Let me be honest with you: I used to think budgeting was just fancy math for people who enjoyed spreadsheets and deprivation. I’d tried the whole “track every penny” thing about seventeen times, and every single time, I’d give up within a week. Sound familiar?

Here’s what changed everything for me: I stopped looking for perfect budgets and started hunting for budgeting hacks for beginners that actually fit into my messy, real life. Not the kind that require a finance degree or monk-like discipline, but simple tricks that work even when you’re tired, busy, or just starting out.

In 2026, with inflation still affecting our grocery bills and housing costs, we need budgeting strategies that are practical, flexible, and—most importantly—sustainable. The good news? I’ve tested dozens of methods, talked to real people who’ve transformed their finances, and discovered ten hacks that genuinely work for beginners. These aren’t theoretical tips from someone who’s never struggled with money. These are battle-tested strategies that helped me and countless others finally take control of our finances.

Key Takeaways

💡 The 50/30/20 rule remains the simplest starting framework: 50% needs, 30% wants, 20% savings—though you may need to adjust to 70/20/10 in high-cost areas[1]

🛒 Shopping every three days instead of weekly can dramatically reduce food waste and save hundreds monthly on groceries[2]

🤖 Automating your savings removes willpower from the equation and builds wealth without constant decision-making[1]

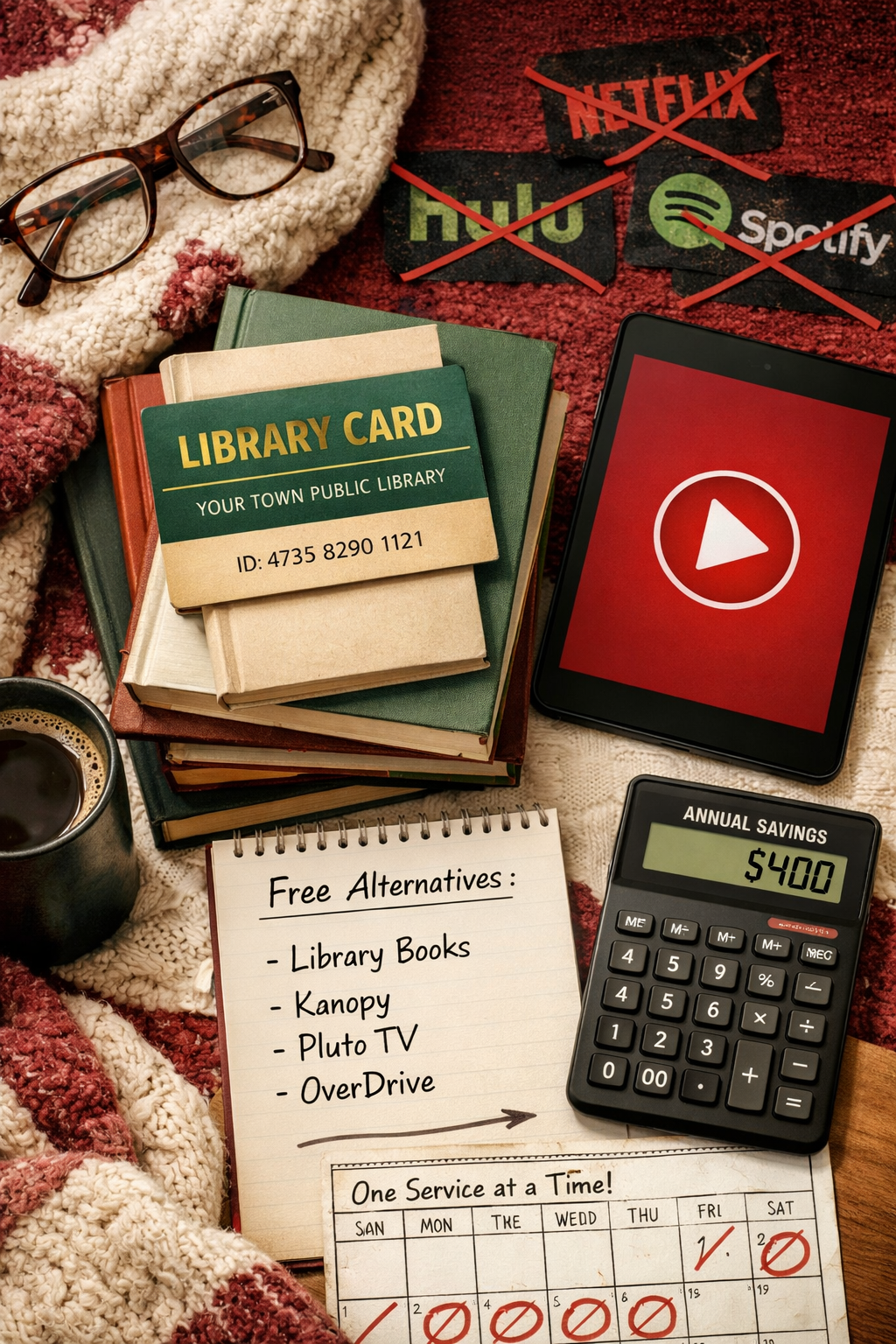

📚 Swapping paid subscriptions for library services and rotating streaming platforms can save $400+ annually without sacrificing entertainment[2]

