I used to dread looking at my bank statement after grocery shopping. Every week, I’d watch hundreds of dollars disappear, wondering how a cart full of food could possibly cost so much. Sound familiar? Last year, my family was spending over $800 per month on groceries—and we weren’t even eating that well! That’s when I decided enough was enough. I committed to finding frugal grocery hacks that actually worked in real life, not just in theory.

The result? I’ve slashed our grocery bill by more than $300 every month, and I haven’t clipped a single coupon. These aren’t extreme measures that require eating ramen for every meal or spending hours hunting for deals. These are practical, sustainable strategies that have transformed how I shop, cook, and think about food. If you’re ready to keep more money in your pocket without sacrificing nutrition or taste, these 21 frugal grocery hacks will change your financial life.

Key Takeaways

- Strategic meal planning and shopping lists can reduce impulse purchases by up to 23%, saving $50-75 monthly

- Store brands offer identical quality to name brands at 25-40% lower prices, accounting for $80+ in monthly savings

- Technology tools and apps provide cashback, price tracking, and inventory management that automates savings

- Reducing food waste through proper storage and meal prep prevents throwing away $150+ worth of food each month

- Bulk buying strategically and cooking at home instead of eating out creates the largest impact on your grocery budget

Understanding the Psychology Behind Grocery Overspending

Before diving into specific frugal grocery hacks, let’s talk about why we overspend in the first place. Grocery stores are designed to make you spend more. The layout, lighting, product placement, and even the music are all carefully orchestrated to encourage impulse purchases[1].

Research shows that shoppers who don’t use a list spend 40% more than those who do[2]. The average American throws away nearly $1,500 worth of food annually, which breaks down to about $125 per month just tossed in the trash[3]. Understanding these psychological triggers is the first step to overcoming them.

When I started tracking my spending patterns, I noticed I was most vulnerable when shopping hungry or stressed. I’d grab convenience items, pre-packaged snacks, and expensive prepared foods. Recognizing these patterns allowed me to create systems that protected me from my own worst habits.

