Picture this: You’re sitting across from your partner at the kitchen table, and someone mentions the credit card bill. Suddenly, the temperature in the room drops ten degrees, shoulders tense up, and what was supposed to be a simple conversation about couples budgeting turns into a full-blown argument about who spent what and why nobody consulted anyone before buying that thing.

Sound familiar? You’re definitely not alone.

Money is one of the biggest sources of stress in relationships, but here’s the good news: it doesn’t have to be. In 2026, more couples are finding creative ways to manage their finances together without turning every budget discussion into a battlefield. Whether you’re newlyweds combining finances for the first time or a long-term couple trying to get on the same page, this bootcamp will give you the tools, strategies, and mindset shifts you need to master couples budgeting without the drama.

Key Takeaways

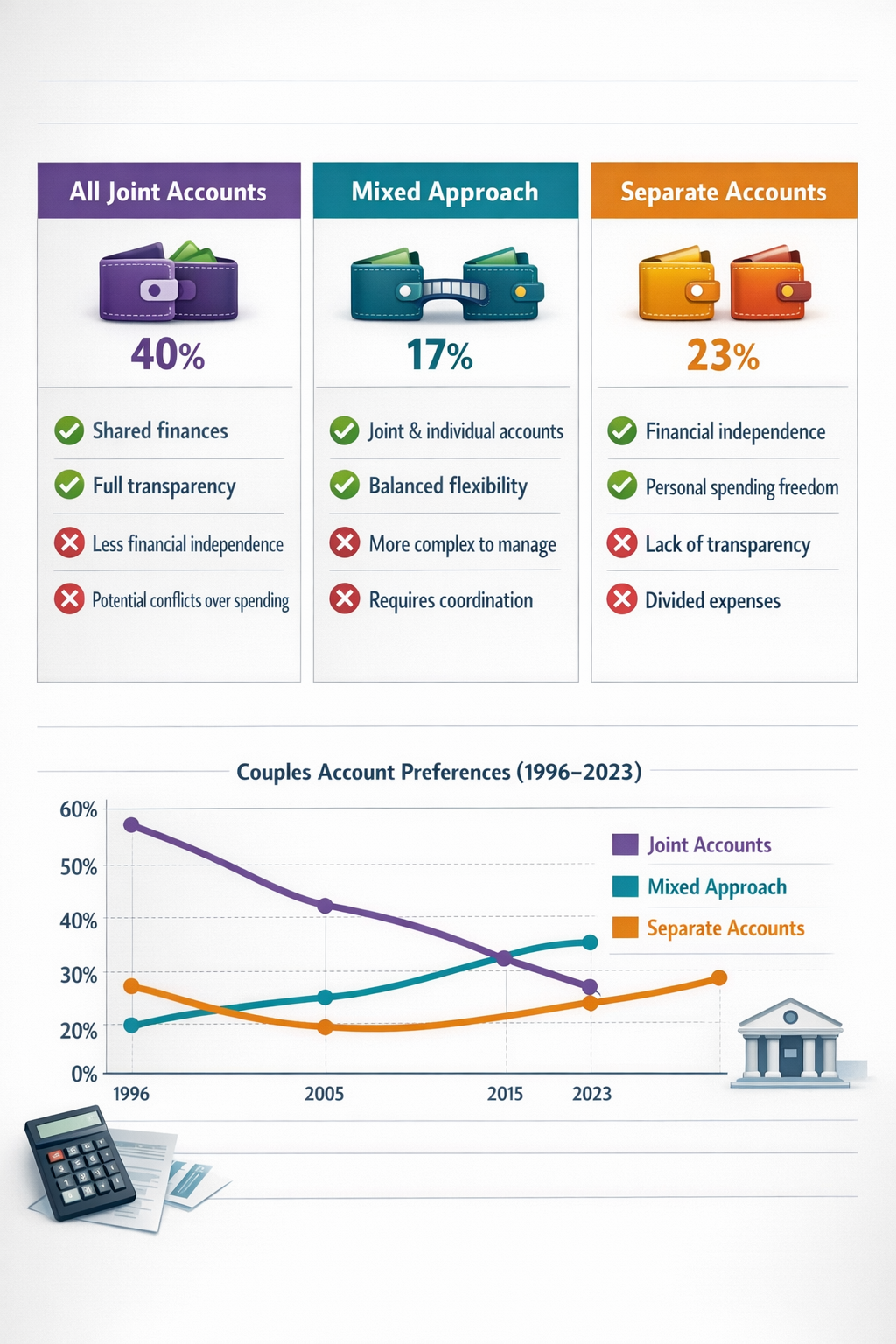

💡 Financial transparency doesn’t require merging everything – You can maintain visibility into household finances while keeping some accounts separate, with 17% of couples now using a mixed approach[4]

