Picture this: It’s 2 a.m., and you’re lying awake, mentally calculating how long it’ll take to pay off that credit card balance. Your stomach churns as you think about the interest piling up. You’re not alone in this midnight worry session—nearly 88% of U.S. adults reported feeling some form of financial stress at the start of 2026[2]. If you’re battling debt stress right now, I want you to know something important: this feeling doesn’t have to define your journey. In fact, with the right mindset and strategies, you can transform that anxiety into fuel for your financial comeback.

As someone who understands the weight of debt stress, I’ve learned that paying off bills isn’t just about numbers—it’s about maintaining your mental health and motivation through what can feel like an endless marathon. With Americans carrying a record $1.23 trillion in credit card debt[1], you’re part of a massive community working toward the same goal: financial freedom.

Key Takeaways

- Debt stress affects nearly 9 out of 10 Americans, making it one of the most common sources of anxiety in 2026—you’re not alone in this struggle

- Small wins and celebration milestones are scientifically proven to maintain motivation during long-term debt payoff journeys

- Managing the emotional side of debt through self-care, support systems, and mindset shifts is just as important as the financial strategies themselves

- 40% of Americans list paying down debt as their top anticipated expense for 2026, reflecting a nationwide shift toward prioritizing financial freedom[2]

- Practical stress-reduction techniques combined with strategic debt payoff methods create sustainable momentum that carries you to the finish line

Understanding Debt Stress and Why It Feels So Overwhelming

The Real Impact of Financial Anxiety

Let me be honest with you—debt stress isn’t just “feeling worried about money.” It’s a legitimate form of chronic stress that affects your sleep, relationships, physical health, and overall quality of life. When 61% of survey respondents identify money as their primary life stressor[4], we’re talking about a nationwide mental health crisis that doesn’t get enough attention.

For those earning under $50,000 annually, the pressure intensifies dramatically. Research shows that 21% of consumers in this income bracket report that their debt keeps them up at night[5]. That’s not just a statistic—that’s real people losing sleep, missing out on moments with their families, and feeling trapped in a cycle they can’t escape.

The psychological weight becomes even heavier when you consider that 77% of Americans experienced a financial setback in 2025[2]. Maybe you had unexpected medical bills, car repairs, or a period of reduced income. These setbacks aren’t character flaws—they’re common experiences that can derail even the best-laid plans.

Why Traditional “Just Budget Better” Advice Falls Short

Here’s what frustrates me about most debt advice: it focuses exclusively on spreadsheets and sacrifice without acknowledging the emotional toll of living under financial pressure. You can have the perfect budget, but if you’re emotionally exhausted and demotivated, you won’t stick with it.

The truth is, 53% of people report an increase in financial stress over the past year[4], and simply telling them to “cut back on lattes” doesn’t address the deeper issue. We need strategies that acknowledge both the practical and psychological dimensions of debt payoff.

When only 20% of respondents report having a surplus “every month”[2], it’s clear that most people are operating on razor-thin margins. This makes every unexpected expense feel like a catastrophe and every month feel like you’re barely keeping your head above water.

The Shift in How Americans Define Success

Something powerful is happening in 2026: 34% of U.S. consumers now picture “the American Dream” as being debt-free first and building wealth later[5]. This represents a fundamental shift in priorities—from keeping up with the Joneses to achieving genuine financial peace.

This mindset change is crucial for your motivation. You’re not just paying off bills; you’re participating in a cultural movement toward financial wellness. When you choose to tackle your debt payoff journey, you’re aligning with millions of others who’ve decided that freedom matters more than appearances.

Building Your Motivation Foundation: Strategies That Actually Work

Start with Radical Self-Compassion 💙

Before we dive into tactics, let’s address something critical: you need to stop beating yourself up. Debt stress multiplies when you layer shame on top of it. The bills are already stressful enough without adding self-judgment to the mix.

I’ve found that people who practice self-compassion during their debt payoff journey are significantly more likely to stick with their plans. Why? Because they don’t spiral into “I’m a failure” thinking every time they have a setback. They acknowledge the challenge, adjust their approach, and keep moving forward.

Try this exercise: Write down three things that contributed to your current debt situation that were genuinely outside your control. Medical emergencies? Job loss? Economic recession? Now give yourself permission to acknowledge that you’re doing your best in difficult circumstances.

