Let me ask you something: what would happen to your financial life if your primary income source disappeared tomorrow? If that question makes your stomach drop, you’re not alone. I’ve been there, and it’s exactly why understanding the 7 streams of income changed everything for me.

The concept of multiple income sources isn’t just financial jargon—it’s your insurance policy against economic uncertainty. In 2026, with job markets shifting faster than ever and AI reshaping entire industries, relying on a single paycheck is like building your house on sand. The 7 streams of income framework offers a blueprint for true financial security, and I’m going to show you exactly how to build yours, step by step.

Key Takeaways

- Income diversification is essential: The 7 streams of income provide financial resilience against job loss, economic downturns, and unexpected life changes

- Three main income categories exist: Earned income (active work), portfolio income (investments), and passive income (automated revenue) each serve different purposes in your wealth-building strategy

- Start with one additional stream: You don’t need all seven immediately—focus on building one complementary income source before expanding

- Leverage technology for automation: Modern tools and platforms make creating and managing multiple income streams easier than ever before

- Tax advantages multiply with diversification: Different income types receive different tax treatment, potentially reducing your overall tax burden

Understanding the Foundation: What Are Income Streams?

Before we dive into the specific 7 streams of income, let’s get clear on what we’re actually talking about. An income stream is simply a source of money flowing into your life. Think of it like tributaries feeding into a river—the more sources you have, the stronger and more reliable your financial flow becomes.

Most people start with just one stream: their job. But here’s what I learned the hard way: single-income dependency is one of the biggest financial risks you can take. When I lost my job in 2019, I realized I’d spent years building someone else’s dream while neglecting my own financial security.

The beauty of the 7 streams of income concept is that it’s not about working seven jobs (that would be exhausting!). It’s about strategically creating diverse revenue sources that work together, with many requiring minimal ongoing effort once established.