💰 Regular money dates prevent bigger fights – Scheduling consistent, judgment-free budget conversations reduces financial stress and improves planning effectiveness[3]

🎯 Shared goals create team mentality – Couples who establish clear combined views of income, spending, and savings before setting goals report better outcomes[3]

🤝 Different spending styles are normal – Understanding that partners approach money differently helps create compromise rather than conflict

📊 Start with the basics together – Successful couples budgeting begins with a complete picture of combined finances, not complicated systems

Why Couples Budgeting Feels So Hard (And Why It Doesn’t Have To Be)

Let me be honest with you—when my partner and I first tried to create a budget together, it was a disaster. We had completely different money personalities. I was the saver who tracked every penny, and they were the free spirit who thought budgets were “too restrictive.” Every conversation felt like a negotiation, and neither of us felt heard.

But here’s what I learned: couples budgeting isn’t hard because of the numbers—it’s hard because of the emotions, histories, and beliefs we bring to the table.

The Real Reasons Money Conversations Turn Into Fights

Different money backgrounds shape how we view spending and saving. If you grew up in a household where money was tight, you might approach finances with anxiety or extreme caution. If your partner grew up with financial abundance, they might have a more relaxed attitude. Neither approach is wrong—they’re just different.

Power dynamics can creep into budget discussions, especially if one partner earns significantly more than the other. The higher earner might feel entitled to more say, while the lower earner might feel defensive or less valued.

Avoidance and secrecy create tension. When couples delay or avoid money conversations, small issues become major conflicts. Financial stress consistently ranks among the top sources of relationship conflict[3], often because problems fester instead of being addressed early.

Lack of shared vision means you’re working toward different goals. One person is saving for a house while the other wants to travel the world. Without alignment, every spending decision feels like a betrayal of someone’s dreams.

The good news? All of these challenges have solutions. And I’m going to walk you through them.

The Changing Landscape of Couples and Money in 2026

Before we dive into the how-to, let’s look at what’s actually happening with couples and money in 2026. The data might surprise you.

Joint Accounts Are No Longer the Default

Remember when getting married automatically meant opening a joint checking account? Those days are fading fast. According to U.S. Census Bureau data, the share of couples with all their bank accounts jointly held dropped significantly from 53% in 1996 to just 40% in 2023[4].

Meanwhile, couples maintaining both joint and separate accounts rose from 9% in 1996 to 17% in 2023[4], and those without any joint accounts increased from 15% to 23%—more than a 50% jump[4].

What does this mean for you? There’s no “right” way to structure your accounts anymore. The most important thing is finding what works for your relationship, not following outdated rules.

The Rise of Financial Independence Within Relationships

This shift toward separate or mixed accounts doesn’t mean couples are less committed—it means they’re finding new ways to balance togetherness with autonomy. Many couples discover that maintaining some financial independence actually reduces stress rather than creating it.

I’ve seen this work beautifully in my own relationship. We have joint accounts for shared expenses and goals, but we also each have personal accounts for discretionary spending. This means I don’t have to justify my coffee shop habit, and my partner doesn’t need my approval for their hobby purchases. It’s created way more peace than when we tried to share everything.

What Real Couples Actually Spend On

Let’s talk real numbers. When it comes to major couple expenses, the averages you see online can be misleading. For engagement rings, nearly two-thirds (64%) of couples spend under $6,000, while one-third spend under $3,000, with only 5% spending over $15,000[1]. Geographic variation is substantial too—spending ranges from $3,005 in South Dakota to $10,109 in Washington state[1].

For weddings in 2026, venue costs average $8,573 and catering averages $6,927[5]. But here’s the thing: these are averages. Your couples budgeting journey should be based on your values and priorities, not what everyone else is doing.

Setting Up Your Couples Budgeting Foundation

Alright, let’s get practical. Before you can create a couples budget that actually works, you need to build a solid foundation. Think of this as the bootcamp basics—the fundamentals that everything else builds on.