✅ Small habit changes like meal planning and eliminating one unhealthy spending habit create compound effects that transform your entire budget[2]

Understanding Budgeting Hacks for Beginners: Why Traditional Methods Fail

Before we dive into the hacks, let’s talk about why most budgeting advice doesn’t work for beginners.

Traditional budgeting often demands perfection. You’re supposed to track every single expense, categorize everything precisely, and never deviate from your plan. That’s exhausting! It’s like trying to run a marathon when you’ve never jogged around the block.

The real secret? Start with systems that work with your habits, not against them.

I learned this the hard way after my third failed attempt at using a complicated budgeting app. I realized I needed something simpler—something I could actually stick with on a Tuesday night when I was tired and just wanted to order takeout.

That’s exactly what these budgeting hacks for beginners provide: low-friction strategies that create results without requiring constant vigilance. If you’re tired of common budgeting mistakes, these practical hacks will feel like a breath of fresh air.

Hack #1: The Modified 50/30/20 Rule (Adjusted for 2026 Reality)

The 50/30/20 rule has been around for years, and there’s a reason it’s still the gold standard for beginners: it’s incredibly simple to understand and implement[1].

Here’s how it works:

- 50% of your after-tax income goes to needs (housing, utilities, groceries, transportation, insurance)

- 30% goes to wants (dining out, entertainment, hobbies, subscriptions)

- 20% goes to savings and debt repayment (emergency fund, retirement, paying off credit cards)

Why This Works for Beginners

You don’t need fancy software or hours of number-crunching. Just three categories. That’s it.

To implement this hack, you only need three steps[1]:

- Calculate your monthly take-home pay after taxes

- Multiply by the percentages to get your three budget amounts

- Track expenses by sorting them into these three categories

But here’s the 2026 twist that makes this even more practical: the 70/20/10 alternative.

The 70/20/10 Adjustment

If you live in a high-cost area where housing and groceries eat up more than 50% of your income, don’t force yourself into an unrealistic budget. Instead, try[1]:

- 70% for needs

- 20% for savings

- 10% for wants

This adjustment reflects the current economic reality many of us face. It’s better to have a budget you can actually follow than an “ideal” one that makes you feel like a failure every month.

I personally use the 70/20/10 split because I live in a city where rent alone takes 40% of my income. This flexibility is what makes the framework work for real people in real situations. For more details on this approach, check out our guide on the 70/20/10 budget rule.

Hack #2: Shop Every Three Days Instead of Weekly

This hack sounds counterintuitive, right? Won’t more frequent shopping trips waste time and tempt you to overspend?

Actually, no. And the results are remarkable.

One beginner shared that they used to throw away at least half of their weekly fresh food purchases due to what they called “visual fatigue”—basically, getting tired of seeing the same foods in the fridge[2]. By switching to shopping every three days, they dramatically reduced waste and saved money.

How the Three-Day Shopping Cycle Works

🥬 Day 1-3: Buy only fresh items you’ll use in the next three days

🥬 Day 4-6: Quick shop for the next three-day cycle

🥬 Day 7: Repeat

The Hidden Benefits

Beyond reducing food waste, this strategy offers several advantages:

- Fresher food that actually tastes good

- More variety in your meals since you’re not eating the same groceries all week

- Better deals because you can take advantage of short-term sales

- Less impulse buying because you’re buying less at once

I started doing this with my produce, and honestly, it’s been a game-changer. My lettuce doesn’t turn into brown slime anymore, and I actually eat the vegetables I buy. Plus, it gives me an excuse for a quick walk to the store, which I count as my daily exercise. Win-win!

This pairs perfectly with other frugal grocery strategies that can transform your food budget.

Hack #3: Meal Planning with Specific Daily Menus

Meal planning isn’t new advice, but most people do it wrong. They create vague plans like “chicken for dinner” without specifics, which leads to decision fatigue and takeout orders.

