Let me be honest with you: when I first heard someone claim they raised their credit score 100 points in six months, I thought it was too good to be true. But after researching proven strategies and hearing from financial experts who’ve helped clients achieve exactly this, I realized how to raise your credit score 100 points isn’t just possible—it’s a realistic goal if you follow the right steps consistently.

Here’s the reality: your credit score isn’t some mysterious number controlled by forces beyond your understanding. It’s a calculation based on specific factors you can influence starting today. Whether you’re recovering from past mistakes, building credit for the first time, or just want to qualify for better loan rates, this guide will show you the exact roadmap to make it happen.

Key Takeaways

- Payment history matters most: Making every payment on time for six months is the foundation of any 100-point increase

- Credit utilization is your quick win: Reducing credit card balances below 30% (ideally under 10%) of your limits can boost your score by 70+ points alone

- Multiple strategies work together: Combining debt payoff, error disputes, and strategic credit-building tools creates compound improvements

- Timeline is realistic but requires commitment: Most people see steady 10-25 point increases monthly when following proven methods consistently

- Free tools accelerate progress: Services like Experian Boost and becoming an authorized user cost nothing but can add 10-30 points quickly

Quick Answer: Can You Really Raise Your Credit Score 100 Points in 6 Months?

Yes, raising your credit score 100 points in six months is achievable for most people, especially those starting in the fair to poor credit range (580-669). According to Tampa-based personal finance expert Andrew Lokenauth, “people’s scores climb 100-plus points in six months using the snowball method” when they combine aggressive debt payoff with perfect payment history.[1]

The key is understanding that your credit score responds to specific actions: paying every bill on time, reducing credit card balances below 30% of limits, disputing errors, and strategically adding positive payment history. These aren’t tricks or hacks—they’re proven methods that directly address the five factors that determine your score.

Your starting point matters. If you’re beginning at 500, reaching 600 is very doable. Starting at 750 and trying to hit 850? That’s much harder because you have less room for improvement and fewer negative items to fix.