Step 1: Schedule Your First (Non-Threatening) Money Date

The biggest mistake couples make is trying to have budget conversations when they’re stressed, tired, or already arguing about something else. Instead, I want you to schedule a dedicated money date.

Here’s how to make it work:

- Pick a specific time when you’re both relaxed (not Sunday night before the work week)

- Choose a comfortable setting (your favorite coffee shop, a cozy spot at home)

- Set a time limit (start with 30-45 minutes so it doesn’t feel overwhelming)

- Bring something enjoyable (good coffee, a favorite snack, background music)

- Establish ground rules (no blaming, no interrupting, no bringing up past mistakes)

The goal of your first money date isn’t to solve everything—it’s to create a safe space for honest conversation.

Step 2: Get Radically Honest About Your Complete Financial Picture

You can’t budget together if you don’t know what you’re working with. Before setting goals, successful couples establish clear views of combined income, spending, savings, debt, and net worth[3].

Create a complete financial inventory together:

Income Sources:

- Salaries and wages

- Side hustles or freelance work

- Investment income

- Any other regular money coming in

If you’re looking to boost your household income, check out these 15 home businesses you can start with no money or explore passive income ideas that earn money while you sleep.

Fixed Expenses:

- Rent or mortgage

- Insurance (health, auto, life, renters/homeowners)

- Loan payments (student loans, car payments)

- Subscriptions and memberships

Variable Expenses:

- Groceries and dining out

- Utilities

- Transportation and gas

- Entertainment and hobbies

- Personal care

Debts:

- Credit card balances

- Student loans

- Car loans

- Personal loans

- Any other outstanding debt

Assets:

- Savings accounts

- Retirement accounts

- Investments

- Property value

This might feel uncomfortable, especially if you’ve been keeping some things separate. But transparency is the foundation of successful couples budgeting. You don’t need to judge each other’s past decisions—just get clear on where you are right now.

Step 3: Identify Your Money Personalities

Understanding how each of you naturally approaches money will save you countless arguments. Here are some common money personalities:

🎯 The Planner – Loves spreadsheets, tracks every expense, thinks ahead

💸 The Spender – Enjoys life now, believes money is meant to be enjoyed

💰 The Saver – Finds security in a growing bank balance, cautious with purchases

🎲 The Risk-Taker – Willing to invest and take chances for bigger rewards

😰 The Worrier – Anxious about money regardless of the actual situation

😎 The Avoider – Prefers not to think about money, finds finance discussions stressful

Most people are a combination of these, and neither person’s approach is wrong. The key is recognizing your differences and finding ways to honor both perspectives in your couples budgeting system.

Creating Your Couples Budgeting System That Actually Works

Now that you’ve laid the groundwork, it’s time to build a budgeting system that fits your unique relationship. There’s no one-size-fits-all approach, but there are some proven frameworks that work for most couples.

Choose Your Account Structure

Based on what we know about how couples are managing money in 2026, you have three main options:

Option 1: Fully Joint Accounts (40% of couples)

Best for: Couples who value complete transparency and simplicity, those with similar incomes and spending styles

How it works: All income goes into joint accounts, all expenses come out of joint accounts

Pros: Maximum transparency, simplified tracking, clear team mentality

Cons: Can feel restrictive, requires constant communication about purchases, potential for one partner to feel controlled

Option 2: Fully Separate Accounts (23% of couples)

Best for: Couples who value independence, those with very different spending styles, partners who came together later in life with established financial systems

How it works: Each person maintains their own accounts and contributes an agreed-upon amount to shared expenses

Pros: Maximum autonomy, no judgment about personal spending, clear boundaries

Cons: Requires careful tracking of shared expenses, can create “yours vs. mine” mentality, less visibility into partner’s financial health

Option 3: Mixed Approach (17% of couples)

Best for: Most couples who want both teamwork and independence

How it works: Joint account(s) for shared expenses and goals, plus individual accounts for personal spending

Pros: Balance of transparency and autonomy, reduces conflict over personal purchases, maintains team goals

Cons: Requires managing multiple accounts, need to decide what’s “shared” vs. “personal”

I personally use the mixed approach, and I recommend it for most couples. It gives you the best of both worlds—you’re working together on shared goals and expenses, but you also maintain some financial independence that reduces day-to-day friction.