Here’s the hack: Create specific daily meal plans with exact recipes and ingredients.

One family reduced their monthly food bill from $650 to $320 for four people by implementing this strategy[2]. That’s a savings of $330 per month, or nearly $4,000 per year!

The Meal Planning Framework

Sunday Planning Session (30 minutes):

- Write out every breakfast, lunch, and dinner for the week

- List specific recipes, not just ingredients

- Create your shopping list from these meals

- Prep what you can in advance

Daily Execution:

- No decisions needed—just follow the plan

- Everything you need is already in the house

- No “what’s for dinner?” stress at 6 PM

Why This Saves So Much Money

When you have a plan, you:

✅ Stop ordering takeout because “there’s nothing to eat”

✅ Use ingredients before they spoil

✅ Buy only what you need

✅ Eat healthier homemade food instead of processed options[2]

I use a simple Google Doc for my meal plans, and I rotate through about 20 favorite recipes. Once you have your system, it takes less time than scrolling through delivery apps trying to decide what to order.

Want to take your savings even further? Try the 54321 grocery shopping method for additional structure.

Hack #4: Quit One Unhealthy Spending Habit

This is where budgeting gets personal—and powerful.

We all have that one habit that drains our wallet while also being bad for our health. For many people, it’s vaping, smoking, or frequent alcohol purchases.

One beginner shared that quitting vaping saved them $30-$60 per week[2]. That’s $120-$240 per month, or up to $2,880 per year. Another person stopped buying alcohol at gas stations and discovered they also stopped impulse-buying chips and snacks that always accompanied those beverage purchases[2].

How to Identify Your Money Drain

Ask yourself these questions:

- What do I buy regularly that doesn’t align with my health goals?

- What purchase do I make out of habit rather than genuine enjoyment?

- What would I be embarrassed to tell someone I spend money on?

The Replacement Strategy

Don’t just eliminate—replace with something cheaper and healthier:

| Old Habit | Annual Cost | Replacement | Annual Savings |

|---|---|---|---|

| Daily vaping | $1,800-$3,600 | Nicotine gum (temporary) | $1,500-$3,200 |

| Weekly alcohol purchases | $1,040-$2,080 | Sparkling water, home brewing | $800-$1,800 |

| Daily energy drinks | $1,095 | Coffee at home | $900 |

| Fast food lunches | $2,600 | Packed lunches | $2,000 |

I quit my daily fancy coffee habit (yes, I was that person) and started making cold brew at home. I saved about $150 per month, and honestly, my homemade version tastes better. The first week was hard, but now it’s just my routine.

This type of habit change is part of developing good financial habits that create lasting wealth.

Budgeting Hacks for Beginners: Automate Everything You Can

If I could only give you one piece of budgeting advice, it would be this: automate your savings.

Relying on willpower to save money is like relying on willpower to go to the gym every day. It works for about a week, then life happens, and suddenly you haven’t saved anything in three months.

Automation removes friction and builds the savings habit without requiring constant decision-making[1].

What to Automate

💰 Savings transfers: Set up automatic transfers to your savings account on payday

💰 Bill payments: Automate all recurring bills so you never pay late fees

💰 Retirement contributions: Increase your 401(k) contribution by 1% every six months

💰 Debt payments: Schedule extra payments automatically to pay off debt faster

The “Pay Yourself First” System

Here’s exactly how to set this up:

- Open a separate savings account (preferably at a different bank so it’s not too easy to access)

- Calculate 20% of your take-home pay (or whatever percentage works for you)

- Schedule an automatic transfer for the day after payday

- Pretend that money doesn’t exist when budgeting for expenses

I started with just $50 per paycheck because that’s all I could afford. But you know what? After a year, I had $1,300 saved without even thinking about it. Then I increased it to $100, then $150. Now it’s just part of my financial life.

The beauty of this system is that you can’t spend money you never see. It’s the ultimate budgeting hack for beginners who struggle with impulse control (guilty!).

For more strategies on building savings quickly, explore these genius savings strategy hacks.

Hack #6: The Library Card Money-Saving Strategy

This hack is so simple it sounds almost silly, but the savings are real.

One reader shared that they saved hundreds of dollars by borrowing 60+ books from the library annually instead of purchasing them or using paid reading apps[2]. But the library offers so much more than just books!

What Your Library Card Gets You (For Free!)

📚 Books (obviously)—including new releases

🎬 Movies and TV shows on DVD or through streaming partnerships

🎵 Music CDs and digital music services

💻 Online courses through platforms like LinkedIn Learning

🎮 Video games at many modern libraries

📰 Magazine and newspaper subscriptions (digital and physical)

🎫 Museum passes and event tickets

🖥️ Free technology access including computers, printers, and WiFi

The Streaming Subscription Rotation

Pair your library card with this additional hack: maintain only one streaming subscription at a time[2].