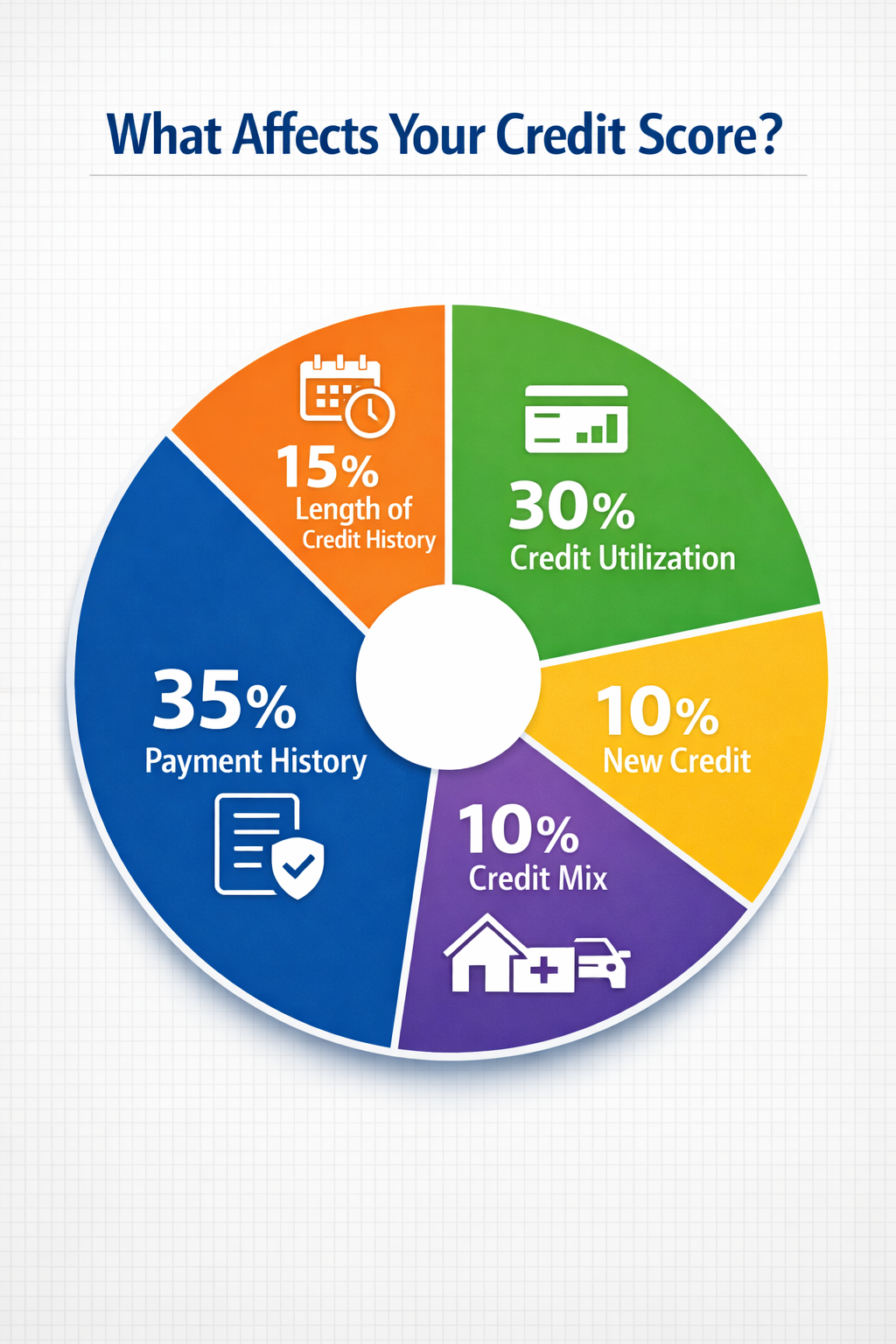

What Factors Determine Your Credit Score?

Your credit score is calculated using five weighted factors, and understanding these percentages helps you prioritize where to focus your energy.

Payment history (35%) is the single biggest factor.[2][4] This tracks whether you pay bills on time, how late any payments were, and how recently late payments occurred. Even one 30-day late payment can drop your score by 60-110 points, which is why protecting this factor is critical.

Credit utilization (30%) measures how much of your available credit you’re using.[1] If you have $10,000 in total credit limits and you’re carrying $3,000 in balances, your utilization is 30%. Experts recommend keeping this below 30% for good scores and below 10% for excellent scores.

Length of credit history (15%) considers how long your accounts have been open and the average age of all your accounts. You can’t speed up time, but you can avoid closing old accounts that help your average age.

Credit mix (10%) looks at the variety of credit types you manage—credit cards, auto loans, mortgages, student loans. Having a mix shows lenders you can handle different types of credit responsibly.

New credit (5%) tracks recent credit applications and new accounts. Each hard inquiry from a credit application can temporarily lower your score by 5-10 points, so avoid applying for multiple cards or loans during your improvement period.

Choose your battles wisely: If you’re starting with poor credit, focus heavily on payment history and utilization since these two factors make up 65% of your score. If you already have good payment history, concentrate on utilization reduction and adding positive credit mix.

How to Raise Your Credit Score 100 Points: The Step-by-Step Plan

Raising your credit score 100 points in six months requires a systematic approach that addresses multiple factors simultaneously. Here’s the month-by-month blueprint that works.

Month 1: Establish Perfect Payment Habits

Set up automatic payments for at least the minimum due on every account. Payment history is 35% of your score, so this is non-negotiable.[2] Late payments stay on your report for seven years, but their impact decreases over time.

Action steps:

- Set up autopay for all credit cards, loans, and bills

- Create calendar reminders 3-5 days before due dates as backup

- If you’ve missed payments recently, call creditors immediately—some will remove the late mark if you ask and have been a good customer

- Consider setting up text or email alerts when bills are due

Common mistake: Assuming autopay means you never need to check your accounts. Always monitor to ensure payments process correctly and you have sufficient funds.