The Three Main Types of Income

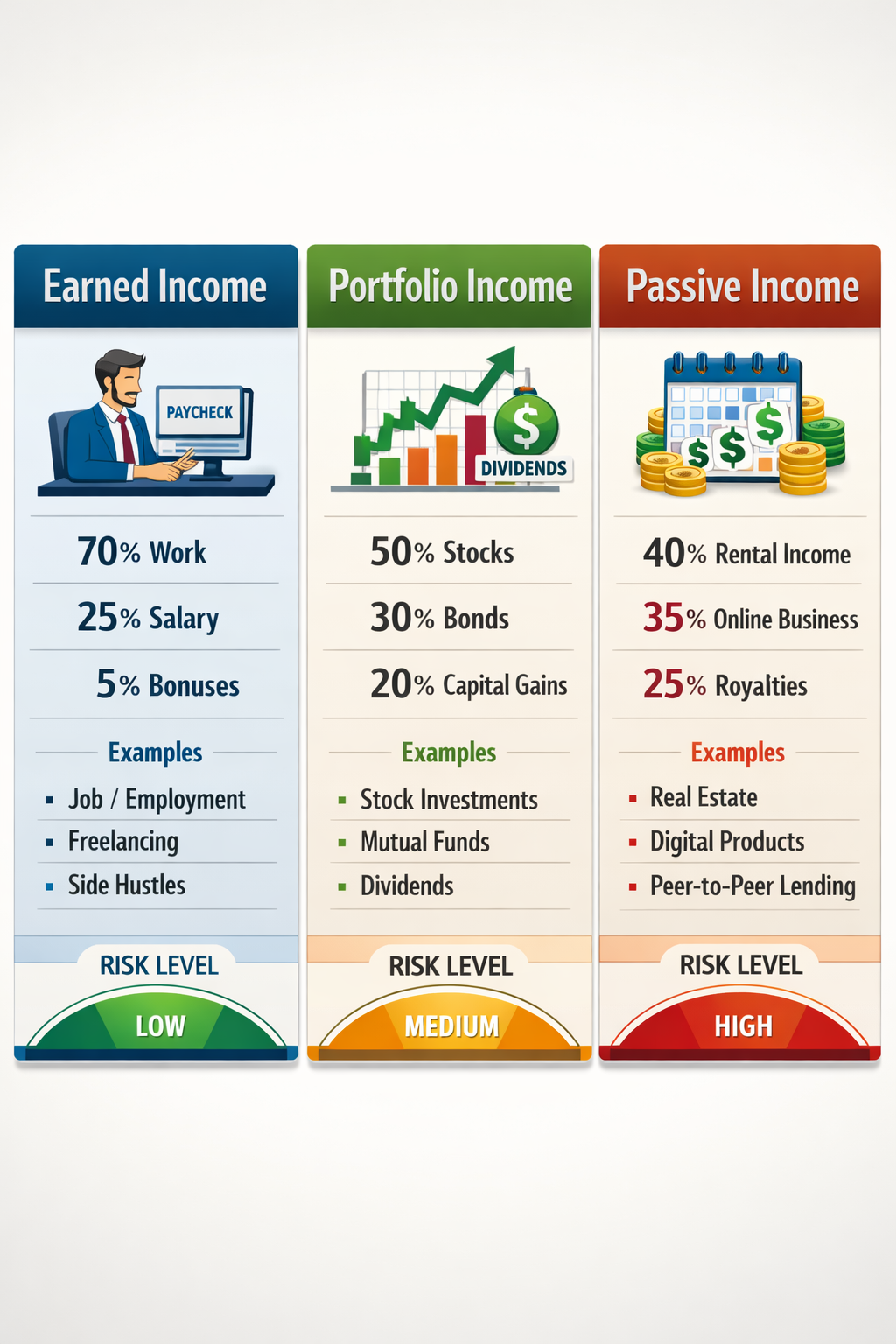

According to the IRS and financial experts, all income falls into three primary categories[1]:

| Income Type | Definition | Tax Treatment | Examples |

|---|---|---|---|

| Earned Income | Money from active work | Highest tax rate | Salary, wages, tips, commissions |

| Portfolio Income | Profits from investments | Capital gains rates | Dividends, interest, stock sales |

| Passive Income | Revenue from minimal effort | Varies by source | Rental income, royalties, business profits |

Understanding these categories is crucial because they’re taxed differently and require different levels of ongoing involvement. This knowledge alone can save you thousands in taxes and help you make smarter decisions about which income streams to pursue first.