Create a Vision That Excites You (Not Just Scares You)

Most debt payoff plans are built on fear: “If I don’t pay this off, terrible things will happen.” While that might provide short-term motivation, it’s exhausting to maintain. Instead, I want you to create a compelling positive vision of your debt-free life.

What will you do with the money currently going to debt payments? How will you feel waking up without that weight? What opportunities will open up? Get specific and emotional about this vision.

Vision-building exercise:

- 🎯 Freedom feeling: Describe in detail how it will feel to make your final debt payment

- 🏖️ First celebration: What’s the first thing you’ll do to celebrate being debt-free?

- 💰 Money redirection: Where will that monthly debt payment go instead?

- 🌟 Life changes: What becomes possible in your life without debt stress?

Write these down and revisit them weekly. When motivation wanes, this vision becomes your north star.

Break Down the Mountain into Pebbles

Looking at your total debt can feel paralyzing. If you owe $30,000, focusing on that number every day is a recipe for despair. Instead, break it into small, achievable milestones that you can celebrate along the way.

Consider implementing strategies from proven debt payoff methods that emphasize quick wins. The debt snowball method, for example, has you pay off your smallest debt first—not because it’s mathematically optimal, but because that psychological victory fuels your motivation to tackle the next one.

Milestone framework:

- Micro-wins (weekly): “I stuck to my budget this week” or “I found an extra $20 to put toward debt”

- Mini-milestones (monthly): “I paid off $500 this month” or “I paid more than the minimum on all cards”

- Major milestones (quarterly): “I eliminated one entire debt” or “I reduced my total debt by 10%”

- Celebration points (annually): “I’m halfway there” or “I paid off $10,000 this year”

Each of these deserves recognition and a small reward that doesn’t derail your progress.

Track Progress Visually (Because Numbers Get Boring)

Here’s a game-changer: create a visual tracker that you can see daily. There’s something deeply satisfying about coloring in a chart or moving a marker that represents your progress.

Visual tracking ideas:

- 📊 Thermometer chart: Draw a thermometer and color it in as you pay down debt

- 🔗 Paper chain: Create a chain with links representing $100 increments; tear one off with each payment

- 📅 Calendar X’s: Mark an X on your calendar for every day you don’t add to your debt

- 🗺️ Debt-free journey map: Create a path from “Starting Point” to “Debt Freedom” with milestones marked

I personally used a large poster board in my kitchen with different colored markers for each debt. Watching those balances shrink in real-time kept me motivated even when the numbers in my spreadsheet felt abstract.