Month 2: Attack Credit Utilization Aggressively

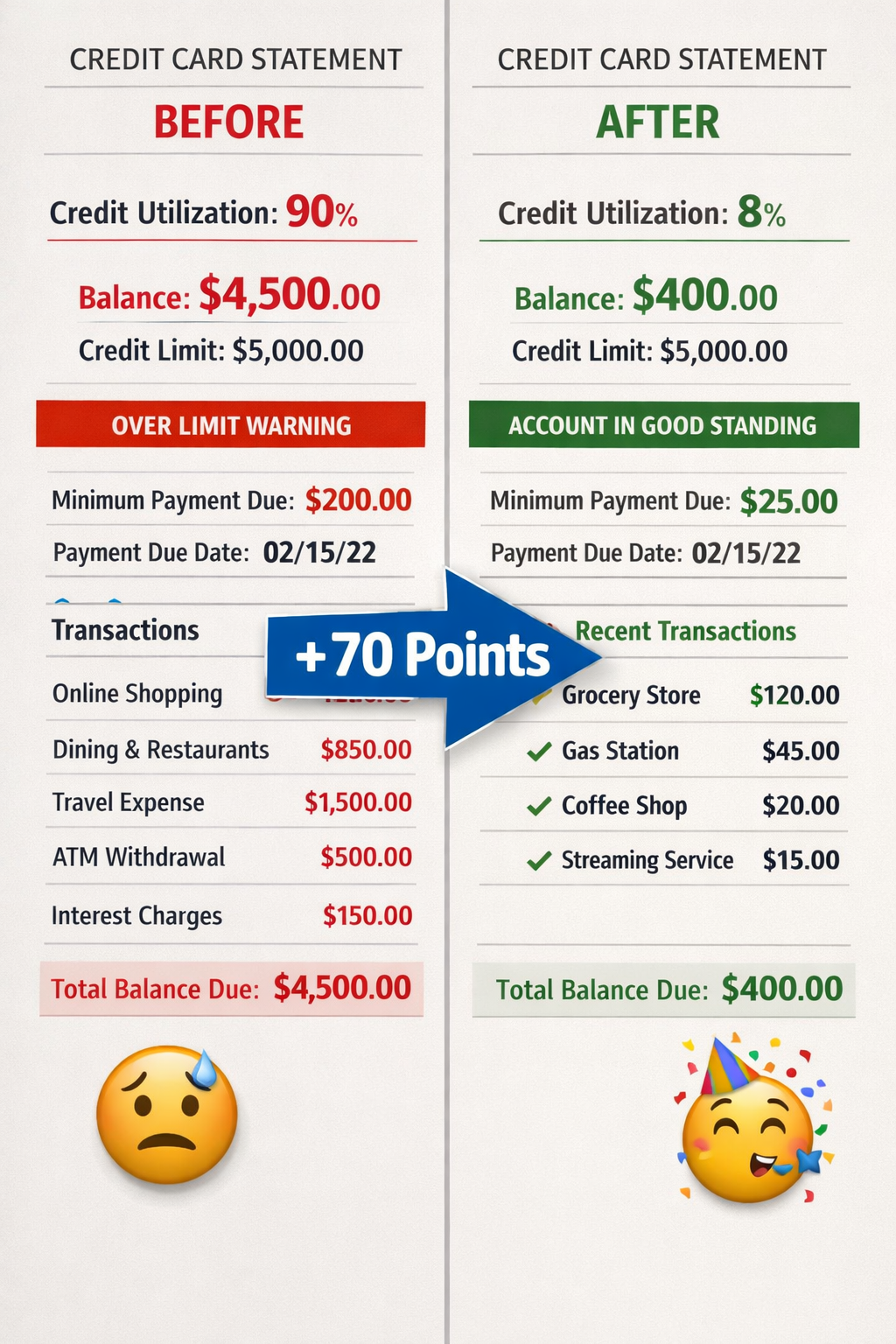

One of Lokenauth’s clients reduced credit card utilization from 90% to a much lower percentage and saw a 70-point credit score increase from this single change.[1] This demonstrates the power of utilization reduction.