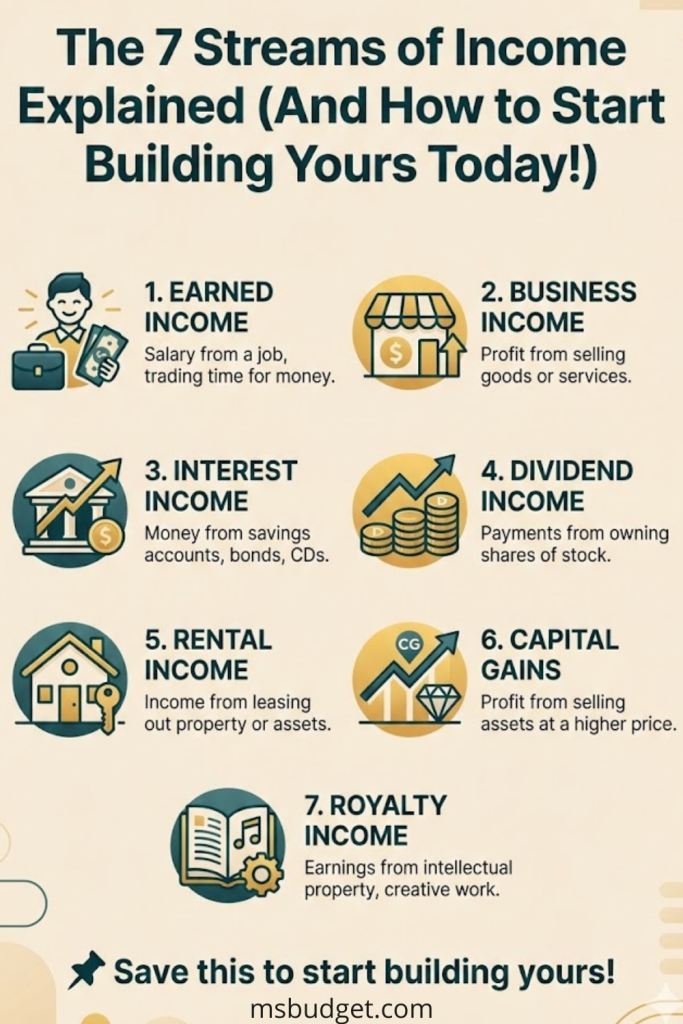

The 7 Streams of Income Explained in Detail

Now let’s break down each of the seven income streams. I’ll explain what they are, how they work, and most importantly, how you can start building each one today.

Stream #1: Earned Income (Wages and Salaries)

This is where most of us start—trading time for money through employment. Your job, freelance work, or consulting fees all fall into this category.

Pros: Predictable, immediate, often includes benefits

Cons: Limited by time, highest tax rate, vulnerable to job loss

How to optimize it: Don’t just accept your current salary. I increased my earned income by 40% in two years by developing high-income skills, negotiating raises, and strategically job-hopping. Focus on skills that command premium pay in your industry.

Stream #2: Business Income (Profit from Enterprises)

This stream comes from owning and operating a business—whether that’s a side hustle or full-time venture. The key difference from earned income? Your earnings aren’t capped by hourly rates.

Pros: Unlimited income potential, tax advantages, asset building

Cons: Requires startup effort, carries risk, demands ongoing management

How to start: You don’t need massive capital. I started my first home business with zero money by offering services I already knew how to do. Consider freelancing, consulting, e-commerce, or service-based businesses. The key is solving a real problem people will pay for.

Stream #3: Interest Income (Money from Lending)

When you save money in high-yield savings accounts, CDs, or bonds, you earn interest. Your money literally makes money while you sleep.

Pros: Low risk, completely passive, FDIC insured (for bank accounts)

Cons: Lower returns, inflation can erode value

How to maximize it: In 2026, high-yield savings accounts are offering competitive rates again. Move your emergency fund from traditional banks (earning 0.01%) to high-yield accounts (earning 4-5%). Even on a $10,000 emergency fund, that’s an extra $400-500 annually for doing absolutely nothing.

Stream #4: Dividend Income (Payments from Stock Ownership)

When you own dividend-paying stocks or funds, companies share their profits with you regularly—usually quarterly. This is my personal favorite stream because it combines growth potential with regular cash flow.

Pros: Passive once established, potential for growth, favorable tax treatment

Cons: Requires initial investment, market volatility, not guaranteed

How to begin: Start with dividend-focused ETFs like VYM, SCHD, or VIG if you’re new to investing. These funds spread your risk across dozens of dividend-paying companies. I started with just $50 monthly through micro-investing, and now my dividend income covers my grocery bill every month.

Stream #5: Rental Income (Property Revenue)

Owning real estate and renting it out creates monthly cash flow. This doesn’t just mean houses—think parking spaces, storage units, or even renting out a room in your home.

Pros: Tangible asset, potential appreciation, tax benefits, inflation hedge

Cons: Requires capital, ongoing management, tenant risks

How to start small: You don’t need to buy a property immediately. I started by renting out my spare bedroom on Airbnb, which generated an extra $800-1,200 monthly. Other options include house-hacking (living in one unit of a multi-family property while renting others) or investing in REITs (Real Estate Investment Trusts) for as little as $100.

Stream #6: Capital Gains (Profit from Asset Sales)

This income comes from selling assets for more than you paid. Stocks, real estate, collectibles, businesses—anything that appreciates in value qualifies.

Pros: Significant profit potential, favorable long-term tax rates

Cons: Requires initial investment, timing dependent, not regular income

How to leverage it: The key is buying assets with appreciation potential and holding them strategically. I’ve made capital gains from flipping items on Facebook Marketplace, selling appreciated stocks, and even domain names. Start small—buy undervalued items, improve them, and sell for profit. This teaches you the fundamentals before scaling up.