The Foundation: Planning and Preparation Frugal Grocery Hacks

1. Master the Weekly Meal Plan

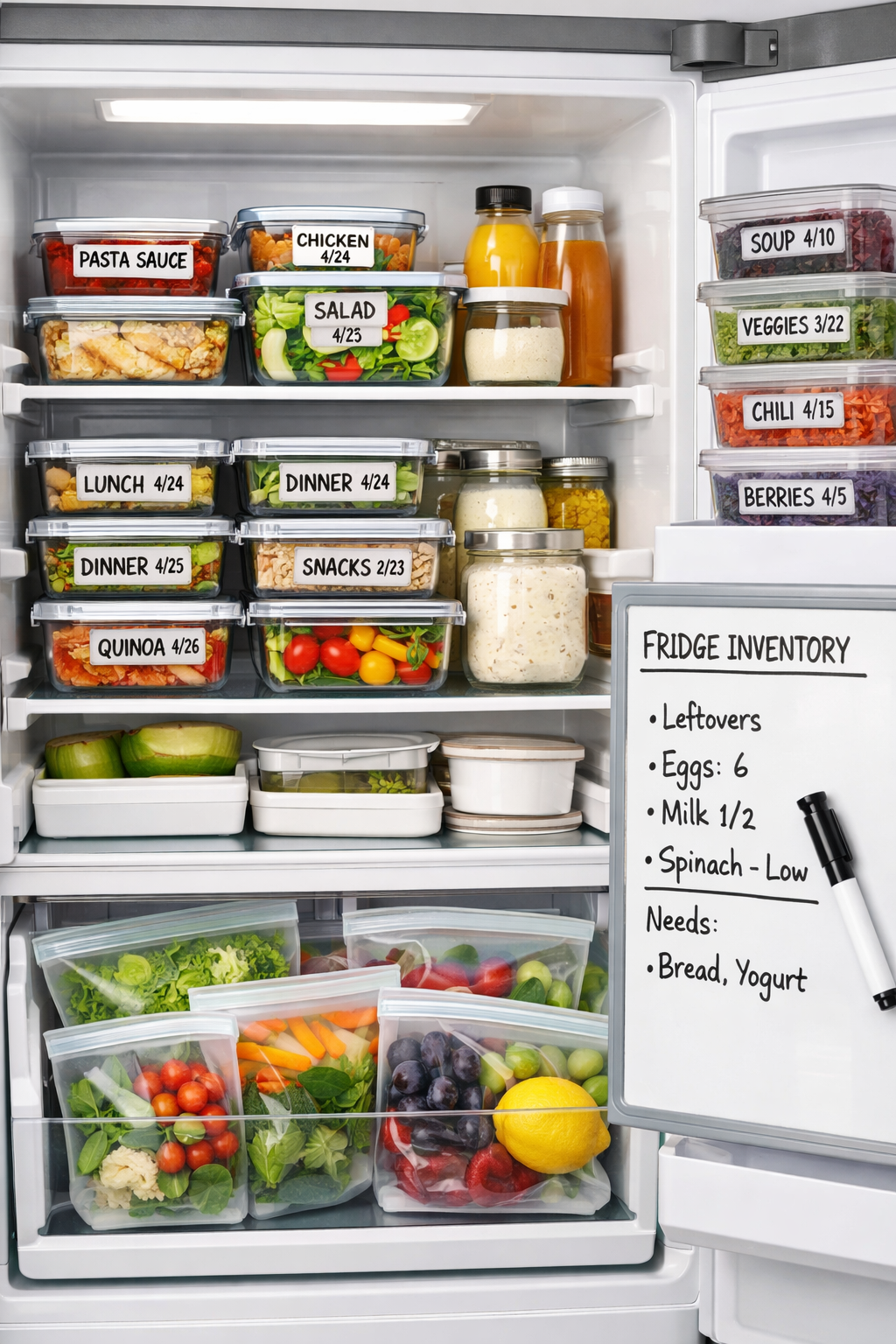

This is the cornerstone of all my grocery savings. Every Sunday, I spend 30 minutes planning our meals for the week. I check what’s already in my pantry, freezer, and refrigerator first. Then I build meals around those ingredients and what’s on sale that week.

My meal planning template includes:

- Breakfast options (usually 2-3 that rotate)

- Lunch ideas (often leftovers or simple combinations)

- Dinner menu (7 meals planned)

- Snack inventory (what we have vs. what we need)

This simple habit has saved me at least $75 per month by eliminating duplicate purchases and reducing food waste. I also recommend checking out effective budgeting strategies to complement your meal planning efforts.

2. Create a Master Grocery List

I maintain a digital master list of everything I regularly buy, organized by store section. When I’m planning my week, I simply check off what I need. This prevents wandering aimlessly through aisles (where impulse purchases happen) and ensures I never forget essential items.

My list is categorized into:

- Produce

- Proteins

- Dairy

- Pantry staples

- Frozen items

- Household goods

Pro tip: Keep this list on your phone so you can add items throughout the week as you run out.

3. Shop Your Pantry First

Before buying anything new, I “shop” my own kitchen. You’d be surprised how many meals you can create from ingredients you already have. I once went two full weeks without buying groceries (except fresh produce and milk) by getting creative with pantry staples.

This hack alone saved me $120 in one month when I committed to using up everything before restocking. It’s also a great way to discover new recipe combinations and reduce food waste.

4. Time Your Shopping Strategically

I shop early Wednesday mornings. Why? Most stores mark down items on Wednesdays, and early morning means fresh markdowns on meat, bakery items, and produce nearing their sell-by dates. These items are perfectly safe and fresh—they just need to be sold quickly.

I’ve scored organic chicken breasts for 50% off, artisan bread for $1, and premium produce at clearance prices. This timing strategy saves me $30-40 monthly.

Smart Shopping: Frugal Grocery Hacks That Cut Costs Instantly

5. Embrace Store Brands Completely

This was a game-changer. Store brands are typically 25-40% cheaper than name brands, and in blind taste tests, most people can’t tell the difference[4]. I switched to store brands for everything from canned goods to dairy products.

