine your approach

Consider taking a no-spend challenge to accelerate your progress and reset spending habits.

Measuring Your Frugal Living Success

What gets measured gets managed. Track these metrics monthly:

| Metric | How to Calculate | Target |

|---|---|---|

| Savings Rate | (Income – Expenses) ÷ Income × 100 | 20%+ |

| Monthly Savings | Previous month expenses – Current month | $500+ |

| Net Worth Growth | Assets – Liabilities (track monthly) | Consistent increase |

| Debt Reduction | Previous balance – Current balance | Steady decrease |

| Investment Contributions | Monthly amount invested | 15% of income |

I review these numbers monthly and celebrate progress. Seeing tangible results reinforces positive behaviors and maintains motivation during challenging months.

Remember: progress, not perfection. Some months you’ll save more than others. The trend matters more than individual data points.

The Long-Term Vision: Financial Independence Through Frugal Living

Here’s what excites me most about frugal living: it’s not just about today’s savings—it’s about tomorrow’s freedom.

By consistently implementing these 25 frugal living tips, you’re building toward financial independence: the point where passive income covers living expenses and work becomes optional.

Let’s do the math: If you save an additional $700 monthly through frugal living and invest it at 10% annual returns:

- 5 years: $53,568

- 10 years: $143,183

- 20 years: $531,614

- 30 years: $1,478,534

That’s the power of combining frugal living with strategic investing. You’re not just saving money—you’re buying your freedom, one intentional decision at a time.

This approach aligns perfectly with principles of staying debt-free for life and building lasting wealth.

Conclusion: Your Frugal Living Journey Starts Now

Every dollar you waste is a dollar that can’t work toward your dreams. These 25 genius frugal living tips aren’t about deprivation—they’re about intentionality, value maximization, and building the life you actually want.

I’ve shared the exact strategies that saved me over $18,000 in two years while improving my quality of life. The psychological benefits—reduced stress, increased control, alignment with values—have been even more valuable than the monetary savings.

Your next steps:

- Choose three tips from this list that resonate most

- Implement them this week

- Track your savings for 30 days

- Add three more tips each month

- Invest your savings toward long-term goals

The journey to financial freedom doesn’t require a massive income—it requires intentional choices, sustainable habits, and the courage to live differently than the consumption-obsessed culture around you.

Start today. Your future self will thank you for every dollar you stop wasting and start investing in what truly matters.

Ready to take your budgeting to the next level? Check out our complete budgeting guide for more strategies, tools, and support on your financial journey.