Here’s how it works:

- Month 1-2: Netflix (watch everything you want)

- Month 3-4: Cancel Netflix, subscribe to HBO Max

- Month 5-6: Cancel HBO Max, subscribe to Disney+

- Repeat

This strategy saves you from paying for multiple services simultaneously while still giving you access to all the content you want throughout the year.

Annual savings example:

- Traditional approach: 4 streaming services × $15/month = $720/year

- Rotation approach: 1 streaming service × $15/month = $180/year

- Savings: $540/year

I do this now, and honestly, it makes me more intentional about what I watch. Instead of mindlessly scrolling through four different apps, I actually finish the shows I start.

Hack #7: The “Eat Before You Go Out” Rule

This is one of those budgeting hacks for beginners that sounds too simple to work, but it’s incredibly effective.

Multiple people identified restaurant eating as overpriced and noted that eating before going out helped them control impulse spending[2].

How This Works in Practice

The strategy isn’t about never going out—it’s about making intentional choices rather than desperate ones.

Scenario 1: Shopping

- ❌ Going to the mall hungry → buying expensive food court meals

- ✅ Eating lunch at home → shopping with clear judgment, maybe just a coffee

Scenario 2: Social Events

- ❌ Meeting friends at 7 PM starving → ordering appetizers, entrees, and dessert

- ✅ Having a snack at 6 PM → ordering just an entree or splitting dishes

Scenario 3: Running Errands

- ❌ Doing errands on an empty stomach → hitting the drive-through

- ✅ Packing snacks in the car → completing errands without food stops

The Psychology Behind This Hack

When you’re hungry, your brain makes different decisions. Studies show that hunger increases impulsive behavior and reduces self-control. You’re more likely to:

- Order more food than you need

- Choose expensive options

- Add extras you don’t really want

- Buy snacks at checkout counters

I keep protein bars in my car and purse for exactly this reason. A $1 protein bar has saved me from countless $15 impulse meals.

This pairs well with other frugal living strategies that reduce unnecessary spending.

Hack #8: The “One In, One Out” Rule for Wants

Here’s a budgeting hack that works especially well for people who struggle with shopping impulses: before buying anything new in a category, you must get rid of something old in that same category.

How to Apply This Rule

Clothing:

- Want a new shirt? Donate or sell an old one first

- Prevents closet overflow and forces intentional purchases

Books:

- Buying a new book? Give away one you’ve already read

- Keeps your shelves manageable and your reading intentional

Kitchen gadgets:

- New blender? Get rid of the old one or another appliance

- Prevents the dreaded “junk drawer” multiplication

Subscriptions:

- Adding a new streaming service? Cancel an existing one

- Maintains a fixed entertainment budget

Why This Works

This hack creates natural spending limits without requiring complex tracking. It also makes you ask important questions:

- Do I want this new item more than what I already have?

- Am I buying this because I genuinely need it or just because it’s on sale?

- Will this actually improve my life?

I started using this rule with clothes, and it completely changed my shopping habits. Instead of buying five mediocre shirts on sale, I save up for one really nice shirt that I absolutely love. My closet is smaller but better, and I spend less overall.

Hack #9: The 24-Hour Rule for Non-Essential Purchases

Impulse purchases are budget killers. This simple hack has saved me literally thousands of dollars: wait 24 hours before buying anything non-essential.

The Implementation

When you want to buy something that isn’t an immediate necessity:

- Add it to your cart but don’t check out

- Set a reminder for 24 hours later

- Walk away and do something else

- Revisit the next day and decide if you still want it

What Usually Happens

In my experience, about 60-70% of items I put in my cart don’t make it to purchase after the 24-hour wait. Either I realize I don’t actually need it, I find it cheaper elsewhere, or the initial excitement fades.

Advanced Version: The 30-Day List

For bigger purchases (over $100), I use a 30-day waiting list:

- Write down the item and date on a list

- Research during the 30 days (reviews, prices, alternatives)

- After 30 days, if I still want it and it fits my budget, I buy it

This strategy has prevented so many regrettable purchases. That $300 gadget I was sure I needed? After 30 days, I realized I’d never actually use it.

Budgeting Hacks for Beginners: The Weekly Money Date

This final hack ties everything together: schedule a weekly 15-minute “money date” with yourself (or your partner if you share finances).

What Happens During Your Money Date

☕ Review the past week:

- What did you spend?

- Any surprises?