Monthly savings from store brands: $85

| Product Category | Name Brand | Store Brand | Monthly Savings |

|---|---|---|---|

| Milk (4 gallons) | $16 | $12 | $4 |

| Bread (4 loaves) | $16 | $10 | $6 |

| Canned goods (20 items) | $30 | $18 | $12 |

| Pasta & grains | $25 | $15 | $10 |

| Frozen vegetables | $24 | $15 | $9 |

| Cheese & dairy | $40 | $28 | $12 |

| Snacks | $35 | $20 | $15 |

| Condiments | $20 | $13 | $7 |

| Cleaning supplies | $25 | $15 | $10 |

6. Buy Seasonal Produce

Strawberries in December cost three times what they do in June. I build my meal plans around what’s in season locally. Not only is seasonal produce cheaper, but it’s also fresher, tastier, and more nutritious.

I follow a seasonal eating guide and save approximately $40 monthly by avoiding out-of-season items. Bonus: this approach is better for the environment too.

7. Compare Unit Prices, Not Package Prices

The bigger package isn’t always the better deal. I always check the unit price (price per ounce, pound, or item) displayed on the shelf tag. Sometimes the medium size offers the best value, or individual items on sale beat the bulk price.

This careful comparison saves me about $15 monthly by ensuring I’m actually getting the best deal.

8. Shop the Perimeter First

The outer edges of grocery stores contain fresh, whole foods: produce, meat, dairy, and bakery. The center aisles hold processed, packaged foods with higher markups. I shop the perimeter first, filling my cart with nutritious basics, then venture into center aisles only for specific staples.

This strategy naturally guides you toward healthier, more economical choices and reduces impulse purchases of expensive packaged snacks.

9. Never Shop Hungry

This seems obvious, but it’s crucial. Studies show hungry shoppers spend 64% more than those who shop on a full stomach[5]. I always eat a meal or substantial snack before heading to the store.

Estimated monthly savings: $25-30

10. Use Cash or a Strict Budget

I load my budgeted grocery amount onto a prepaid card or bring cash. When the money’s gone, I’m done shopping. This physical limitation prevents overspending and forces me to prioritize.

This psychological barrier has been incredibly effective, keeping me accountable to my monthly budget goals.

Technology-Enabled Frugal Grocery Hacks

11. Leverage Cashback Apps

I use multiple cashback apps that don’t require clipping coupons. Apps like Ibotta, Fetch Rewards, and Checkout 51 give you money back for purchases you’re already making. I simply scan my receipt after shopping.

Monthly cashback earnings: $20-35

These apps work alongside other money-making apps to boost your income.

12. Track Prices with Apps

I use price tracking apps to know when items hit their lowest price. Apps like Flipp and Basket show me which stores have the best deals on items I regularly buy. I stock up when prices bottom out.

This strategic buying saves approximately $30 monthly by ensuring I never pay peak prices for staples.

13. Digital Grocery List Apps

Apps like AnyList or OurGroceries sync across devices, so my whole family can add items as we run out. These apps also remember prices and help track spending in real-time as I shop.

The organization and awareness these apps provide prevent duplicate purchases and forgotten items, saving about $20 monthly.

14. Use Store Apps for Digital Coupons

Most major grocery chains have apps that automatically load digital coupons to your loyalty card. Unlike paper coupons, these require zero clipping—just click to add them to your account before shopping.

I spend 5 minutes weekly adding relevant digital coupons and save $15-25 monthly with minimal effort.

Food Waste Reduction: The Hidden Frugal Grocery Hacks

15. Master Food Storage Techniques

Proper storage extends food life dramatically. I learned that:

- Herbs last weeks when stored upright in water like flowers

- Lettuce stays crisp for 2 weeks wrapped in paper towels in a container

- Cheese doesn’t mold when wrapped in parchment paper instead of plastic

- Bread freezes beautifully and tastes fresh when thawed

These storage techniques alone prevent $40-50 worth of food waste monthly.

16. Implement FIFO (First In, First Out)

I organize my refrigerator and pantry so older items are in front. When I bring groceries home, new items go in back. This simple rotation system ensures nothing expires before we use it.