Pick a Budget Framework Together

Once you’ve decided on your account structure, you need a framework for actually allocating your money. Here are some popular options that work well for couples budgeting:

The 50/30/20 Rule

- 50% to needs (housing, food, utilities, insurance)

- 30% to wants (entertainment, dining out, hobbies)

- 20% to savings and debt repayment

This is one of the simplest frameworks to start with. I’ve written extensively about how the 50/30/20 budget rule helped me save $1,847 in 2 months, and it’s particularly great for couples because the categories are broad enough to accommodate different priorities.

The 70/20/10 Rule

- 70% to living expenses

- 20% to savings

- 10% to giving/investing

Learn more about the 70/20/10 budget rule explained if this appeals to you.

Zero-Based Budgeting

Every dollar gets assigned a job before the month begins. This is more detailed but gives you maximum control.

The Half Payment Method

If you both get paid biweekly, this method can help you avoid the “feeling broke” trap. Check out how to budget biweekly paychecks without feeling broke for details.

Decide How to Split Expenses

This is where couples budgeting gets personal. There are several approaches:

50/50 Split: Each person contributes equally to shared expenses

- Works best when: Incomes are roughly equal

- Watch out for: Can feel unfair if incomes are very different

Proportional Split: Each person contributes based on their percentage of total household income

- Works best when: Incomes are significantly different

- Example: If you earn 60% of household income, you pay 60% of shared expenses

One Income Covers Fixed, Other Covers Variable: One person’s income handles rent/mortgage and fixed bills, the other covers groceries and variable expenses

- Works best when: You have one steady income and one variable income

- Watch out for: Can create resentment if variable expenses are harder to control

Complete Pooling: All income is “ours” regardless of who earned it

- Works best when: You’re fully committed to the “team” mentality

- Watch out for: Requires high trust and communication

My partner and I use the proportional split for shared expenses, and it’s eliminated so much tension. When I was earning more, I contributed more. Now that our incomes are closer, we’re nearly 50/50. It feels fair to both of us.

Set Up Your Shared Goals

Here’s where couples budgeting gets exciting instead of restrictive. When you’re working toward goals together, the budget becomes a tool for building your dream life rather than a list of restrictions.

Short-term goals (1-12 months):

- Build an emergency fund

- Pay off a credit card

- Save for a vacation

- Buy new furniture

Medium-term goals (1-5 years):

- Save for a wedding

- Down payment on a house

- Pay off student loans

- Start a family

Long-term goals (5+ years):

- Retirement savings

- Children’s education

- Financial independence

- Dream home or property

For each goal, get specific:

- What exactly do you want?

- How much will it cost?

- When do you want to achieve it?

- How much do you need to save monthly?

The key is making sure both partners feel represented in these goals. If all the goals are one person’s dreams, the other person won’t feel motivated to stick to the budget.

Avoiding the Common Couples Budgeting Pitfalls

Even with the best system, there are some common mistakes that can derail your couples budgeting efforts. Let me help you avoid them before they become problems.

Pitfall #1: Not Accounting for “Fun Money”

This is huge. If your budget is all sacrifice and no enjoyment, you’ll both hate it and eventually abandon it.

The solution: Build individual discretionary spending into your budget. This is money each person can spend without explanation or judgment. Even if it’s just $50-100 per month, having this freedom prevents resentment.

For more money-saving strategies that don’t feel restrictive, check out these tips for saving money on a budget with 21 ways to cut costs.

Pitfall #2: Letting One Person Do All the Work

If only one person tracks spending, pays bills, and manages the budget, that person will eventually burn out and resent their partner.

The solution: Share the responsibility. Maybe one person handles bill payments while the other tracks spending. Or alternate months. Or schedule those money dates where you review everything together.

Pitfall #3: Being Too Rigid

Life happens. Unexpected expenses come up. Sometimes you need to adjust the budget mid-month, and that’s okay.

The solution: Build flexibility into your system. Have a “miscellaneous” category. Review and adjust monthly. Don’t treat the budget as a rigid law—it’s a flexible tool.

Pitfall #4: Not Addressing Debt Openly

Hiding debt or minimizing its impact is one of the fastest ways to destroy trust and derail your financial progress.

The solution: Get everything out in the open during your financial inventory. Create a debt payoff plan together. If you need help, read about 7 proven ways to pay down debt faster.