Stream #7: Royalty Income (Payments for Intellectual Property)

Create something once, get paid repeatedly. Books, music, patents, online courses, photography, or digital products all generate royalties.

Pros: True passive income, scalable, creative fulfillment

Cons: Upfront creation time, competitive markets, income variability

How to create it: In 2026, creating digital products has never been easier. I created a simple budgeting spreadsheet that sells on Etsy for $12, generating $300-600 monthly with zero ongoing work. Other options include writing ebooks on Amazon KDP, creating stock photos, developing online courses, or licensing your expertise. The internet has democratized royalty income—you don’t need a publishing deal anymore.

Building Your 7 Streams of Income: A Practical Roadmap

Here’s the truth: you don’t need all seven streams immediately. In fact, trying to build them all at once is a recipe for burnout and failure. I learned this the hard way.

The Strategic Approach: Start with Your Income Multiplier Score

I developed this simple framework to help you prioritize which streams to build first:

Calculate your current situation:

- How many income streams do you currently have? (Most people: 1-2)

- How much time can you realistically dedicate weekly? (Be honest!)

- What’s your risk tolerance? (Conservative, moderate, aggressive)

- What resources do you have? (Skills, capital, network)

Year One: The Foundation Phase

Months 1-3: Optimize your earned income while building your first additional stream. I recommend starting with either business income (side hustle) or interest income (high-yield savings), depending on whether you have more time or money available.

For most people, a side hustle is the fastest path to your second income stream. Choose something that leverages skills you already have—this reduces the learning curve and accelerates results.

Months 4-6: Once your first additional stream generates consistent income (even if it’s just $200-500 monthly), start building your investment foundation. Open a brokerage account and begin systematic investing in dividend-paying funds. Even $50-100 monthly compounds significantly over time.

Months 7-12: Explore creating a digital product or royalty-generating asset. This is where the magic happens—you’re building assets that can generate income indefinitely with minimal ongoing effort.

Technology Tools for Managing Multiple Income Streams

One of the biggest game-changers in 2026 is the technology available for tracking and automating your income streams. Here are the tools I actually use:

- Income tracking: Personal Capital (free) aggregates all your accounts and shows your complete financial picture

- Automation: Set up automatic transfers to investment accounts, savings, and business accounts

- Tax optimization: Use software like TurboTax Self-Employed or hire a CPA who understands multiple income streams

- Time management: Time-blocking apps help ensure you’re making progress on building new streams without burning out

The key is creating systems that run on autopilot. I spend maybe 2-3 hours weekly maintaining my seven income streams because I’ve automated everything possible.

Overcoming the Psychological Barriers to Income Diversification

Let’s talk about the mental blocks that stop most people from building multiple income streams, because this is where I see people struggle most.

The “I Don’t Have Time” Trap

This was my biggest excuse. The truth? You don’t need more time—you need better priorities. I was spending 15 hours weekly watching Netflix while claiming I was “too busy” to build additional income.

The solution: Start with just 3-5 hours weekly. That’s one Netflix binge session. Use the half payment budget method to free up mental energy from financial stress, making it easier to focus on building new streams.

The Perfectionism Paralysis

Waiting for the “perfect” business idea, investment strategy, or market timing keeps people stuck for years. I waited 18 months to start my first side hustle because I was overthinking everything.

The solution: Embrace the “minimum viable income stream” approach. Start small, test quickly, adjust based on results. Your first digital product doesn’t need to be perfect—it needs to exist.

The Fear of Failure

What if your business fails? What if your investments lose money? What if your rental property sits empty?

The solution: Reframe failure as education. Every “failed” income stream taught me valuable lessons that made my successful streams possible. Plus, diversification means one stream’s failure doesn’t devastate your finances. This is exactly why you’re building multiple streams in the first place!

Tax Implications and Legal Considerations

Here’s something most articles about the 7 streams of income completely ignore: different income types have dramatically different tax consequences. Understanding this can save you thousands annually.