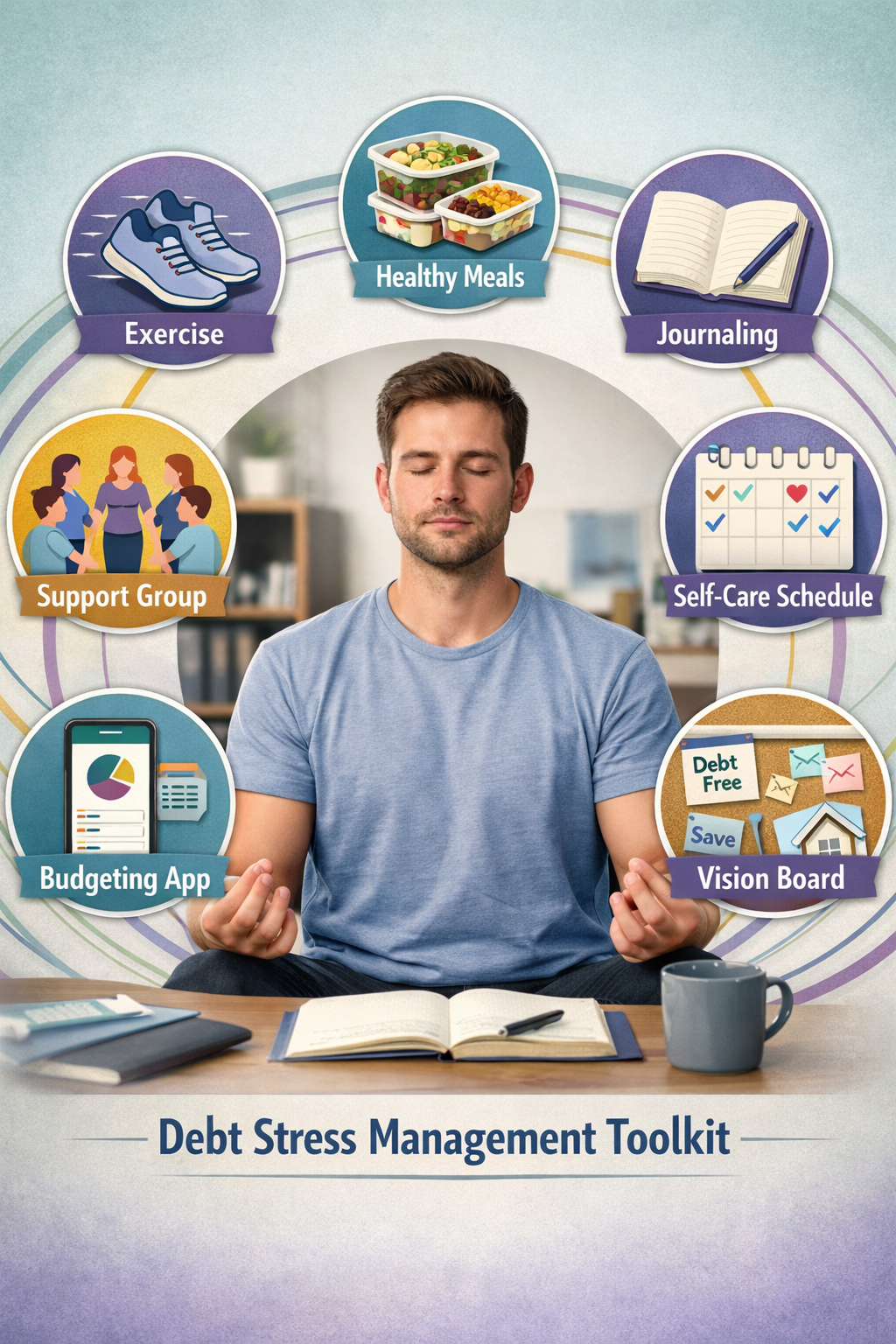

Find Your Accountability Partner or Community

Debt stress thrives in isolation. When you’re struggling alone, it’s easy to give up or convince yourself that one more purchase “won’t matter.” But when you have accountability, everything changes.

This could be:

- 👥 A trusted friend who’s also paying off debt

- 💑 Your partner (check out couples budgeting strategies for managing money together)

- 🌐 An online community of people on similar journeys

- 📱 A financial accountability app that checks in with you

The key is regular check-ins—weekly or bi-weekly conversations where you share your wins, challenges, and commitments for the coming period. Knowing someone will ask about your progress creates positive pressure that keeps you on track.

Practical Strategies to Reduce Debt Stress While Paying Off Bills

Master the Art of the “Good Enough” Budget

Perfectionism is the enemy of progress when it comes to budgeting. I’ve seen countless people create elaborate budgets with 47 categories, only to abandon them after two weeks because they’re too complicated to maintain.

Instead, aim for a “good enough” budget that you’ll actually use. The biweekly budgeting approach works particularly well for many people because it aligns with how most of us get paid.

Simple budget framework:

| Category | Percentage | Purpose |

|---|---|---|

| Essentials | 50-60% | Housing, utilities, groceries, minimum debt payments |

| Debt payoff | 20-30% | Extra payments beyond minimums |

| Life happens | 10-15% | Small buffer for unexpected expenses |

| Sanity savers | 5-10% | Small pleasures that keep you human |

Notice that last category? It’s crucial. Depriving yourself completely leads to burnout and binge spending. Budget for small joys—whether that’s a coffee date with a friend or a streaming subscription—so you don’t feel like you’re living in financial prison.

Increase Your Income (Even Just a Little)

While cutting expenses helps, there’s a limit to how much you can reduce spending. But your income? That has unlimited potential. Even an extra $200-500 per month can dramatically accelerate your debt payoff and reduce stress.

Consider these approaches:

- 💼 Side hustles: Explore home businesses you can start with no money or ways to make money from home

- 📈 Ask for a raise: If you’ve been performing well, research market rates and make your case

- 🎓 Skill development: Learn high-income skills that command better pay

- 💰 Declutter for cash: Sell items you no longer need for quick debt payments

The psychological benefit of increasing income is profound. Instead of only focusing on what you can’t have, you’re actively expanding what’s possible. This shifts your mindset from scarcity to abundance, which is essential for long-term motivation.