Target these thresholds:

- Immediate goal: Get all cards below 30% of their limits

- Optimal goal: Push balances under 10% for maximum score benefit

- Per-card utilization matters: Even if your overall utilization is 20%, having one card maxed out hurts your score

Strategies to reduce utilization quickly:

- Make multiple payments throughout the month (not just one payment on the due date)

- Pay down cards before your statement closing date, which is when most issuers report to credit bureaus

- Request credit limit increases on cards you’ve had for 12+ months with good payment history (this lowers utilization without paying down debt)

- Use the debt avalanche method to target high-interest cards first

If you have $5,000 in credit limits, aim for balances under $1,500 (30%) immediately, then work toward $500 (10%) over the next few months.[1]

Month 3: Dispute Errors and Inaccuracies

According to a Consumer Reports study, one in five people has an error on their credit report. These mistakes can cost you 20-100 points depending on severity.

How to dispute effectively:

- Get free credit reports from all three bureaus at AnnualCreditReport.com

- Review every line for accounts you don’t recognize, incorrect balances, or paid debts still showing as open

- File disputes online through each bureau’s website (Experian, TransUnion, Equifax)

- Provide documentation supporting your claim

- Follow up after 30 days if you haven’t received a response

What to look for:

- Accounts that aren’t yours (possible identity theft)

- Payments marked late that you paid on time

- Debts you’ve paid off still showing balances

- Duplicate accounts

- Incorrect credit limits (lower limits make your utilization look worse)

Bureaus must investigate within 30 days and remove unverified information.[4] This can produce quick score jumps if errors are found.

Month 4: Add Positive Payment History Strategically

If you have limited credit history or are rebuilding after problems, adding new positive payment data accelerates improvement.

Credit-builder loans: These specialized loans hold your borrowed money in a savings account while you make fixed payments for 6-24 months.[4] At the end, you get the money back. Ensure the lender reports to all three bureaus for maximum impact.

Become an authorized user: Ask a family member with excellent credit and low utilization to add you as an authorized user on their oldest card. You inherit their positive payment history and credit age, potentially adding 10-30 points within 30-60 days. You don’t need the physical card or spending privileges—just being listed helps.

Experian Boost: This free service adds on-time payments for utilities, phone bills, rent, insurance, and streaming services to your Experian credit report.[4] You need at least three payments in the past six months (including one in the past three months). Some users see instant 10-15 point increases.

Secured credit cards: If you can’t qualify for traditional cards, secured cards require a deposit (usually $200-500) that becomes your credit limit. Use it for small purchases and pay in full monthly to build positive history.

Month 5: Optimize Your Credit Mix (If Applicable)

If you only have credit cards, adding an installment loan (auto, personal, or credit-builder loan) can improve your credit mix, which accounts for 10% of your score.[2]

When this makes sense:

- You already have good payment history and low utilization

- You need the loan anyway (don’t take debt just for credit score purposes)

- You can afford the monthly payments comfortably

When to skip this step:

- You’re still working on payment consistency

- Adding a loan payment would strain your budget

- Your utilization is still above 30%

Focus on the big factors first. Credit mix helps, but it’s not worth going into unnecessary debt.

Month 6: Maintain Momentum and Avoid New Inquiries

By month six, your score should show significant improvement if you’ve followed the previous steps. Now protect your progress.

What to do:

- Continue perfect on-time payments (this never stops being important)

- Keep utilization below 10% if possible

- Avoid applying for new credit unless absolutely necessary

- Don’t close old credit cards, even if you’re not using them (this helps your credit age and available credit)

- Monitor your credit score monthly to track progress and catch new errors

What not to do:

- Don’t max out cards again after paying them down

- Don’t make large purchases on credit right before applying for a loan

- Don’t let success make you complacent about payment dates

For additional strategies, check out these 11 proven ways to raise your credit score fast.