Monthly savings from reduced waste: $30

17. Batch Cook and Freeze

Every Sunday, I prepare 2-3 meals in large batches and freeze portions. This prevents the “I don’t feel like cooking” takeout temptation and uses ingredients efficiently before they spoil.

Batch cooking has reduced our takeout spending by $100+ monthly and ensures we always have convenient, homemade meals ready.

18. Repurpose Leftovers Creatively

Leftover roasted chicken becomes chicken salad, soup, tacos, or stir-fry. Vegetable scraps become homemade stock. Stale bread becomes croutons or breadcrumbs. I’ve gotten creative about using every bit of food.

This “waste nothing” approach saves approximately $35 monthly and has made me a more inventive cook.

Strategic Buying Frugal Grocery Hacks

19. Buy Meat in Bulk and Portion

I buy large packages of meat when they’re on sale (often 30-50% off), then portion and freeze them immediately. A family pack of chicken breasts gets divided into meal-sized portions in freezer bags.

This strategy saves $50-60 monthly compared to buying smaller packages at regular prices. I also incorporate these savings into my broader frugal living strategies.

20. Join a Wholesale Club Strategically

I have a warehouse club membership, but I’m selective about what I buy there. I only purchase items I know we’ll use completely before they expire. My best buys include:

- Paper products and cleaning supplies

- Frozen vegetables and fruits

- Nuts and seeds

- Olive oil and cooking staples

- Cheese (I portion and freeze it)

Monthly savings from strategic bulk buying: $45

21. Grow Simple Herbs and Vegetables

Even without a garden, I grow herbs on my windowsill and tomatoes in containers. Fresh herbs from the store cost $3-4 per package, but a $3 plant produces herbs for months.

My small herb garden saves about $15-20 monthly and provides fresher, more flavorful ingredients.

The $300+ Monthly Savings Breakdown

Let me show you exactly how these frugal grocery hacks add up to over $300 in monthly savings:

| Strategy | Monthly Savings |

|---|---|

| Meal planning & shopping list | $75 |

| Store brands instead of name brands | $85 |

| Seasonal produce | $40 |

| Reducing food waste | $50 |

| Strategic meat buying | $55 |

| Cashback apps | $25 |

| Price tracking & strategic stocking | $30 |

| Batch cooking (avoiding takeout) | $100 |

| Growing herbs | $18 |

| Shopping timing & markdown items | $35 |

| TOTAL MONTHLY SAVINGS | $513 |

As you can see, I actually save over $500 monthly, though I conservatively say $300+ because results vary based on family size and location.

Maintaining Nutrition While Saving Money

One concern people often have about cutting grocery costs is sacrificing nutrition. I’ve found the opposite to be true. By focusing on whole foods, seasonal produce, and home cooking, my family actually eats healthier now than when we spent more.

Budget-friendly nutritious staples I always keep:

- Dried beans and lentils (protein-packed and pennies per serving)

- Frozen vegetables (just as nutritious as fresh, often cheaper)

- Eggs (the most affordable complete protein)

- Oats (versatile, filling, and incredibly cheap)

- Seasonal fruits (maximum nutrition, minimum cost)

- Canned tomatoes (foundation for countless healthy meals)

- Brown rice and whole grain pasta (filling, nutritious carbs)

These staples form the foundation of nutritious, budget-friendly meals that cost $2-3 per serving instead of $8-10 for convenience foods.

The Environmental Benefits of Frugal Grocery Shopping

An unexpected benefit of these frugal grocery hacks is their positive environmental impact. By reducing food waste, buying seasonal local produce, and avoiding excessive packaging, I’ve significantly reduced my family’s carbon footprint.

Environmental wins from frugal shopping:

- 🌱 60% less food waste going to landfills

- ♻️ Reduced packaging from buying bulk and whole foods

- 🚗 Fewer shopping trips through better planning

- 🌍 Lower carbon emissions from seasonal, local produce

- 💧 Less water waste from throwing away food

These benefits align perfectly with my values and make the savings feel even more rewarding. It’s proof that what’s good for your wallet is often good for the planet.