Pitfall #5: Skipping Regular Check-Ins

Creating a budget once and never revisiting it is like going to the gym once and expecting to stay fit forever.

The solution: Schedule regular money dates—weekly for the first few months, then at least monthly once you’ve got a rhythm. These check-ins keep you aligned and catch problems before they become crises.

For additional guidance, review these 10 budgeting mistakes to avoid if you want to stop living paycheck to paycheck.

Tools and Apps That Make Couples Budgeting Easier

Let’s talk about the practical tools that can simplify couples budgeting in 2026. Technology has made this so much easier than the spreadsheet-only days.

Best Apps for Couples Budgeting

Shared Budgeting Apps:

- Honeydue – Designed specifically for couples, shows both partners’ accounts, lets you chat about transactions

- Goodbudget – Envelope budgeting system that syncs across devices

- YNAB (You Need A Budget) – Zero-based budgeting with excellent educational resources

- Mint – Free option that tracks spending across all accounts

- Simplifi by Quicken – Great for tracking both individual and shared finances

Couples who use shared budgeting tools and maintain visibility into household finances report reduced stress and more effective financial planning[3].

Low-Tech Options That Work Too

Not everyone wants an app for everything, and that’s fine. Some couples prefer:

- Shared spreadsheet (Google Sheets works great for real-time collaboration)

- Physical envelope system for cash spending

- Bullet journal budget if you’re both into that aesthetic

- Weekly budget meetings with a simple notebook

The best tool is the one you’ll actually use consistently.

Communication Strategies for Drama-Free Money Talks

Here’s the truth: even with the perfect budgeting system, you’ll still need to talk about money regularly. The difference between couples who succeed at budgeting together and those who don’t often comes down to how they communicate.

The Money Date Framework

I mentioned money dates earlier, but let me give you a specific framework that works:

Before the meeting:

- Each person reviews accounts and spending

- Both come prepared with any concerns or ideas

- Set a positive intention (this is about building your future together)

During the meeting:

- Start with wins (“We stayed under budget on groceries!”)

- Review income and expenses from the past period

- Discuss any surprises or challenges

- Adjust budget categories if needed

- Confirm upcoming expenses

- Check progress on goals

- End with something positive (plan a fun, budget-friendly activity together)

After the meeting:

- Update your tracking system

- Make any necessary account adjustments

- Schedule the next money date

Ground Rules for Healthy Money Conversations

Establish these rules and stick to them:

✅ No blame or shame – Focus on solutions, not accusations

✅ No bringing up past mistakes – What’s done is done; focus on moving forward

✅ Active listening – Repeat back what you heard to ensure understanding

✅ “I” statements – “I feel anxious when…” instead of “You always…”

✅ Timeout option – Either person can call a break if emotions get too high

✅ No financial decisions when angry – Table big decisions until you’re both calm

When You Disagree on a Purchase

This will happen. Here’s a framework for working through it:

- Each person explains their perspective without interruption

- Identify the underlying values – What does this purchase represent to each of you?

- Look at the numbers – How does it fit (or not fit) in the current budget?

- Explore alternatives – Is there a compromise option?

- Set a decision deadline – Don’t let it drag on indefinitely

- Agree on a threshold – Maybe purchases under $100 don’t require discussion, but anything over does

Special Situations in Couples Budgeting

Every couple’s situation is unique. Let me address some common scenarios that require special consideration.

When One Partner Earns Significantly More

This can create power imbalances if you’re not careful. The higher earner might feel they should have more say, while the lower earner might feel less valued.

Strategies that help:

- Use proportional contribution to shared expenses

- Recognize non-financial contributions (childcare, household management, etc.)

- Ensure both partners have equal say in financial decisions

- Each person gets equal “fun money” regardless of who earned more

Remember: you’re a team. The person who earns less might be enabling the higher earner to focus on their career by handling other responsibilities.

When You’re Combining Finances After Years Apart

If you’re coming together later in life or after maintaining separate finances for years, the transition can feel overwhelming.

Take it slow:

- Start with one joint account for shared expenses only

- Gradually increase integration as you build trust and systems

- Don’t rush to combine everything immediately

- Respect each other’s established financial habits

When One Partner Is a Spender and One Is a Saver

This is one of the most common dynamics, and it can actually work well if you approach it right.