Should You Use Debt Consolidation to Raise Your Credit Score?

Debt consolidation can be a powerful tool for credit improvement, but it works best in specific situations.

Consolidation helps in two major ways: it combines multiple debts into one payment, improving on-time payment consistency, and it can reduce your interest rate, making debt payoff faster.[1] When you consolidate credit card debt with a personal loan, you also convert revolving debt to installment debt, which can immediately improve your credit utilization ratio.

Consolidation methods that work:

Balance transfer cards offer 0% APR for 12-18 months on transferred balances.[1] If you can pay off the balance during the promotional period, you save hundreds in interest. Watch for balance transfer fees (typically 3-5% of the transferred amount). Choose this if you can realistically pay off the debt within the promotional window.

Personal consolidation loans combine multiple debts into one fixed payment at a lower interest rate than credit cards. This works well if you qualify for a rate below what you’re currently paying (usually requires credit scores above 620). Your credit may dip slightly from the hard inquiry and new account, but rebounds quickly as you make on-time payments.

Home equity loans or lines of credit offer the lowest rates but put your home at risk if you can’t pay. Only consider this if you have significant equity and stable income.

When consolidation backfires:

- You consolidate but don’t change spending habits, running up the cards again

- The new loan has higher fees or interest than your current debts

- You close credit cards after consolidating, reducing your available credit and hurting utilization

- You miss payments on the consolidation loan (this damages your score more than scattered small debts)

For more guidance on paying off debt strategically, see our guide on how to become debt-free in 12 months.

What Mistakes Hurt Your Credit Without You Knowing?

Some credit-damaging behaviors aren’t obvious, and avoiding these hidden traps protects your progress.

Closing old credit cards seems logical after paying them off, but it reduces your available credit (increasing utilization) and lowers your average account age. Keep old cards open and use them for one small purchase every few months to keep them active.

Only making minimum payments keeps you in good standing but doesn’t improve your utilization ratio significantly. Your score responds to balance reduction, not just on-time payments. Pay more than the minimum whenever possible.

Ignoring small collections under $100 can still tank your score by 50-100 points. Medical bills, library fines, and utility debts often go to collections without warning. Pay these immediately and request a “pay for delete” agreement in writing before paying.

Applying for retail cards at checkout for the 10-20% discount creates a hard inquiry that lowers your score. Multiple applications in a short period compound the damage. Avoid new credit applications during your improvement period.

Letting authorized user accounts go bad means if the primary cardholder misses payments or maxes out the card, it damages your credit too. Monitor any accounts where you’re an authorized user.

Co-signing loans makes you fully responsible if the primary borrower doesn’t pay. Late payments show on your credit report, not just theirs. Only co-sign if you can afford to take over payments.

Learn more about 7 surprising things that hurt your credit score that most people overlook.

How Long Do Negative Items Stay on Your Credit Report?

Understanding the timeline for negative items helps you plan your credit improvement strategy realistically.

Late payments: Remain on your report for seven years from the original delinquency date, but their impact decreases significantly after two years.[2] A 90-day late payment hurts more than a 30-day late payment.

Collections: Stay for seven years from the date of first delinquency (the date you first missed a payment on the original debt, not when it went to collections). Paying a collection doesn’t remove it, but newer scoring models (FICO 9, VantageScore 3.0 and 4.0) ignore paid collections.

Charge-offs: Remain for seven years. A charge-off means the creditor gave up on collecting and wrote off the debt, but you still legally owe it.

Bankruptcies: Chapter 7 bankruptcy stays for 10 years; Chapter 13 stays for seven years. These have the most severe impact but decrease over time, especially if you rebuild credit responsibly.

Hard inquiries: Remain for two years but only affect your score for the first 12 months. Multiple inquiries for the same type of loan (mortgage, auto) within 14-45 days count as one inquiry.

Foreclosures and repossessions: Stay for seven years and severely damage scores initially, but you can rebuild while they’re still on your report.