Tax Treatment Breakdown

Earned income faces the highest tax burden—income tax plus FICA (Social Security and Medicare) taxes. If you’re in the 24% federal bracket, you’re actually paying closer to 32% when you include FICA[2].

Portfolio income gets preferential treatment. Long-term capital gains (assets held over one year) are taxed at 0%, 15%, or 20% depending on your income—significantly lower than earned income rates. Qualified dividends receive similar treatment.

Passive income varies. Rental income is taxed as ordinary income but offers deductions (depreciation, expenses, mortgage interest) that can dramatically reduce your taxable amount. Royalties are also taxed as ordinary income but may qualify for the Qualified Business Income deduction.

The Strategic Tax Advantage

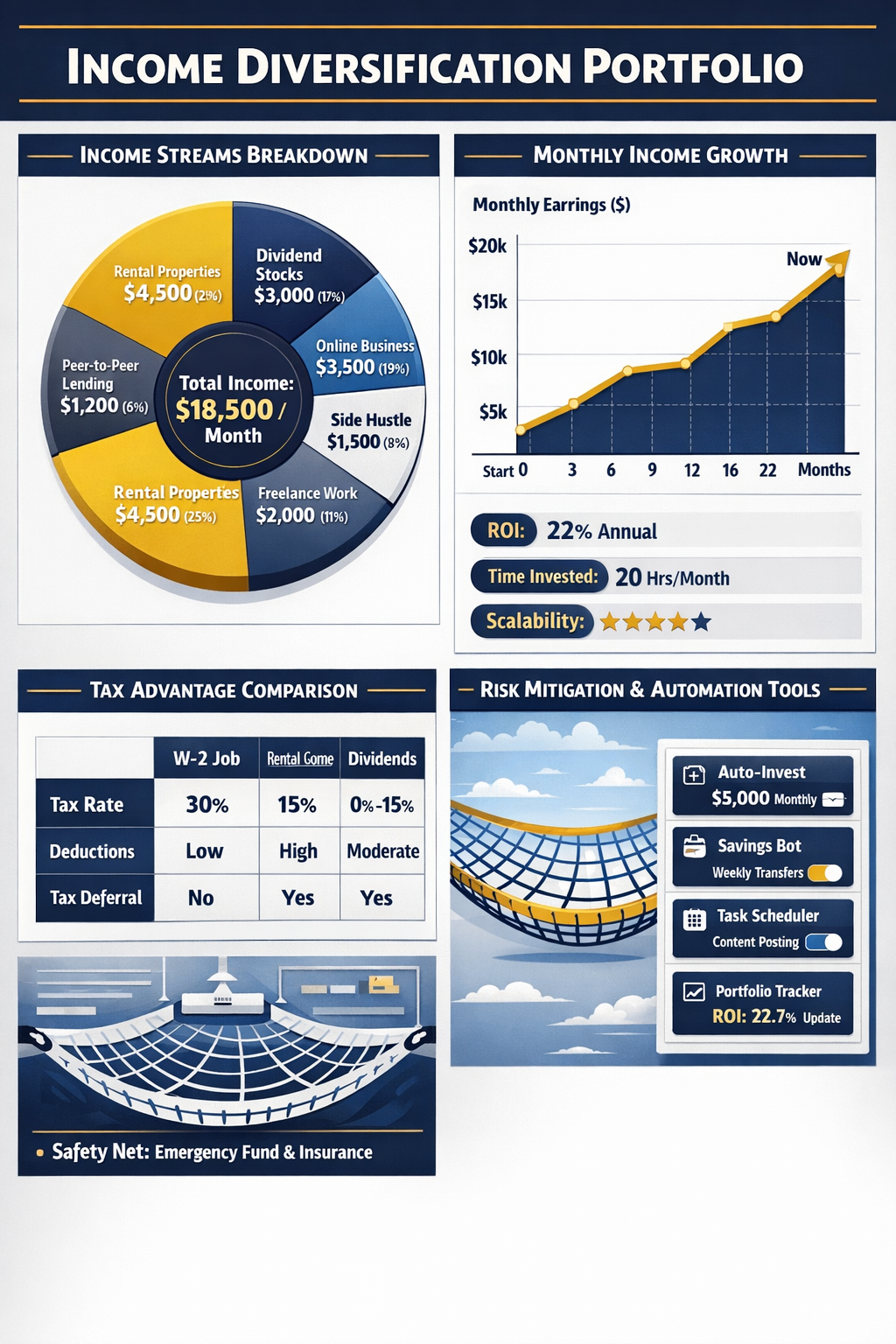

By diversifying across all three income categories, you can potentially reduce your overall effective tax rate. For example, I shifted from 90% earned income to 60% earned, 25% portfolio, and 15% passive income. My total income increased by 40%, but my effective tax rate actually decreased by 3%—saving me over $5,000 annually.

Important: Consult with a tax professional who understands multiple income streams. The strategies available—like real estate professional status, retirement account optimization, and business expense deductions—can be complex but incredibly valuable.

Real-World Success Stories: The 7 Streams in Action

Let me share three real examples of people who successfully built multiple income streams (names changed for privacy):

Sarah’s Story: From Single Income to Financial Freedom

Sarah, a teacher earning $52,000 annually, felt trapped by her single income. Over three years, she systematically built:

- Earned income: Teaching salary ($52,000)

- Business income: Tutoring business ($18,000)

- Interest income: High-yield savings ($400)

- Dividend income: ETF portfolio ($1,200)

- Rental income: Renting spare bedroom ($9,600)

- Royalty income: Teachers Pay Teachers digital resources ($3,800)

- Capital gains: Annual stock sales ($2,000)

Total annual income: $87,000 (67% increase)

Time to build: 36 months

Weekly time investment: 8-12 hours initially, now 4-5 hours