Automate Your Debt Payments (Remove the Decision Fatigue)

Here’s a truth about motivation: it’s unreliable. Some days you’ll feel fired up about debt payoff; other days you’ll want to give up entirely. That’s why automation is your secret weapon.

Set up automatic payments for:

- ✅ Minimum payments on all debts (so you never miss one)

- ✅ Extra payment on your target debt (your snowball or avalanche focus)

- ✅ Small amount to emergency savings (even $25/month helps)

When these payments happen automatically, you don’t have to rely on willpower or motivation. The progress happens whether you feel like it or not. This consistency is what transforms debt payoff from a constant battle into a sustainable system.

Negotiate Everything (You Have More Power Than You Think)

Many people don’t realize that interest rates and payment terms are often negotiable, especially in 2026 with new regulatory changes. With the announcement that credit card companies will begin capping interest rates at 10 percent[1], there’s unprecedented opportunity to reduce your debt burden.

What to negotiate:

- 📞 Interest rates: Call your credit card companies and ask for a lower rate; mention competitor offers

- 💳 Balance transfer options: Look for 0% APR transfer offers (watch for fees)

- 📅 Payment dates: Align due dates with when you get paid to improve cash flow

- 🏥 Medical bills: Hospitals often have financial assistance programs or payment plans

- 📱 Monthly subscriptions: Call and ask for loyalty discounts or promotional rates

I’ve personally reduced my interest rates by an average of 4% just by making phone calls. That might not sound dramatic, but on a $10,000 balance, it saves hundreds of dollars and months of payments.

Build a Micro Emergency Fund (Your Stress Buffer)

One of the biggest sources of debt stress is the fear that any unexpected expense will derail your progress. That’s why even a small emergency fund—$500 to $1,000—can dramatically reduce anxiety.

I know what you’re thinking: “How can I save when I’m drowning in debt?” Here’s the thing: this small buffer actually accelerates your debt payoff because it prevents you from adding new debt when emergencies arise.

Use strategies from how to save $1000 in a month to build this cushion quickly. Once you have it, you’ll sleep better knowing that a flat tire or broken appliance won’t destroy your progress.

Practice Strategic Spending Cuts (Not Deprivation)

Remember how 59% of consumers aim to cut back on small daily purchases in 2026, with 45% admitting that impulse spending has derailed their progress[4]? The solution isn’t eliminating all joy from your life—it’s being strategic about where your money goes.

Apply the “Worth It” test to every purchase:

- Will I remember this purchase in a week?

- Does it align with my values and goals?

- Is there a free or cheaper alternative that provides 80% of the benefit?

- Would I rather have this OR be debt-free sooner?

This isn’t about judgment; it’s about conscious choice. Sometimes the answer will be “Yes, this is worth it.” And that’s okay! The point is making intentional decisions rather than mindless ones.

For grocery savings specifically, check out these frugal grocery hacks that can free up hundreds monthly for debt payoff.

Managing the Emotional Rollercoaster of Debt Payoff

Recognize and Name Your Triggers

Debt stress doesn’t hit randomly—it usually has specific triggers. Maybe it’s opening your credit card statement, seeing friends post vacation photos on social media, or having conversations about money with family members.

Common emotional triggers:

- 😰 Comparison: Seeing others spend freely when you’re budgeting tightly

- 😔 Setbacks: Unexpected expenses that feel like they’ve erased your progress

- 😤 Resentment: Feeling angry about past financial decisions

- 😨 Fear: Worrying that you’ll never get out of debt

- 😞 Shame: Feeling embarrassed about your financial situation

Once you identify your triggers, you can develop specific coping strategies. For example, if social media comparison is your trigger, you might limit your time on Instagram during your debt payoff journey, or curate your feed to include more financial wellness content.

Develop Healthy Stress-Relief Rituals

When debt stress spikes, you need healthy outlets that don’t involve spending money. The worst thing you can do is try to relieve financial stress through retail therapy—it creates a vicious cycle.