The good news: You don’t have to wait for negative items to fall off to improve your score. Adding positive payment history, reducing utilization, and disputing errors can raise your score significantly even with negative marks still present.

Can You Raise Your Credit Score If You Have No Credit History?

Building credit from scratch requires different strategies than repairing damaged credit, but you can still achieve a 100-point increase from no score to a fair score in six months.

Start with a secured credit card: Deposit $200-500 to open the account, use it for small purchases (gas, groceries), and pay the full balance monthly. Most secured cards graduate to unsecured cards after 6-12 months of responsible use.

Credit-builder loans: These are specifically designed for people with no credit or bad credit.[4] You make monthly payments, the lender reports to credit bureaus, and you get the money at the end. Look for credit unions offering these with low fees.

Become an authorized user: This is the fastest way to establish credit history. Choose someone who has had their card for 5+ years, keeps utilization below 10%, and never misses payments. Their entire positive history can appear on your report within 30-60 days.

Experian Boost: Add utility, phone, and streaming payments to your Experian report immediately.[4] This creates a credit file if you don’t have one and can generate a score where none existed.

Report rent payments: Services like Rental Kharma, RentTrack, and LevelCredit report your rent payments to credit bureaus for a small monthly fee ($5-10). Since rent is often your largest monthly payment, this builds substantial positive history.

Student loans: If you have federal or private student loans, these report to credit bureaus and contribute to your credit mix and payment history. Set up autopay to ensure you never miss a payment.

Timeline expectations: With no credit, you can typically establish a FICO score within 3-6 months of opening your first account. Reaching 650-700 within six months is realistic if you maintain perfect payment history and keep utilization low.

How Much Will Your Credit Score Increase Each Month?

Credit score improvement isn’t linear, but understanding typical monthly gains helps you set realistic expectations and stay motivated.

Month 1: +5-15 points from establishing autopay and avoiding new late payments. If you dispute errors and they’re removed, you might see 20-50 points.

Month 2: +15-25 points as you reduce credit utilization below 30%. If you started with very high utilization (80%+), the improvement can be 40-70 points.[1]

Month 3: +10-20 points from continued on-time payments and further utilization reduction. Error disputes resolved this month can add another 10-30 points.

Month 4: +10-20 points from becoming an authorized user or adding Experian Boost. Your payment history is now consistently positive for four months.

Month 5: +10-15 points as utilization drops below 10% and your positive payment history strengthens. Credit mix improvements (if you added an installment loan) begin showing impact.

Month 6: +10-15 points from sustained perfect payment history and low utilization. Your score has now stabilized at a higher level.

Total potential: 60-130 points over six months, with most people landing in the 80-110 point range if they follow all strategies consistently.

Factors that accelerate gains:

- Starting with high utilization (60%+) gives you more room for improvement

- Having errors on your report that get removed

- Adding positive payment history through authorized user status or Experian Boost

- Paying off collections or charge-offs

Factors that slow gains:

- Recent late payments (within the past 6-12 months) continue to drag your score

- Maxed-out cards that you can only pay down slowly

- No credit history to build upon

- New hard inquiries or accounts during the improvement period

If you’re working on debt reduction alongside credit improvement, try a no-spend month challenge to free up cash for debt payoff.

Should You Pay for Credit Repair Services?

Credit repair companies promise fast score increases, but most charge fees for services you can do yourself for free.

What credit repair companies actually do:

- Pull your credit reports from all three bureaus

- Identify errors and negative items

- Send dispute letters to credit bureaus

- Follow up on disputes

- Provide credit education

What they cannot legally do:

- Remove accurate negative information from your report

- Create a new credit identity for you

- Guarantee specific score increases

- Charge you before performing services (illegal under federal law)

The truth: Anything a credit repair company can do, you can do yourself for free. The Fair Credit Reporting Act gives you the right to dispute errors directly with credit bureaus at no cost.[4] Bureaus must investigate within 30 days regardless of whether you or a company submits the dispute.