Common Mistakes to Avoid

Even with the best intentions, I’ve made mistakes along the way. Here are pitfalls to avoid:

❌ Buying bulk items you won’t use completely – That 5-pound bag of spinach seems economical until half of it rots

❌ Ignoring unit prices – Bigger isn’t always better value

❌ Shopping multiple stores for minimal savings – Your time and gas have value; save this for significant price differences

❌ Buying sale items you don’t need – A deal isn’t a deal if you wouldn’t have bought it anyway

❌ Forgetting to check expiration dates – Especially on clearance items

❌ Not accounting for preparation time – Super cheap ingredients that require hours of prep might not be worth it for your lifestyle

Learning to avoid these common budgeting mistakes has made my frugal grocery strategy much more sustainable.

Creating Your Personalized Frugal Grocery System

Not every hack will work for every household. The key is experimenting to find what fits your lifestyle, family size, and preferences. Here’s how to build your personalized system:

Step 1: Track Your Current Spending

For one month, save every grocery receipt and categorize your purchases. This baseline shows where your money actually goes.

Step 2: Identify Your Biggest Waste Areas

Are you throwing away produce? Buying too many convenience foods? Shopping too frequently? Your tracking will reveal patterns.

Step 3: Implement 3-5 Hacks That Address Your Specific Issues

Don’t try all 21 at once. Start with strategies that target your biggest waste areas.

Step 4: Measure Your Results

After one month, compare your spending to your baseline. Celebrate wins and adjust strategies that didn’t work.

Step 5: Gradually Add More Strategies

Once initial hacks become habits, layer in additional strategies to increase savings.

This systematic approach is similar to how I tackled paying off debt faster—one strategic step at a time.

The Ripple Effect: How Grocery Savings Impact Overall Financial Health

Saving $300+ monthly on groceries doesn’t just reduce one expense—it creates opportunities across your entire financial life. Here’s what I’ve done with my grocery savings:

💰 Built an emergency fund – I redirected $200 monthly to savings, reaching my $1,000 emergency fund goal in 5 months

💳 Paid down credit card debt – An extra $100 monthly payment accelerated my debt payoff timeline

📈 Started investing – Once debt-free, I began investing the savings for long-term wealth building

🎯 Funded other goals – Some months I use the savings for experiences, gifts, or home improvements

The psychological boost of seeing tangible results from your efforts cannot be overstated. Success with grocery savings builds momentum for other financial habits that changed my life.

Frugal Grocery Hacks for Different Family Situations

For Singles and Couples

Challenge: Smaller quantities, limited bulk buying options

Solutions:

- Split bulk purchases with friends or neighbors

- Freeze portions immediately

- Focus on versatile ingredients that work in multiple meals

- Shop more frequently for fresh items in smaller quantities

For Large Families

Challenge: High volume needs, diverse preferences

Solutions:

- Maximize bulk buying and wholesale clubs

- Implement “planned leftovers” where one meal becomes two

- Assign each family member a weekly meal to plan and help prepare

- Buy whole chickens and break them down yourself (huge savings)

For Busy Professionals

Challenge: Limited time for cooking and planning

Solutions:

- Batch cook on weekends

- Use slow cooker and instant pot for hands-off cooking

- Keep a rotation of 10-12 simple meals you can make quickly

- Invest in quality storage containers for grab-and-go convenience

For Health-Conscious Shoppers

Challenge: Organic and specialty items cost more

Solutions:

- Follow the “Dirty Dozen” and “Clean Fifteen” to prioritize organic purchases

- Shop farmers markets at closing time for discounts

- Grow your own organic herbs and greens

- Buy organic staples in bulk from online retailers

Technology Tools That Maximize Your Savings

Beyond basic apps, here are advanced technology strategies:

Price Book Spreadsheet

I maintain a simple spreadsheet tracking the lowest prices I’ve found for items I buy regularly. This helps me recognize genuine deals and know when to stock up.

Inventory Management

I use a simple app to track what’s in my freezer and pantry with expiration dates. This prevents duplicate purchases and food waste.