Free or low-cost stress relievers:

- 🧘♀️ Movement: Walking, yoga, dancing in your living room

- 📝 Journaling: Writing out your worries and wins

- 🎨 Creative expression: Drawing, crafting with materials you already have

- 🌳 Nature time: Parks and trails are free therapy

- 📚 Library resources: Free books, movies, and sometimes classes

- 🫂 Connection: Quality time with supportive friends and family

Build these into your routine before you need them. When stress hits, you’ll have established pathways to relief that don’t derail your progress.

Celebrate Non-Financial Wins

Progress isn’t only measured in dollars. Some of the most important victories in your debt payoff journey are behavioral and emotional changes that deserve celebration.

Non-financial milestones worth celebrating:

- ✨ You said no to an impulse purchase

- ✨ You had a hard conversation about money with your partner

- ✨ You stuck to your budget for a full month

- ✨ You didn’t check your debt balances obsessively

- ✨ You felt genuinely hopeful about your financial future

- ✨ You helped someone else with financial advice

These shifts in behavior and mindset are the foundation of lasting financial change. Acknowledge them with the same enthusiasm you’d give to paying off a debt.

Reframe Setbacks as Data, Not Failure

Here’s a guarantee: you will have setbacks. You’ll overspend one month. An emergency will drain your progress. You’ll make a financial decision you regret. This doesn’t mean you’re failing—it means you’re human.

The difference between people who successfully pay off debt and those who give up isn’t that the successful ones never mess up. It’s that they reframe setbacks as learning opportunities rather than evidence of personal failure.

When something goes wrong, ask:

- 🤔 What can I learn from this?

- 🤔 What would I do differently next time?

- 🤔 What systems can I put in place to prevent this?

- 🤔 How can I adjust my plan to accommodate this reality?

This growth mindset keeps you moving forward instead of spiraling into shame and giving up.

Practice Gratitude Alongside Striving

This might sound contradictory, but you can simultaneously work hard to change your financial situation and practice gratitude for what you have right now. In fact, this balance is essential for maintaining motivation without burning out.

Daily gratitude practice for debt payoff:

- 🙏 One thing you’re grateful for financially (even if it’s “I have a job” or “I made a payment today”)

- 🙏 One non-financial blessing in your life

- 🙏 One small win from today, no matter how tiny

This practice prevents the bitterness and resentment that can build during long-term financial challenges. It reminds you that your life has value beyond your net worth.

Know When to Seek Professional Support

Sometimes debt stress crosses the line from normal financial worry into anxiety or depression that requires professional help. There’s no shame in this—in fact, recognizing when you need support is a sign of strength.

Signs you might benefit from professional help:

- 🚨 Debt stress is affecting your sleep, appetite, or physical health

- 🚨 You’re having panic attacks related to finances

- 🚨 You’re avoiding all financial tasks (opening mail, checking accounts)

- 🚨 You’re experiencing relationship problems primarily due to money stress

- 🚨 You’re having thoughts of self-harm related to your financial situation

Many therapists specialize in financial stress and anxiety. Additionally, non-profit credit counseling agencies can provide both emotional support and practical debt management strategies.

Creating Your Sustainable Debt Payoff Plan for 2026

Choose Your Debt Payoff Method

With 40% of Americans listing paying down debt as their top anticipated expense for 2026[2], you’re joining a massive movement. But you need a clear method to follow.

The Debt Snowball Method:

- Pay minimums on all debts

- Put extra money toward your smallest debt

- When that’s paid off, roll that payment to the next smallest

- Best for: People who need quick wins for motivation

The Debt Avalanche Method:

- Pay minimums on all debts

- Put extra money toward your highest interest rate debt

- When that’s paid off, roll that payment to the next highest rate

- Best for: People motivated by math and maximum savings

The Hybrid Approach:

- Start with one quick win (smallest debt) for momentum

- Then switch to highest interest rates

- Best for: People who need both psychological wins and mathematical optimization

There’s no “wrong” choice here. The best method is the one you’ll actually stick with. For more detailed strategies, explore these ways to pay down debt faster.

Set Realistic Timelines (And Build in Flexibility)

One major source of debt stress is unrealistic expectations. If you have $50,000 in debt and make $40,000 per year, you’re probably not going to be debt-free in six months—and that’s okay.