When credit repair might make sense:

- You have multiple complex errors across all three bureaus and don’t have time to manage disputes

- You’re not comfortable writing dispute letters or navigating bureau websites

- You want someone to handle the administrative burden while you focus on payment and utilization

Red flags for credit repair scams:

- Guarantees to remove accurate negative information

- Asks you to dispute accurate information (this is fraud)

- Charges upfront fees before doing any work

- Tells you not to contact credit bureaus directly

- Promises to create a new credit identity using an EIN instead of your Social Security number (this is illegal)

Better alternatives: Nonprofit credit counseling agencies offer free or low-cost help creating debt management plans, negotiating with creditors, and understanding your credit report. Look for agencies accredited by the National Foundation for Credit Counseling (NFCC) or Financial Counseling Association of America (FCAA).

For a comprehensive approach to managing money while improving credit, explore these budgeting hacks for beginners.

Frequently Asked Questions

How fast can you raise your credit score 100 points?

Most people can raise their credit score 100 points in 4-6 months by combining perfect payment history, reducing credit utilization below 30%, disputing errors, and adding positive payment data through authorized user status or Experian Boost. Those starting with very high utilization or recent errors may see faster results, while those with limited credit history may need closer to 6-9 months.

What is the fastest way to raise your credit score?

The fastest single action is reducing credit utilization below 30% of your limits, which can increase your score 40-70 points within one billing cycle when balances are reported.[1] Combining this with disputing errors, becoming an authorized user on an old account with perfect history, and using Experian Boost can produce 50-100 point increases within 60-90 days.

Can you raise your credit score 200 points in 6 months?

Raising your credit score 200 points in six months is possible but rare, typically only achievable if you’re starting with a very low score (below 550), have multiple errors on your report that get removed, and have extremely high credit utilization that you pay down completely. Most realistic improvement for people with fair credit is 80-120 points in six months.

Does paying off collections raise your credit score?

Paying off collections helps your creditworthiness but may not immediately raise your score with older scoring models. Newer models (FICO 9, VantageScore 3.0+) ignore paid collections, which can produce score increases. Request a “pay for delete” agreement in writing before paying, where the collection agency agrees to remove the item entirely in exchange for payment.

How many points does a late payment lower your credit score?

A single 30-day late payment can lower your credit score by 60-110 points depending on your starting score and credit history.[2] The higher your score before the late payment, the more points you lose. Late payments hurt less over time, with the most significant impact in the first two years.

Will closing a credit card hurt my score?

Yes, closing a credit card typically hurts your score by reducing your available credit (increasing utilization) and potentially lowering your average account age. Keep old cards open even if you’re not using them regularly. Make one small purchase every 3-6 months to keep the account active and prevent closure by the issuer.

How often should I check my credit score?

Check your credit score at least monthly to monitor progress and catch errors or fraudulent accounts early. You can get free credit scores from many credit card issuers, Credit Karma, or directly from Experian. Pull your full credit reports from all three bureaus at AnnualCreditReport.com at least once yearly, or every four months rotating between bureaus.

Can I get a mortgage with a 680 credit score?

Yes, a 680 credit score qualifies you for most conventional mortgages, FHA loans, and VA loans. You’ll get better interest rates with scores above 740, but 680 is sufficient for approval with decent terms. Each 20-point score increase can lower your interest rate by 0.25-0.5%, saving thousands over a 30-year mortgage.

Does income affect your credit score?

No, income does not directly affect your credit score calculation. Credit bureaus don’t have access to your income information. However, higher income can indirectly help by making it easier to pay bills on time, pay down debt, and maintain low credit utilization—all of which improve your score.

How long does it take for credit utilization changes to show on my score?

Credit utilization changes typically appear on your credit report within 30-45 days after your statement closing date, when most credit card issuers report to bureaus. Your score updates shortly after the new balance is reported. To see faster results, pay down balances before your statement closes or ask your issuer to report mid-cycle.

What credit score do I need for the best interest rates?