Automated Budgeting

My budgeting app connects to my bank account and categorizes grocery spending automatically, alerting me when I’m approaching my limit.

Recipe Cost Calculator

I calculate the per-serving cost of my most-made meals, which helps me choose the most economical options when planning.

These tools complement other money-saving strategies I use across my financial life.

Seasonal Shopping Strategies

Different seasons offer different opportunities for savings:

Spring

- Stock up on fresh greens, asparagus, and strawberries

- Buy Easter ham at deep discounts

- Plant herb and vegetable gardens

Summer

- Preserve abundant produce through freezing and canning

- Shop farmers markets for peak-season deals

- Buy grilling meats in bulk

Fall

- Stock up on apples, squash, and root vegetables

- Buy turkey and baking supplies after Thanksgiving

- Preserve summer produce before winter

Winter

- Focus on hearty soups and stews using cheap cuts

- Buy citrus fruits at peak season

- Stock pantry staples during holiday sales

Building Community Around Frugal Shopping

One unexpected benefit has been connecting with others who share these values. I’ve found community through:

Food Swaps – Trading homemade preserves, baked goods, and garden produce with neighbors

Bulk Buying Groups – Splitting wholesale purchases with friends to access bulk pricing without waste

Recipe Exchanges – Sharing budget-friendly recipes and meal ideas

Shopping Buddies – Coordinating store trips to split gas costs and share deals

This community support makes frugal living feel less like deprivation and more like a positive lifestyle choice. Similar to participating in a no-spend challenge, having support makes the journey more enjoyable.

Addressing the Time Investment Concern

The most common objection I hear is: “This sounds like a lot of work.” I get it. Initially, implementing these strategies does require time and mental energy. But here’s the truth:

Initial time investment: 2-3 hours weekly (meal planning, list making, strategic shopping)

Time investment after 2 months: 45-60 minutes weekly (once systems are established)

Time saved from fewer shopping trips: 1-2 hours weekly

Time saved from having meals planned: 30-60 minutes daily (no “what’s for dinner?” stress)

The math actually works out to a net time savings once you’re in a groove, plus you’re saving $300+ monthly. That’s like earning $75+ per hour for the time you invest.

Long-Term Financial Planning Through Grocery Optimization

These frugal grocery hacks aren’t just about immediate savings—they’re about building long-term financial security. Here’s the bigger picture:

Year 1: $3,600+ saved on groceries

- Use for: Emergency fund, debt payoff, or initial investments

Year 2: $3,600+ saved + habits fully ingrained

- Use for: Continue building wealth, fund retirement accounts

Year 5: $18,000+ saved + compound interest if invested

- Result: Significant progress toward financial independence

Year 10: $36,000+ saved + substantial investment growth

- Result: Major milestone toward financial freedom

This long-term perspective transforms grocery shopping from a mundane chore into a powerful wealth-building tool.

Conclusion: Your Action Plan for Grocery Savings Success

Saving $300+ monthly on groceries without clipping coupons isn’t a fantasy—it’s completely achievable with the right strategies and mindset. These 21 frugal grocery hacks have transformed my family’s finances and reduced stress around food spending.

Your action plan to get started today:

- This week: Track every grocery purchase to establish your baseline spending

- Next week: Implement meal planning and create your master grocery list

- Week 3: Switch to store brands for 10 items you regularly buy

- Week 4: Download 2-3 cashback and price tracking apps

- Month 2: Add food storage techniques and batch cooking to your routine

- Month 3: Evaluate your savings and add 3-5 more strategies

Remember, you don’t need to implement all 21 hacks at once. Start with 3-5 that address your biggest spending leaks, master those, then gradually add more. The key is consistency and patience as new habits form.

The money you save can fund your emergency fund, accelerate debt payoff, or build long-term wealth through investing. Every dollar saved on groceries is a dollar working toward your financial goals.

What frugal grocery hack will you try first? Start today, track your progress, and watch your savings grow. Your future self will thank you for taking control of your grocery spending now.

For more strategies to optimize your overall budget and build wealth, explore these proven budgeting techniques that complement your grocery savings journey.