The spender brings: Joy, spontaneity, ability to enjoy life now

The saver brings: Security, long-term thinking, financial cushion

Make it work:

- The saver loosens up a bit on fun spending

- The spender commits to savings goals

- Set specific amounts for both saving and spending

- Appreciate what each person brings to the relationship

When You’re Planning a Major Purchase Together

Big purchases like engagement rings, weddings, houses, or cars require special attention in your couples budgeting.

For perspective, remember that actual couple spending is often far below national averages. Nearly two-thirds of couples spend under $6,000 on engagement rings[1], and you shouldn’t let social pressure drive your financial decisions.

For major purchases:

- Start planning early (months or years in advance)

- Research costs thoroughly

- Save in a dedicated account

- Discuss priorities (would you rather have a bigger wedding or bigger down payment?)

- Don’t go into debt for wants

If you’re working toward building wealth together, read about how to achieve financial freedom in 5 simple steps.

Your 30-Day Couples Budgeting Bootcamp Action Plan

Ready to put this all into practice? Here’s your step-by-step plan for the next 30 days.

Week 1: Foundation and Discovery

Day 1-2: Schedule your first money date and set ground rules

Day 3-4: Each person completes a financial inventory independently

Day 5-6: Share inventories with each other (remember: no judgment!)

Day 7: Discuss money personalities and past money experiences

Week 2: Structure and Systems

Day 8-9: Decide on your account structure (joint, separate, or mixed)

Day 10-11: Choose a budget framework that appeals to both of you

Day 12-13: Determine how you’ll split expenses

Day 14: Set up accounts and/or budgeting tools

Week 3: Goals and Planning

Day 15-16: Brainstorm individual goals, then share with each other

Day 17-18: Identify shared goals and prioritize them

Day 19-20: Calculate how much you need to save monthly for each goal

Day 21: Create your first monthly budget together

Week 4: Implementation and Adjustment

Day 22-24: Start tracking spending according to your new budget

Day 25-26: Have a mid-month check-in to see how it’s going

Day 27-28: Make any necessary adjustments

Day 29-30: Celebrate your first month of couples budgeting!

For additional support on building better money habits, check out these 10 budgeting hacks for beginners that work in 2026.

Real Talk: What to Do When You Still Fight About Money

Even with all these strategies, you might still have money fights sometimes. That’s normal. Here’s what to do when it happens.

Recognize the Real Issue

Money fights are rarely actually about money. They’re usually about:

- Control – Who gets to make decisions?

- Security – Will we be okay?

- Values – What’s important to us?

- Respect – Do you value my contribution/opinion?

- Fear – What if we can’t afford our dreams?

When you start arguing about money, pause and ask: “What’s this really about?”

Take a Strategic Timeout

If the conversation is getting heated:

- Acknowledge that you’re both upset

- Agree to take a break (set a specific time to resume)

- Do something calming separately

- Come back when you’re both ready to problem-solve

Get Help If You Need It

There’s no shame in seeking support. Consider:

- Financial counselor – Helps with the practical money stuff

- Couples therapist – Addresses underlying relationship dynamics

- Financial education classes – Many are free through community organizations

- Accountability partner couple – Friends who are also working on their finances

Conclusion: Your Journey to Financial Harmony Starts Now

Here’s what I want you to remember: couples budgeting isn’t about restriction, control, or conflict. It’s about creating a system that helps you build the life you both want—together.

You don’t need to be perfect. You don’t need to agree on everything. You don’t need to have it all figured out before you start.

What you do need is:

- Honesty about your current financial situation

- Respect for each other’s perspectives and values

- Communication through regular, judgment-free money conversations

- Flexibility to adjust your system as life changes

- Commitment to working together as a team

The couples who succeed at budgeting together aren’t the ones who never disagree about money. They’re the ones who’ve built systems and communication patterns that help them navigate those disagreements productively.

Start with your first money date this week. Just one conversation. Get clear on where you are financially. Choose one small thing to implement together. Then build from there.

Your financial future—and your relationship—will thank you.

Your Next Steps

- Today: Schedule your first money date within the next 7 days

- This week: Each person completes a financial inventory

- This month: Choose your account structure and budget framework

- This quarter: Establish your shared goals and start tracking progress

- This year: Build the financial foundation for your dream life together

Remember, every successful couple who’s mastered their finances together started exactly where you are right now. The only difference is they took the first step.

You’ve got this. Now go schedule that money date! 💪💰