Sarah didn’t quit teaching—she built financial security while keeping her stable base income. Now she has options, which is what true financial freedom means.

Marcus’s Approach: Aggressive Wealth Building

Marcus, a software engineer earning $95,000, took a more aggressive approach focused on scaling quickly:

- Earned income: Software engineering ($95,000)

- Business income: Freelance consulting ($45,000)

- Interest income: High-yield savings and bonds ($1,500)

- Dividend income: Aggressive dividend growth portfolio ($4,200)

- Rental income: House-hacked duplex ($12,000 net)

- Capital gains: Strategic stock trading ($8,000)

- Royalty income: Online coding course ($6,300)

Total annual income: $172,000 (81% increase)

Time to build: 48 months

Initial investment: $35,000 (for duplex down payment)

Marcus’s strategy required more capital and risk tolerance, but his diversified income allowed him to achieve financial independence by age 34.

Jennifer’s Conservative Path: Low-Risk Diversification

Jennifer, a single mom earning $38,000, focused on low-risk, manageable streams:

- Earned income: Administrative job ($38,000)

- Business income: Virtual assistant side hustle ($6,000)

- Interest income: High-yield savings ($300)

- Dividend income: Small ETF portfolio ($400)

- Rental income: Storage unit rental ($1,200)

- Royalty income: Etsy digital planners ($2,100)

Jennifer hasn’t built all seven streams yet, but she’s increased her income by 27% while maintaining her full-time job and parenting responsibilities. She’s proof that you can start small and still make meaningful progress.

Common Mistakes to Avoid When Building Multiple Income Streams

After coaching dozens of people through this process, I’ve identified the most common pitfalls:

Mistake #1: Spreading Too Thin Too Fast

Trying to launch five income streams simultaneously leads to mediocre results across all of them. Focus on building one stream to a meaningful level ($500+ monthly) before adding another.

Mistake #2: Ignoring Your Foundation

Don’t build investment income while carrying high-interest credit card debt. The math doesn’t work—you can’t earn 8% in dividends while paying 22% on debt. Pay down high-interest debt first, then build wealth.