- What went well?

📊 Check your progress:

- Are you on track with your budget categories?

- How’s your savings growing?

- Any bills coming up?

🎯 Plan the week ahead:

- What expenses are coming?

- Any potential challenges?

- What’s your focus for the week?

Why Weekly Instead of Monthly?

Monthly check-ins are too infrequent. By the time you notice you’ve overspent, it’s already too late to course-correct. Weekly reviews let you catch problems early and adjust before they become disasters.

I do my money date every Sunday morning with my coffee. It’s become a ritual I actually look forward to because I can see my progress. Watching my savings grow and my debt shrink is incredibly motivating.

This habit is part of a broader set of simple habits that help you stay debt-free for life.

Making It Stick

To make your money date a lasting habit:

- Same time every week (consistency is key)

- Make it pleasant (good coffee, comfortable spot)

- Keep it short (15 minutes maximum)

- Celebrate wins (saved money this week? Acknowledge it!)

Bonus Tips: Making These Budgeting Hacks Work Together

The real magic happens when you combine these budgeting hacks for beginners into a cohesive system. Here’s how they work together:

The Complete System

- Start with the 50/30/20 framework (or 70/20/10) to establish your basic structure

- Automate your 20% savings so it happens without thinking

- Implement meal planning to control your biggest variable expense

- Shop every three days to reduce waste and stick to your meal plan

- Use the library and subscription rotation to minimize entertainment costs

- Apply the 24-hour rule to prevent impulse purchases

- Hold weekly money dates to monitor everything and stay on track

Common Obstacles and Solutions

“I don’t make enough to save 20%”

→ Start with 5% or even 1%. The habit matters more than the amount.

“I always forget to track expenses”

→ That’s why automation is key. Set up systems that work without your memory.

“My income varies every month”

→ Base your percentages on your lowest typical month, and treat extra income as bonus savings.

“I tried budgeting before and failed”

→ You didn’t fail—the method failed you. These hacks are designed for real people with real lives.

If you’re dealing with irregular income, check out our guide on how to budget biweekly paychecks for additional strategies.

Real Results: What Happens When You Implement These Hacks

Let me share what implementing these budgeting hacks for beginners actually looks like in practice.

Month 1: The Setup Phase

- Set up automatic savings transfers

- Create your first meal plan

- Start the three-day shopping cycle

- Begin weekly money dates

Expected savings: $100-$200 as you eliminate waste and impulse purchases

Month 2: Building Momentum

- Refine your meal planning based on what worked

- Cancel unnecessary subscriptions

- Get your library card and explore resources

- Apply the 24-hour rule consistently

Expected savings: $200-$400 as systems become habits

Month 3: Seeing Results

- Your automated savings has built a small emergency fund

- Grocery spending has stabilized at a lower level

- You’re making intentional rather than impulsive decisions

- The weekly money date feels natural

Expected savings: $300-$500 as compound effects kick in

Month 6 and Beyond

- You’ve saved $1,000-$2,000 without feeling deprived

- Budgeting feels normal, not restrictive

- You’re ready to tackle bigger goals like paying off debt faster

- You might even start exploring passive income ideas

These aren’t theoretical numbers. These are real results from real people who implemented these exact strategies.

Conclusion: Your Next Steps to Budget Success

Budgeting doesn’t have to be complicated, restrictive, or miserable. The budgeting hacks for beginners I’ve shared aren’t about deprivation—they’re about intentionality.

You don’t need to implement all ten hacks at once. In fact, I’d recommend against it. Instead, choose two or three that resonate most with your current situation and start there.

Here’s my suggested starting point:

Week 1: Set up automated savings transfers and schedule your first weekly money date

Week 2: Create your first meal plan and try the three-day shopping cycle

Week 3: Apply the 24-hour rule to all non-essential purchases

Week 4: Review what’s working and add one more hack

Remember, the goal isn’t perfection. The goal is progress. Every dollar you save, every impulse purchase you avoid, every automated transfer that happens—these are all wins worth celebrating.

The beautiful thing about these hacks is that they build on each other. Once you’ve automated your savings and started meal planning, you’ll naturally spend less. Once you’re holding weekly money dates, you’ll catch problems before they spiral. Once you’ve implemented the 24-hour rule, you’ll make better purchasing decisions automatically.

You’ve got this. Start small, stay consistent, and watch your financial life transform. In 2026, you can finally take control of your money—not through deprivation, but through smart systems that actually work.

Ready to take the next step? Check out our complete guide to budgeting for dummies for even more beginner-friendly strategies, or explore our New Year budget plan to set yourself up for long-term success.