Use a debt payoff calculator to determine a realistic timeline based on:

- Your total debt amount

- Interest rates

- How much you can realistically pay monthly

- Potential income increases

Then add 20% more time as a buffer. If the calculator says 24 months, plan for 29 months. This buffer accounts for life happening—because it will. When you finish earlier than expected, it’s a bonus. When life throws curveballs, you’re still on track.

Build in Regular Progress Reviews

Schedule monthly “financial dates” with yourself (or your partner) to review progress. This isn’t about judgment—it’s about course correction and celebration.

Monthly review checklist:

- ✅ What was our total debt at the start of the month vs. now?

- ✅ Did we stick to our budget? If not, why?

- ✅ What unexpected expenses came up?

- ✅ What went really well this month?

- ✅ What needs adjustment for next month?

- ✅ How are we feeling emotionally about our progress?

These reviews keep you connected to your goals without obsessing daily about every dollar.

Plan for Life After Debt

Here’s something that doesn’t get talked about enough: you need a vision for life after debt or you risk falling back into old patterns once you’re free.

Start thinking now about:

- 💭 Where will your debt payments be redirected? (Emergency fund? Retirement? House down payment?)

- 💭 What financial habits will you maintain?

- 💭 How will you prevent future debt?

- 💭 What does financial freedom look like for you?

Having this clarity helps you see debt payoff not as the end goal, but as the foundation for the life you’re building.

The Optimism Factor: Why 2026 Might Be Your Year

Despite all the challenges, there’s genuine reason for hope. 76% of people feel confident that their finances will improve in 2026[4]. This isn’t blind optimism—it’s based on real shifts happening in the financial landscape.

The new policy capping credit card interest rates at 10%[1] represents a significant opportunity for debt reduction. If you’re currently paying 18-24% APR, this change could save you thousands of dollars and years of payments.

Additionally, the collective focus on debt freedom means more resources, communities, and support systems are available than ever before. You’re not pioneering this path alone—you’re part of a movement.

Top financial resolutions for 2026 reflect this shift: increase savings (21%), pay down debt (20%), and boost income (15%)[4]. Notice that these are all proactive goals rather than reactive ones. People aren’t just trying to survive—they’re actively building better financial futures.

Your Debt-Free Journey Starts With One Decision

The journey from debt stress to financial freedom isn’t a straight line. There will be setbacks, frustrations, and moments when you want to give up. But here’s what I know: every single person who’s successfully paid off debt felt exactly the way you’re feeling right now at some point in their journey.

The difference between those who make it and those who don’t isn’t intelligence, income, or luck. It’s persistence powered by the right strategies and support systems.

You don’t have to be perfect. You don’t have to do everything right. You just have to keep going, adjust when needed, and refuse to give up on yourself.

If you’re ready to take the next step, consider starting with a complete debt-free plan that breaks down the entire process into manageable steps. Or if you’re working with limited income, explore strategies for paying off credit card debt on a low income.

Remember: being debt-free isn’t about being perfect with money. It’s about making progress, learning from setbacks, and building a life where financial stress no longer controls your decisions, your sleep, or your happiness.

Conclusion

Debt stress is real, overwhelming, and affects nearly 9 out of 10 Americans in 2026. But it doesn’t have to define your life or your future. By combining practical debt payoff strategies with emotional wellness practices, you can maintain motivation through the entire journey—not just the exciting beginning.

The key insights to remember:

- Motivation comes from small wins, not just the distant goal of being debt-free

- Your mental health matters as much as your payment strategy—address both simultaneously

- Community and accountability transform debt payoff from a lonely struggle into a supported journey

- Flexibility and self-compassion keep you going when perfectionism would make you quit

- 2026 offers unprecedented opportunities with policy changes and collective focus on debt freedom

Your next steps are simple:

- Choose your debt payoff method (snowball, avalanche, or hybrid)

- Set up one visual tracker to make progress tangible

- Find one accountability partner or join a community

- Schedule your first monthly review for 30 days from now

- Celebrate your decision to take control—that itself is a victory worth acknowledging

The path from debt stress to financial peace is walked one day, one decision, one payment at a time. You’ve already taken the first step by reading this article and educating yourself. Now keep that momentum going.

You’ve got this. And on the days when you don’t feel like you’ve got this, remember that millions of others are walking this same path, cheering you on, and proving that financial freedom is absolutely possible.

Here’s to your debt-free future—it’s closer than you think. 🎉