Mistake #3: Neglecting the Legal and Tax Setup

Operating a side business without proper structure, failing to track expenses, or missing quarterly tax payments can create expensive problems. Set up your systems correctly from day one—it’s much harder to fix later.

Mistake #4: Chasing Shiny Objects

Every week there’s a new “hot” opportunity promising easy money. I’ve wasted thousands chasing trends instead of building sustainable streams. Stick with proven models and give them time to mature.

Mistake #5: Underestimating the Compound Effect

Most people quit too early because results start slowly. My first month of dividend income? $3.47. Now? Over $800 monthly. My first digital product sale took six weeks. Now it generates income daily. Persistence beats perfection every time.

The Income Stream Compatibility Matrix

Not all income streams work well together. Some create synergies; others compete for your limited time and attention. Here’s my framework for choosing compatible streams:

High Synergy Combinations:

- Earned income (consulting) + Business income (consulting firm) + Royalty income (course teaching your expertise)

- Rental income (real estate) + Capital gains (property appreciation) + Interest income (savings for next property)

- Business income (content creation) + Royalty income (digital products) + Dividend income (investing business profits)

Low Synergy Combinations:

- Multiple active businesses competing for time

- High-maintenance rental properties while building a demanding business

- Day trading (capital gains) while working demanding full-time job

The key is choosing streams that complement rather than compete with each other.

Your 90-Day Action Plan to Start Building Today

Enough theory—let’s create your specific action plan. Here’s exactly what to do in the next 90 days:

Days 1-30: Assessment and Foundation

Week 1:

- Calculate your current income sources and amounts

- Identify your available time (realistically—3-5 hours weekly is fine)

- Assess your skills, interests, and resources

- Review your current budget and identify money for investing

Week 2-4:

- Choose your first additional income stream based on your assessment

- Create a specific, measurable goal (Example: “Generate $300 monthly from freelance writing by Day 90”)

- Set up necessary accounts (business bank account, investment account, etc.)

- Build your basic systems (time tracking, expense tracking, income tracking)

Days 31-60: Implementation and Learning

Week 5-6:

- Launch your first income stream (even if imperfect)

- Dedicate your allocated time consistently

- Track all activities and results

- Learn from early mistakes and adjust

Week 7-8:

- Optimize based on what’s working

- Increase effort in high-return activities

- Eliminate or outsource low-return tasks

- Celebrate small wins to maintain motivation

Days 61-90: Scaling and Adding

Week 9-10:

- Scale your first stream if it’s generating income

- Automate whatever possible

- Document your systems and processes

- Prepare to add your second stream

Week 11-12:

- Begin building your second income stream

- Maintain (don’t abandon) your first stream

- Review your 90-day progress

- Plan your next 90-day goals

This systematic approach prevents overwhelm while ensuring consistent progress. I’ve used this exact framework to help people go from one to four income streams in less than a year.

Conclusion: Your Path to Financial Resilience Starts Today

The 7 streams of income aren’t just a financial strategy—they’re your insurance policy against an uncertain future. In 2026, with AI reshaping careers, economic volatility continuing, and traditional retirement looking increasingly uncertain, multiple income sources aren’t optional anymore. They’re essential.

But here’s what I want you to remember: you don’t need all seven streams to transform your financial life. Even adding one or two additional streams can dramatically improve your financial security, reduce stress, and create options you don’t currently have.

The people who succeed with this aren’t smarter, luckier, or more talented than you. They simply started. They took imperfect action. They persisted through the awkward beginning phase. And they built their streams one small step at a time.

Your action step for today—not tomorrow, not next week, but today—is to choose one additional income stream to build. Just one. Write it down. Schedule three hours this week to work on it. That’s it.

The river of financial abundance doesn’t appear overnight. It’s built one stream at a time, flowing together to create something powerful and sustainable. Your first stream starts today.

Ready to take the next step? Check out these 15 passive income ideas that actually work in 2026 to find your perfect starting point, or explore proven ways to achieve financial freedom with a comprehensive strategy. The journey to financial resilience begins with a single decision—make yours today.