Credit scores of 740 and above typically qualify for the best interest rates on mortgages, auto loans, and personal loans. Scores of 760+ get the absolute best rates. The difference between a 680 score and a 760 score can mean 0.5-1.5% higher interest rates, costing thousands over the life of a loan.

Should I use all my available credit types?

You don’t need to use all available credit types, but having a mix of revolving credit (credit cards) and installment loans (auto, mortgage, personal loans) can slightly improve your credit mix score component (10% of your total score). Only take on credit you actually need and can afford to repay—never borrow just to improve credit mix.

Key Takeaways: Your Path to 100 Points Higher

- Perfect payment history is non-negotiable: Set up autopay for every account and never miss a due date for the entire six months—this single factor is 35% of your score

- Reduce credit utilization below 30% immediately, then target 10%: This can produce 40-70 point increases alone and is the fastest way to see score improvements[1]

- Dispute every error you find: One in five people has errors on their credit report, and removing them can add 20-100 points depending on severity

- Add positive payment history strategically: Become an authorized user, use Experian Boost, or open a credit-builder loan to add new positive data quickly

- Avoid new credit applications: Each hard inquiry costs 5-10 points and signals risk to lenders—wait until after your six-month improvement period

- Monitor progress monthly: Check your score every 30 days to stay motivated and catch new errors immediately

- Combine multiple strategies: The 100-point increase comes from addressing payment history, utilization, errors, and credit mix simultaneously, not from any single action

- Don’t close old accounts: Keep old credit cards open to maintain your credit age and available credit, even if you’re not using them

- Be patient with negative items: Late payments and collections stay on your report for seven years, but their impact decreases significantly after two years

- Free tools work as well as paid services: You can achieve the same results as credit repair companies by disputing errors yourself, using Experian Boost, and following the strategies in this guide

Conclusion: Your 100-Point Increase Starts Today

Raising your credit score 100 points in six months isn’t about magic tricks or secret loopholes. It’s about understanding the five factors that determine your score and systematically improving each one through consistent, proven actions.

Start with the foundation: set up automatic payments today so you never miss another due date. Then tackle credit utilization by paying down balances below 30% of your limits, focusing on the highest-balance cards first. Pull your credit reports this week and dispute any errors you find—this alone could add 20-50 points if errors exist.

Add positive payment history through authorized user status or Experian Boost, and avoid applying for new credit during your improvement period. Check your progress monthly to stay motivated and adjust your strategy as needed.

The timeline I’ve outlined—Month 1 through Month 6—gives you a clear roadmap. Follow it consistently, and you’ll likely see 10-25 point increases each month, reaching your 100-point goal by the end of six months. Some of you will get there faster, especially if you’re starting with high utilization or have errors to remove.

Remember that credit improvement is a marathon, not a sprint. The habits you build during these six months—paying on time, keeping balances low, monitoring your credit—will serve you for life. A higher credit score isn’t just a number; it’s access to better interest rates, easier loan approvals, lower insurance premiums, and more financial opportunities.

Your next steps:

- Set up autopay for all accounts today

- Pull your free credit reports from AnnualCreditReport.com this week

- Calculate your current credit utilization and create a payoff plan

- Sign up for Experian Boost and add eligible payments

- Ask a trusted family member about becoming an authorized user

- Set a calendar reminder to check your score monthly

You’ve got this. Six months from now, you’ll look back at today as the moment everything changed. Start now, stay consistent, and watch your score climb.

For more strategies to improve your overall financial health while working on your credit, check out these 15 good financial habits that changed my life.

References

[1] How To Repair Your Credit Score In Proven Strategies That Actually Work – https://www.amerisave.com/learn/how-to-repair-your-credit-score-in-proven-strategies-that-actually-work

[2] 25 Tips To Improve Credit In 2026 And Beyond – https://luminasolar.com/25-tips-to-improve-credit-in-2026-and-beyond/

[4] Ways To Improve Credit – https://www.experian.com/blogs/ask-experian/ways-to-improve-credit/